Scott Luton (00:12):

Good morning, Scott Luton here with you on this edition of this week in business history. Welcome to today’s show on this program, which is part of the supply chain. Now family of programming. We take a look back at the upcoming week, and then we share some of the most relevant events and milestones from years past, of course, mostly business focused with a little dab of global supply chain. And occasionally we might just throw in a good story outside of our primary realm. So I invite you to join me on this. Look back in history to identify some of the most significant leaders, companies, innovations, and perhaps lessons learned in our collective business journey. Now let’s dive in to this week in business history.

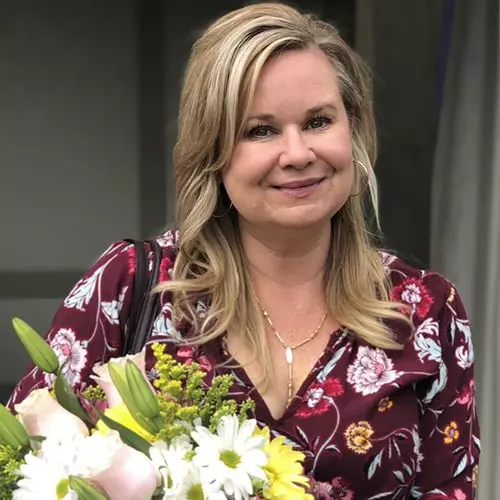

Kelly Barner (01:11):

Hello, and thanks for joining us. I’m Kelly Barner, owner of buyers meeting point and the host of Dial P for procurement here on supply chain. Now you can join us on the third Tuesday of each month for a video live stream that runs from 12 to 1:00 PM Eastern. As I bring together the leading minds in corporate spend management and do my best to blur the lines between procurement and supply chain. In this week’s episode, we’ll be remembering a number of key stories, innovations, inventions, and firsts that took place over the years between July 5th and the ninth. Our main story celebrates the 132nd birthday of the wall street journal. First published on July 8th, 1889. The wall street journal was the brain child of Dow Jones reporters, Charles Dow, Edward Jones, and the somewhat mysterious Charles Berg stressor. Now I’m sure you’ve heard of MREs Dow and Jones, but very few people know much about Charles Berg stressor.

Kelly Barner (02:17):

He met the other two while working at the Kiernan news agency in New York. The idea to leave Kiernan and start the company that would become Dow Jones was Berg stressors for reasons that have been lost to history. He chose to be a silent partner, but we do know that he was the one that named the new paper, the wall street journal, because it was published in the basement at 15 wall street, right near the New York stock exchange. He was the only one of the three with a college degree and he provided the capital to finance Dow Jones. Ironically, he also worked at Dow Jones longer than either of his partners. Jones left the company in 18 nine, and Dowe died three years later. Now back in 1889, the three men published what they called flimsy. These, these were little leaflets of news that would be printed during the day and handed out to traders at the New York stock exchange containing updated information on the Dow Jones industrial average.

Kelly Barner (03:20):

Now don’t feel bad if you haven’t heard of flimsy is you probably know them by another name, ticker tape. The flimsy were carbon paper stacks that allowed clerks to create up to 24 sheets at a time just by pressing really hard. When writing by hand financial news was shared on broader tape and stark market quotes were put on narrower tape, helping everyone keep the types of information separate on the hectic trading floor, Dow Jones and Berg stressor got the idea to combine the flimsy as of the day into something a little more substantial and switched to a daily printing schedule. The four page wall street journal came out each afternoon and satisfied a growing need for objective business and financial news in a time when unreliable information was a problem for business owners and investors alike, the four-page paper sold for 2 cents a copy. Originally the journal only published Monday through Friday, but in 2005, they added a weekend edition, which publishes on Saturdays today.

Kelly Barner (04:29):

There are 12 versions of the journal available in nine different languages until the great depression which began in 1929. The journal only covered financial and economic news during the depression. However, the paper began to include occasional feature articles, a trend that would expand in the years after the second, second world war as of 2019, the wall street journal has the second average, highest weekday paid circulation in the United States. It’s second, only to the USA today, which feels like cheating. If you ask me because of all those hotel distribution contracts, but that’s an aside. Another interesting fact is that the title of the newspaper has a period at the end punctuation as in the wallet street journal period over the year, the wall street journal has earned no less than 35 Pulitzer prizes for its coverage of world and business news. And for a podcast dedicated to the history of business old wall street journal cover pages are a treasure trove of the breaking news of days gone by.

Kelly Barner (05:41):

They include headlines like standard oil company dissolution ordered by Supreme court May 16th, 1910, 11 computed tabulating to change its name will be called international business machines January 1st, 1924 to Japanese automakers plan to drive into us auto market. For first time in July, July 15th, 1958, Netscapes IPO gets an explosive welcome August 9th, 1995 and UK votes to leave EU June 24th, 2016 in 2004, the wall street journal launched its first app based version. By one year later, its readership profile consisted of about 60% top management with an average income of $191,000. An average household net worth of $2.1 million and an average reader age 55 in may of 2020, the journal hit the 3 million subscribers mark. And I happened to be one of them, despite that impressive reader profile and a long impressive history. The wall street journal has faced cost pressures and cutbacks like the rest of the newspaper industry that has led to them altering or combining sections or reducing staff head count over the years since being purchased by news Corp in 2007, the wall street journal has at times faced criticism for having a decidedly conservative opinion page and financial section with more liberal general news coverage.

Kelly Barner (07:21):

As a result, the two sections of the paper are actually managed in parallel by separate people as with all content consumption. The burden is on the reader to think critically and consult multiple sources on every topic as Dow Jones and the mysterious Mr. Verge dresser stated 132 years ago. Their vision was to produce news. That is honest, intelligent, and unprejudiced period. From my perspective, anyone that wants to be well-versed on the latest news and discussions in the world of business has to have the wall street journal on their daily reading list. For our next story, we’re going to pivot from the epitome of buttoned-up business news. Just something a little quirkier on July 9th, 1962, an artist, no one had ever really heard of burst onto the Los Angeles art scene with 32 paintings of soup Campbell’s soup. Actually Andy Warhol painted a different flavor of soup in each picture.

Kelly Barner (08:23):

Epitomizing what was starting to emerge as the defined pop art style. Although they would go on to be famous. The show did not initially do all that well. One art critic reviewed the show. Thus this young artist is either a soft headed fool or a hard headed charlatan, a competing art dealer down the street filled his gallery windows with actual cans of Campbell’s soup. With a sign that read do not be misled. Get the original, our low price two for 33. My favorite reaction of all comes from a newspaper comic that ran at the time. There were two women looking at art in a gallery, and the one says to the other, or frankly, the cream of asparagus does nothing for me, but the taste terrifyingly intensity of the chicken noodle gives me a real Zen feeling. Irving Bluhm, one of the owners of the Ferris gallery, where the paintings were first shown managed to sell five of them after the show.

Kelly Barner (09:27):

But he later regretted the decision and decided to buy the paintings back so they could remain as a set. He bought them all from Warhol for $1,000, paid in installments over a period of 10 months. In 1996, he sold the set to the museum of modern art in New York for over $15 million. Now that one Zen chicken noodle soup from wonderful soup to Mr. Wonderful. I would like to wish a very happy birthday to my favorite shark. Kevin O’Leary born on July 9th, 1954 in Montreal, Canada. He learned about investment and fiscal conservatism from his mother. His father struggled with alcoholism and sadly passed away. When Larry was just seven years old, as he reached adulthood, he managed to secure an internship at Nabisco in Toronto, where he learned about marketing while being responsible for the company’s cat food line. From there, he founded a company called soft key in his basement.

Kelly Barner (10:31):

They sold CD rom based educational software for youth use. After a series of mergers and acquisitions, the company would eventually end up as part of the toy company Mattel in 2006, Elyria peered as part of the cast of the Canadian show Dragon’s den with future fellow shark. Robert herky Vick show was duplicated for American audiences in 2009 and renamed shark tank. He and herky vac both joined the cast, working both shows in parallel for a while. If you’ve ever watched shark tank more than once, you probably have a favorite shark. As I mentioned, he’s my absolute favorite. Despite the probably self appointed nickname. Mr. Wonderful Elyria is known for being honest to the point of harsh, but that’s the reality. When you become an entrepreneur, you have to work hard, think fast, sacrifice and learn to roll with the punches. As he said to one inventor, it’s a stupid idea.

Kelly Barner (11:34):

It’s going to zero, take it behind the barn and shoot it. And quote, least with Mr. Wonderful. You don’t have to try to read between the lines to figure out what he means. Here’s some of O’Leary’s key show investment stats. According to the site, Sharka Lytics. His total on-air investment is over $8.50 across 40 deals. He is invested in 8% of the deals he has heard during 131 episodes. His largest single deal size was $2.5 million for a company called zips, which makes single serve glasses of wine. They come in glass like plastic stemware, Kevin O’Leary central piece of advice for business owners comes from something. His mother taught him. If you never lie to anybody, even though it’s hard to tell the truth, you never have to remember what you said and you never get caught in a lie. It’s tough love, but it’s love all the same one last quote, before we go, life is hard.

Kelly Barner (12:37):

Money doesn’t care and your tears don’t add value. Before I wrap for the week, here are a few more notable dates on July 5th, 1994. Jeff Bezos founded Amazon in his garage in Bellevue Washington in 2020, the company reported $386 billion in revenue. And of course they are a force to be reckoned with, from a supply chain perspective. According to Rakuten intelligence in 2020, Amazon made 56% of last mile deliveries in the United States compared to 30% by the unit, the United States postal service and 14% by ups on July 7th, 1930, the project to build the Hoover dam got underway. The project took five years and provided not only critical infrastructure but much needed jobs during the great depression. The original budget was $49 million. The equivalent about $675 million. Today 112 deaths were reported during the construction of the dam. Most of which were categorized as pneumonia. Although questions do remain about whether it was actually carbon monoxide poisoning.

Kelly Barner (13:53):

There are not bodies and capsulated in the dam itself as has been rumored at times to bring our episode full circle. I’d like to leave you with a description of the Hoover dam as published in the wall street journal in 2006, the romance of the engineer’s still lives in the graceful lines and brute strength of Hoover dam. The courage of the construction worker is written in concrete and steel across the face of the cliffs. And one generation’s belief in the destiny of the next is proclaimed by the deep throated hum of the dynamos and quote and period that wraps up this edition of this week in business history. Thank you so much for tuning into the show each week. Don’t forget to check out the wide variety of industry thought leadership available@supplychainnow.com as a friendly reminder, you can find this week in business history, wherever you get your podcast from and be sure to tell us what you think we would love to earn your review. And we encourage you to subscribe so that you never miss an episode on behalf of the entire team here at this week in business history and supply chain. Now this is Kelly Barner wishing all of our listeners, nothing but the best on that note. We’ll see you next time here on this week in business history.