The Value of a Data-Driven Approach to Demand Sensing and Forecasting

Special Guest Blog Post written by Chris Cunnane with InterSystems

Demand sensing and demand forecasting are both crucial aspects of optimizing supply chains, but they do have slightly different functions in their approach and focus. Demand sensing uses real-time data and analytics to identify and respond to immediate demand fluctuations, while demand forecasting uses historical data to predict future demand over a longer period (months or years). Different methods, such as statistical modeling and machine learning, are used to enhance the accuracy and adaptability of these processes. Both areas are crucial for companies when it comes to projecting sales, managing inventory, and coordinating replenishment. In the end, the goal is to accurately predict customer demand by using predictive models to forecast future demand.

InterSystems surveyed 450 senior supply chain practitioners and stakeholders to examine key supply chain technology challenges, trends, and decision-making strategies across five key use cases: fulfillment optimization; demand sensing and forecasting; supply chain orchestration; production planning optimization; and environmental, social, and governance (ESG). This blog focuses on demand sensing and forecasting.

Current State of Demand Sensing and Forecasting

According to the survey results, when asked how they currently forecast demand, 36% of respondents indicated that they have several solutions that require staff input. The use of multiple systems often leads to disjointed, disparate data silos. When different systems are unable to communicate, decisions take longer to make and are usually not as accurate, leading to errors in demand sensing and forecasting. To maintain data accuracy and relevance, it is crucial that data is updated and transferred regularly.

The harsh reality is that the use of intelligent data platforms is not widespread. The survey revealed that only 27% of respondents have an intelligent data platform. For these platforms to be effective, it is essential that all data is validated before being used in forecasting models to ensure consistency and accuracy.

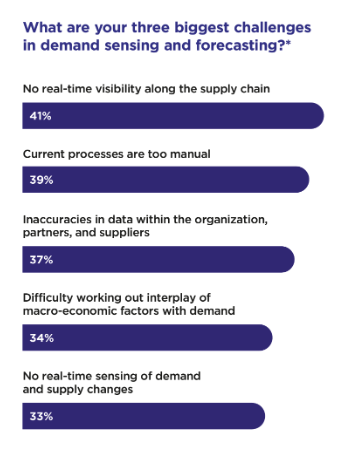

Demand Sensing and Forecasting Challenges with External Demand Signals

When asked to identify their top challenges in demand sensing and forecasting, respondents cited the following: no real-time visibility along the supply chain (41%), current processes are too manual (39%), inaccuracies in data within the organization, partners, and suppliers (37%), and no real-time sensing of demand and supply changes (34%).

Supply chain visibility enables companies to track the location and status of products, components, and materials as they move through the supply chain. However, it also encompasses the entire end-to-end supply chain, from the sourcing of raw materials to the final delivery to the end consumer. To respond effectively to demand changes, companies must be able to adjust inventory levels quickly in response to market volatility and shifting consumer demand.

The second challenge identified by respondents is reliance on manual processes. Automated demand sensing processes leverage real-time data and advanced analytics to predict short-term demand fluctuations, while manual methods rely on human interpretation of data, which can be time-consuming and prone to errors.

Demand Sensing and Forecasting Capabilities to Improve Forecast Accuracy

The top capability survey respondents said would improve their ability to forecast demand is the ability to ingest and analyze real-time data from many sources in disparate formats (27%). InterSystems Supply Chain Orchestrator is a data platform that ingests all relevant data from the sources that matter, both internally and externally, including geopolitical events, information on supply chain product integrity issues, supplier fulfillment discrepancies, and much more. Harmonizing and normalizing all this information to provide accurate data in real time, the platform simulates your business processes and then applies embedded AI and ML capabilities.

The second capability identified by respondents is integrated inventory management with enterprise resource planning (ERP) and electronic point of sale (EPOS) to automate demand-sensing and forecasting (24%). By leveraging Supply Chain Orchestrator for demand sensing, organizations can increase output by adjusting production schedules in response to predicted demand, ensuring they meet customer needs effectively.

Final Thought

To be agile and competitive, organizations must be capable of extracting critical insights in near real-time. This remains a significant challenge when so many businesses lack end-to-end visibility or rely on manual data analysis and ad hoc provisioning and integration of different solutions. For demand sensing and forecasting, a reliance on manual data analysis, especially given the current state of disparate data streams, can be catastrophic. If companies are unable to understand the reasons behind supply shifts, they will be unable to adjust their demand forecasting accurately, which will lead to improper inventory availability, lost sales, and higher cost of goods sold.

Read the full blog here.

InterSystems Can Help

For over 45 years, InterSystems has helped businesses unlock value from data – quickly, safely, and at scale. Our AI-enabled supply chain decision intelligence platform predicts disruptions before they occur, and optimally handles them when they do, so you will be ready to manage the unexpected with confidence. It includes a real-time data gateway that unifies disparate data sources, and a set of next-generation supply chain solutions that complement your existing technology infrastructure to accelerate decision-making and time to value, driving efficiencies throughout your entire supply chain. Learn more at InterSystems.com/SupplyChain.

Chris Cunnane is responsible for developing and executing marketing strategy and content for the InterSystems supply chain technology suite. Chris has 20+ years of supply chain expertise, leading the supply chain practice at ARC Advisory Group, as well as holding various sales, marketing, and operations roles in the wholesale, retail, and automotive parts markets. He holds a BA in Communications from Stonehill College and an MA in Global Marketing Communications from Emerson College.

More Blogs

ToolsGroup CEO Sean Elliott on Embracing Uncertainty, Probabilistic Planning, and Preparing for an Agentic Future