I think we will continue to see what we’re seeing in this report for at least the next two quarters. Prices will stay somewhat stable while demand continues to drop to adjust to trucking availability in the country.

-Enrique Alvarez, Managing Director, Vector Global Logistics

Episode Summary

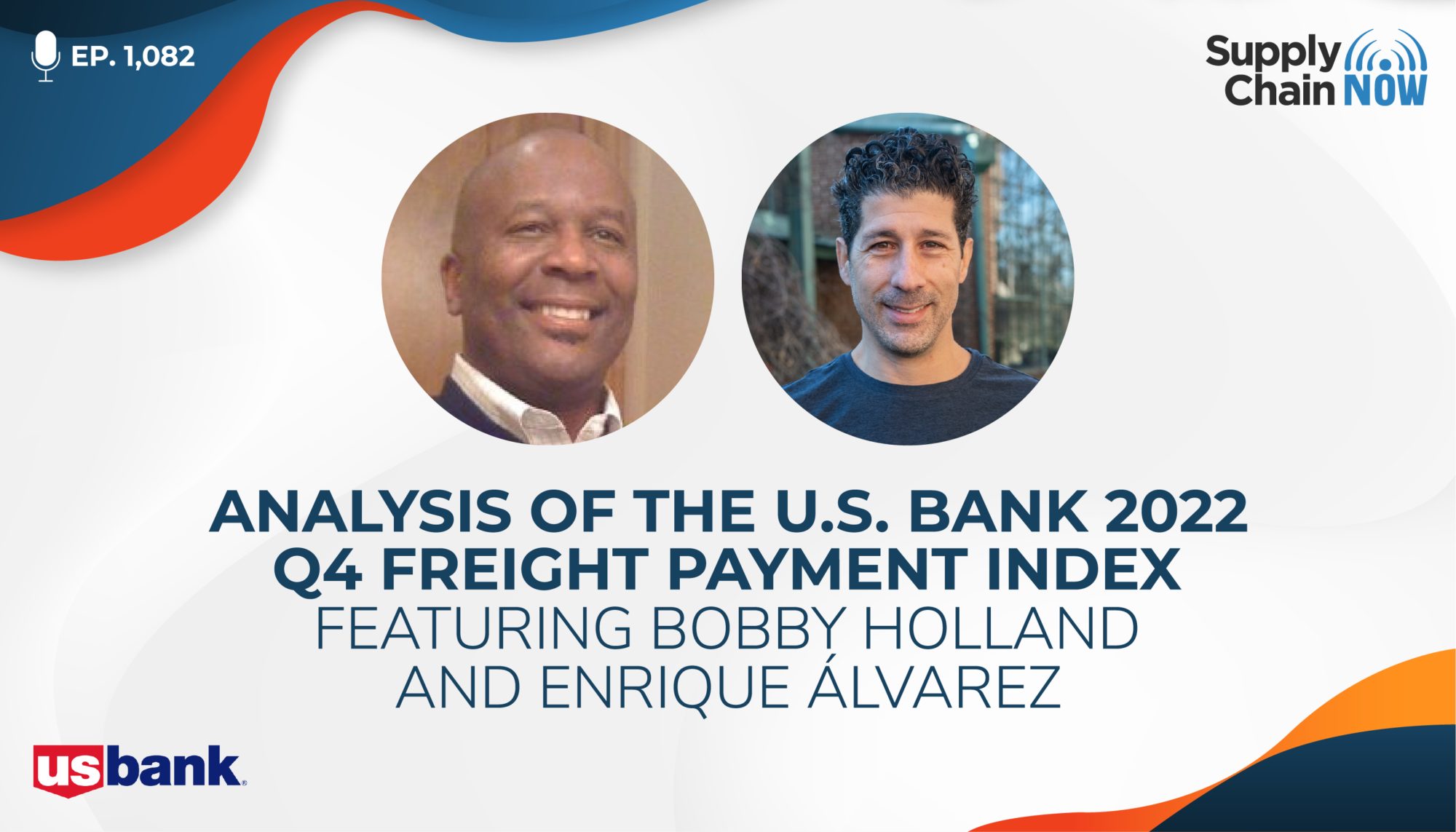

In 2022, U.S. Bank processed $46 billion in freight payments for some of the world’s largest corporations and government agencies. Those payments and the data that accompanies them are analyzed quarterly by Bobby Holland, U.S. Bank vice president and director of Freight Data Solutions and his team. The FPI report includes quarter over quarter, year over year, and full year data and analysis.

In Q4, truck freight shipments experienced the largest year-over-year drop in volume since the third quarter of 2020 – the height of the COVID-19 pandemic. Although volume is down, driven in part by a decline in consumer spending, carrier spending did not decline significantly, suggesting that capacity is tight and that cost pressures are driving smaller carriers out of the market.

In this interview, Bobby is joined by Enrique Alvarez from Vector Global Logistics to share the results of the Q4 2022 report with Supply Chain Now Co-hosts Greg White and Scott Luton, interpreting what they may mean for the economy and the shipping industry in the short and longer term.

• How high interest rates are influencing consumer spending, and the impact this is having on the freight marketplace

• Secondary headwinds from a slowdown in manufacturing activity and construction spending

• Why the Southwest was the only region of the five defined by U.S. Bank to experience growth in shipments and spending

Episode Transcript

Intro/Outro (00:03):

Welcome to Supply Chain Now, the voice of global supply chain. Supply Chain Now focuses on the best in the business for our worldwide audience, the people, the technologies, the best practices, and today’s critical issues, the challenges and opportunities. Stay tuned to hear from those making global business happen right here on Supply Chain Now.

Scott Luton (00:33):

Hey. Hey. Good morning, good afternoon, good evening wherever you are. Scott Luton and Greg White here with you live on Supply Chain Now. Welcome to today’s livestream. Gregory, how are we doing?

Greg White (00:42):

Live. Live.

Scott Luton (00:45):

Times two.

Greg White (00:46):

Yeah.

Scott Luton (00:48):

And we are just talking about a certain movie figure out in theaters that is extra Live as well, Greg, right?

Greg White (00:54):

Yeah. Should we share the title?

Scott Luton (00:57):

We’ll save that for later, how about that?

Greg White (00:59):

Yeah. Like, wow, what a promo. That might be the most compelling lightning trailer ever. And I bet people can guess maybe just from that. But we’ll save it for later.

Scott Luton (01:11):

Undoubtedly. Well, hey, Greg, it’s Super Bowl week. We’re going to save that discussion. Of course, it’s your Kansas City Chiefs versus the Philadelphia Eagles. It should be a great game, Sunday.

Greg White (01:23):

That shoulder? [Inaudible] from Patrick Mahomes.

Scott Luton (01:25):

Legendary. He’s becoming quite a legend with that throw. But today, folks, we got basically the Super Bowl of the domestic freight market. Greg, how about that?

Greg White (01:36):

I like that.

Scott Luton (01:37)

So, today, we’re going to be sharing key insights from one of the leading transportation industry resources, so U.S. Bank Freight Payment Index for Q4 2022. Now, Greg, we’re going to be bringing on a couple guests here, but I want to share to folks what they can expect with the U.S. Bank Freight Payment Index. You know, we’ve been covering this thing, I think, going on three, four years now and we’re going to dive into this report a lot deeper. But we want to invite all of our listeners out there, hey, download your own copy of the Freight Payment Index to follow along. We’re going to be dropping links and how to get that here. You can see some of the data. They break it out in five different regions, chock full of good insights and takeaways. And, folks, if you’re tuning in, if you’re listening to us, you can go to freight.us bank.com to get your copy. You can mark it up, dog ear it, spill coffee on it, whatever. But use it, right, Greg?

Greg White (02:25):

Don’t print it.

Scott Luton (02:27):

That’s right. Who prints stuff these days?

Greg White (02:29):

Yeah. Finally, Adobe Acrobat will let you make comments on stuff without paying Adobe. So, be cheap, be frugal, be environmentally friendly. But still mark it up, like Scott says. I mean, look, it is worth getting into for sure. And, man, this one – wow.

Scott Luton (02:51):

So, before I throw it over to you, getting key takeaways, again, domestic freight market from not only the Freight Payment Index, but two business leaders that have extensive experience in the industry, especially the transportation sectors. But, Greg, before we introduce our guests here – we’ve got two good ones – tell us more, I mean, we’ve really enjoyed this ongoing collaboration with U.S. Bank, right?

Greg White (03:13):

Yeah. I mean, this is such an important report and U.S. Bank processes $46 billion worth of payments in 2022 – 46 billion, B as in Bezos, as you like to say, Scott, in payments. And that’s just an incredible amount of volume. And I don’t know how many thousands or hundreds of thousands of shipments that is. We’d have to go back and do the math, or maybe Bobby or Dan can let us know. But it is truly impressive. There’s a lot of information here that lets you see what happened in the last quarter, why it happened, and what that might it portend for the future.

Scott Luton (03:56):

Nice. That’s a nice word. Very nice word, portend.

Greg White (03:59):

It means [inaudible] basically.

Scott Luton (04:02):

All right. Well, hey, Greg, man, 46 billion. That is a massive number. A ton of insights from all of that data. But, folks, don’t take our word for it. We’re about to introduce our guests. I want to say just hello to a few folks. I see Adul in Birmingham, Brandy from Central Texas, of course, Amanda and Katherine. The whole production team, thank you all for what you do. Shelly’s back with us. Kashon, David, Juan from Dubai. Great to have everybody. And we look forward to hearing your insights on the data we talk about here today. Okay. Greg, are you ready to go?

Greg White (04:31):

Let’s do this.

Scott Luton (04:32):

All right. Looking forward. So, let’s bring on our first guest as we dive in here. Of course, back by popular demand, we have Bobby Holland, Director, Freight Data Solutions at U.S. Bank. Hey, hey, Bobby. How are you doing?

Bobby Holland (04:46):

I’m doing well. Good morning.

Scott Luton (04:48):

Good morning to you. Greg, it’s not a quarter unless we have Bobby Holland stopping with us, right?

Greg White (04:53):

Yeah. We’ve been doing this for three years, right, Bobby? Are we going into our fourth year now?

Bobby Holland (04:59):

Going into the fourth.

Greg White (05:00):

Holy mackerel.

Bobby Holland (05:02):

It’s great.

Greg White (05:03):

Obviously, I feel like we’ve kind of grown up together. I mean, we were relatively new to this, you were relatively new to doing this for U.S. Bank, and the way this has evolved and grown has been truly impressive. And, of course, it’s always great to just share some time with you.

Scott Luton (05:21):

That’s right, And so, congrats on the rock and roll star you have become. We had to go through your agent to get you booked this time. But, hey, I digress. We’re going to jump into lots of freight data in just a moment. But really quick, Bobby, you just got back on a trip to Cancun, and I’d love to know your one single favorite part about that trip.

Bobby Holland (05:40):

Food. I love Mexican food as it is. Going into the source, we went to Isla Mujeres and had some tacos. Simple tacos but they know what they’re doing, and I thoroughly enjoyed it.

Scott Luton (05:52):

Man, thank you for making Greg and I starving, probably the whole production team back there and all of our audience members. But we’ll get to get the pictures from you later, Bobby.

Greg White (06:00):

Yeah. That whole area down there is beautiful. Isla Mujeres is incredible, even considering everything that’s beautiful about Cancun and that area.

Scott Luton (06:09):

So, now, we got to get back to work. And Bobby, as Greg and I both shared, great to have everybody in. We see our dear friend, Sylvia, part of the Charleston supply chain ecosystem down there. Bobby, all of our audience really enjoys your quarterly insights perspective, as do folks really around the global Supply Chain Now family. I want to start though. I want to start. We’ve got a special guest joining us here in about 15 minutes. But let’s start with a very brief sneak peek, the five key takeaways from the Q4 2022 Freight Payment Index that we’re going to dive in. So, we just want to tease it on the frontend. And, folks, stick around for more analysis. So, Bobby, what would those five things be?

Bobby Holland (06:47):

Well, the five takeaways from this index are softening market, softening trucking market. We had contracting freight volumes. We had overall spend drop that didn’t meet expectations. We had some lively activity in the Southwest region. And then, we also had a sluggish West Coast region.

Scott Luton (07:06):

Okay. So, folks, we’re going to dive into each of those five things. Greg, when you hear that sneak peek, anything surprise you? Any comment there?

Greg White (07:15):

Yeah. I mean, I think the fact that overall we have market contraction, but the spending didn’t fall as much as we expected. I mean, we’ll get into detail to what that actually means longer term. But it’s funny, Scott, we were talking about freight recession and the absence thereof not so long ago it seems like, Bobby. And it feels like we’re at least getting to some level of equilibrium. So, we’ll dive deeper into that and talk about where the market is going.

Scott Luton (07:42):

Agreed. Agreed. So, y’all stick around, let us know what you think. And by the way, Bobby, you’re not making just our team hungry. Shelly, “Bobby sounds like a Taco Wednesday.” I love that. You’re making everybody hungry. Okay. So, we got the sneak peek. Folks, we want to encourage you, again, download your own copy of the Freight Payment Index to follow along. You can learn more at freight.us bank.com and check that out. Okay. So, Greg, before Enrique Alvarez joins us here in about four or five minutes, where else are we going to take Bob really quick for maybe some helpful background and level setting?

Greg White (08:14):

Yeah. I mean this 46 billion thing, that’s a big wow for me. I think we were discussing offline, that’s about a 24 percent increase over 2021. So, Bobby, I mean, that’s a huge amount of volume. I think, may these are not market leading statements. We have no dog in this fight. But I think that may make U.S. Bank apt or near the top of all freight payment processor. So, it’s incredible the amount of volume that you guys do. Obviously, that’s a big data set. But aside from that, what really makes the Freight Payment Index a good resource for folks to use? And give us a little bit of insight on how it works and what it tells or what your clients tell you they use it for.

Bobby Holland (09:00):

Well, the Freight Payment Index is U.S. Bank’s view of the marketplace. And like you said, it’s based on our processing of millions of invoices to the tune of 46 billion in spend last year. It makes it a great resource because of the broad spectrum of customers that we have. Obviously, we’re in big data territory, which gives us a viewpoint of the marketplace that, individually, carriers and shippers wouldn’t have otherwise. We’re not saying we are the end all and be all of indexes. We’re another viewpoint. And so, the idea is take our data points with others that you have and use that to make some informed decisions in the marketplace, at least get a broad spectrum view of the marketplace. And so, we try to make it as accurate as possible, statistically significant, it’s a chain based index. We’re measuring, you know, the velocity of change in the marketplace on both shipments and spend.

Bobby Holland (09:58):

And, again, one of the things that makes our view point a little bit different is the fact that we have it broken down in the regions. We have the national, the highest level overview, and then it’s broken down into the five United States regions. And by doing so, you can see the impacts affecting each of those regions differently. The Southeast versus the West, they have different drivers. Midwest, same thing. And we’ll go into that a little bit as we talk about the five points.

Greg White (10:27):

I think what’s really important is that it’s a viewpoint that you can’t have as an individual company. And, again, as, Bobby, you said, because of the different areas of focus in terms of commerce in different parts of the country, it allows you to assess, not only a bigger slice than your company represents, but how your industry compares to other industries. Of course, you know, that’s automotive in the upper Midwest and the Southeast, and a whole range of other kinds of commerce in the other parts of the country. So, that is a really good reason to utilize this thing. It’s just to have that broader perspective, but also to have that focus on your either market area or regional area of the country.

Scott Luton (11:14):

All right. So, Bobby, good stuff there. Thanks for being back with us. We got a great discussion coming up. So, what Greg and Bobby both touched on are the business leaders out there that use the Freight Payment Index, and other resources, a number of different ways to make better decisions and plan better. Anyone think planning is important in global supply chain, Greg?

Greg White (11:33):

I don’t think so.

Scott Luton (11:34):

So, one of those such leaders, a dear friend of the show, and a business leader out there making it happen is Enrique Alvarez, Managing Director and Cofounder of Vector Global Logistics. Let’s bring in Enrique. Enrique, good afternoon. How are you doing?

Enrique Alvarez (11:51):

Scott, Greg, and Bobby, it’s a pleasure to be here with you guys today. And one cannot have enough of those swooshing moments that makes you feel important, smart, and ready all at the same time.

Scott Luton (12:04):

Greg, as we’ve said a thousand times, the swoosh is a real star of the show. Clearly, that’s what gets everybody’s attention. But, Enrique, great to have you back. I was with members of your team yesterday on the Leveraging Logistics for Ukraine, an ongoing humanitarian mission. And I’m just honored and we’re all inspired by what you and the whole team, the community have come together to do. So, with that aside, Enrique, I want to start with a two-part question. So, first off, level set with us about what Vector Global Logistics does. And then, also speak to how business leaders, like you, utilize the Freight Payment Index and similar resources.

Enrique Alvarez (12:39):

Absolutely. Well, Vector Global Logistics is an international logistics company with a very unique results-based mentality and a passion to give back. We’re a purpose-driven organization focusing in certain industries, like the automotive, aerospace, renewable, energy, and purpose-driven organizations all over the world. We have our own offices in the U.S., Mexico, Chile, Malaysia, Vietnam, China. And this year, we’re going to open one in Peru, so we’re very excited about that.

Enrique Alvarez (13:08):

And the second question, which, of course, is the most important one, this is an incredible tool. The U.S. Bank Freight Payment Index is a very powerful way of really gauging what the market is doing and what the market could potentially do in the future. As Greg mentioned, visibility is everything. The pandemic made that very clear for every supply chain professional out there. And so, using this index – and I would argue not only at the CEO leadership level, but we usually forward it to everyone in our organization – I think it’s very powerful because everyone gets the opportunity to understand the market. And I think one of the keys to being successful and being efficient is knowing the market and being ready for changes to come, because there’s always going to be changes. And I’m sure we’ll talk about some of those insights from the report in a second with Bobby. But definitely very powerful.

Scott Luton (14:00):

Yeah. Good stuff there. Thank you so much, Enrique. And you’ve got my vote, Enrique. I love that opening salvo there. Okay. So, Bobby and Enrique and Greg, we’re ahead of schedule just by a couple minutes, and if I can, I want to revert back to the food themes since Bobby made us really hungry. We had a commenter here – if I can find it – that said, “El Paso best authentic Mexican food stateside.” Enrique, I’d love to get you to weigh in here. What’s one great place for Mexican food that would make Bobby Holland approve?

Enrique Alvarez (14:32):

Mexico City would be a great place to start. But there’s plenty of really good restaurants all around the U.S. I think the Latin and Mexican culture are very well-ingrained in this country by now. So, you can find good tacos anywhere. You just have to be brave and willing to explore some of those, maybe, not so frequented areas. But I’m with Bobby, tacos, that’s my favorite too.

Scott Luton (14:54):

And, Greg, to belabor the point, we love Nuevo Laredo here in the Atlanta area. Is that right, Greg?

Greg White (15:02):

Yeah. That’s great. And, of course, you know, I moved to Atlanta from Phoenix. My wife is from Phoenix. And when I worked in industry, it was Mexican, so he showed me all of the best, most legit Mexican places in Phoenix. Carolinas, which used to be on a dirt road in the center of downtown Phoenix is the best tortilla I’ve ever had in my entire life. Very legitimate. That’s where his mother went to get tortillas. That’s how I found the place.

Enrique Alvarez (15:32):

So, Scott, I didn’t know that we were allowed to endorse specific points. I’m sure Nuevo Laredo will send those later. But if I may, Buford Highway, El Taco Veloz here in Atlanta. It’s really good.

Scott Luton (15:48):

All right. I got to call a timeout. No more taco. No more food talk, man. Y’all are killing me.

Greg White (15:53):

We’re back on schedule, Scott, and even more hungry.

Greg White (15:54):

We’re back on schedule.

Enrique Alvarez (15:58):

Yes, thank you.

Scott Luton (15:59):

All right. So, thank y’all for indulging me. While we’re all here, Bobby, I want to dive a little deeper into those five key takeaways that you shared on the frontend from the Q4 2022 Freight Payment Index. So, let’s dive in. Let’s take the first one. I think you mentioned the softening trucking market. So, Bobby, tell us more.

Bobby Holland (16:17):

Well, the first one is seismic shifts in consumer spending patterns have affected the marketplace. And rising interest rates are also having disproportionate impact on the market on good consumption. Big ticket items, like autos and homes, those are interest rate sensitive, so when interest rates rise, people stop or slow down in their buying of those things and start shifting more towards services. And we see that in things like recreation entertainment, we can see that those are going up. And the consumer price index for December, the entertainment index and recreation index were two of the ones that continued to rise while others fell. So, it’ll be interesting to see, though, as we move forward, there’s been some talk that mortgage rates are dropping or have dropped some back in September, but not enough to necessarily drop people out in the fourth quarter back into the market. But if that continues, mortgage rate is dropping. It’ll be interesting to see if that’s reflected in any way in Q1, so we’ll be looking at that.

Scott Luton (17:20):

Good. And one of the things you touched on, and certainly the report touches on, is consumer spending less. So, according to data released in January by the U.S. Department of Commerce, both in November and December 2022, durable goods spending – so spending dropped across the board – dropped almost 3 percent alone in November. So, Enrique, weigh in on the kind of overall theme in this number one key takeaway, the softening trucking market.

Enrique Alvarez (17:45):

Well, I think you can definitely see that in a general aspect of the markets. Well, definitely demand is slowing down, for sure. Now, one of the things that is very interesting to see also in the report is how this compares from one region to the other. And that’s something that you’ll definitely have to factor in, and I’m sure we’ll talk a little bit more about that. But that, and then also something that Greg mentioned at the beginning, there’s a disparity between the demand, the shipment is kind of slowing down, but the price is not slowing down at the same rate, which is very interesting. And I think, for me in particular, it speaks to some of the other challenges that the trucking company has in this country, like not enough drivers and some other things related to infrastructure.

Scott Luton (18:26):

Yeah. Good stuff there, Enrique. Greg, weigh in here on number one.

Greg White (18:30):

Well, durable goods are tied to home sales. Home sales are tied to interest rates. Interest rates have skyrocketed. Although, for those of us of a certain age – that’s all of us here except for Bobby who just recently bought a house, the rest of us – not long ago would’ve thought 4 or 5 percent interest rates – which, I know they’ve gone past that in some cases – we would’ve been happy to buy houses at that rate. I remember long ago when you were happy to just have single digit interest rates for your housing. And, now, we’ve gotten quite spoiled. But it is a very real problem. And, of course, to the point that, Enrique, you made earlier, inflation is a big time factor driven by labor, in my opinion, in the trucking industry, much like it’s driven by labor and many other reasons for industries area.

Scott Luton (19:18):

Good stuff there, Greg. And I love your context on how mortgage rates have evolved. Okay. So, Bobby, moving right along. Let’s move into number two of your top five key takeaways. What would that be?

Bobby Holland (19:30):

Well, Enrique kind of touched on it in the fact that spend on freight services didn’t drop as much as you would expect given the lower volumes. And another thing that kind of makes this interesting is the fact that diesel prices were actually down during the quarter, but yet the contract freight rates remained fairly stable. So, we take this to mean that, or as an indication that, industry capacity might have shrunk a little. We kind of look at that, you know, possibly as a lot of smaller carriers finding business climate difficult. And so, a lot of capacity kind of left the market on the lower end, if you will. And that kind of helped to keep spend a little higher than what you would expect considering the drop in shipments. Nationally, spend was only down 0.2 percent. But shipments were down 4.6 percent. So, again, big disparity showing that capacity is still a little tight in the marketplace, even with the shipment volumes declining.

Scott Luton (20:34):

Yeah. All right. So, Enrique, as Bobby mentioned, you were letting the cat out of the bag a little bit on your earlier commentary.

Greg White (20:41):

Way to go, Enrique.

Enrique Alvarez (20:42):

Thank you, guys. I’ll leave now.

Bobby Holland (20:44):

I prefer to look at it as a segue. A very nice segue.

Scott Luton (20:46):

That’s right, Bobby. That’s right. Very good.

Greg White (20:52):

Transitional data.

Scott Luton (20:53):

Transitional data. That’s right. All right. So, speak to, Enrique, those freight volumes contracting.

Enrique Alvarez (20:58):

Should I talk about the third bullet point then?

Greg White (21:01):

Yeah. Go ahead.

Enrique Alvarez (21:02):

No. So, for us, at least here on Vector, from a freight forwarding logistics forwarder that actually partners with a lot of trucking companies out there, we still see not enough capacity, as Bobby mentioned. But for us, it’s really more about making sure that we continue to partner with the right kind of companies. So, we pay for service, we pay for quality. And so, for us, it’s really more an investment not to try to go after the cheapest option, but really stick with the partners we’ve had. We had really good couple years, so right now that the market might be slightly turning, we are making a very conscious and strategic effort to continue honoring the commitments we have because we know that we are only as strong as our suppliers. And we are incredibly thankful and appreciative for the relationships and partnerships that we have gotten through the years with the trucking companies that we work with. And they clearly were the heroes during the pandemic, maybe even a little bit of uncalled heroes, but they kept this country and the world running. And so, we’re just basically not going to react to the downward pressure as quickly as others.

Scott Luton (22:09):

That’s right. That’s right. Good stuff there, Enrique. And, Greg, before I come to you next, I want to just point out a great question. Aaron, we’re going to encourage the U.S. Bank, Bobby, and Dan and the team to get back to you after today’s show. Aaron’s talking about if the index is able to identify specific charge trends. So, we’ll get the team to follow up with you there. Great question. Thank you for being here, Aaron. Greg, kind of follow up, you get the last comment here on Bobby’s key takeaway number two.

Greg White (22:31):

It’s a bit of a whiplash effect. A lot of companies move to contract rates from the spot market just about as they saw the spot market elevating. And they went to contract rates at – not at – or maybe at or around the peak of rates, and now they’re stuck with them to a certain extent. That happened. And, of course, remember, a lot of what we saw in Q3 and Q4 that probably, at least nationally, drove shipments down was so many retailers and CPGs overstocked on import good or buying them throughout the year. And then, ceasing their purchasing throughout Q3 and Q4, which has impacted both the shipment count and then the rates as well. I think companies, they’re reaching their limit of their tolerance for where rates are right now. And that probably has something to do with the reason that shipments are going down as well. That’s why I use the E word before equilibrium. And it’s possible that this could be an indicator that things will start to calm down.

Scott Luton (23:32):

Yeah. Was it just equilibrium before the eCommerce era, Greg?

Greg White (23:37):

It was. Yes. Before Amazon, we just called it Quilibrium.

Scott Luton (23:44):

All right. So, good discussion there. And we’re just not even halfway through the five key takeaways. Folks, you got to check out the Freight Payment Index to come up with your own. Maybe you agree with what Bobby is sharing here. Maybe you disagree with what Enrique is sharing here. But let us know.

Greg White (23:57):

Most certainly disagree with what I’m sharing.

Scott Luton (24:01):

Oh, boy. So, Greg, Enrique, and Bobby – Bobby, let’s walk into your number three. So, we’re talking about overall spending drop that didn’t meet expectations for number three, right?

Bobby Holland (24:10):

Yeah. The fact that we had household spending on goods. We had seen a decline in housing activity. Again, which as we talked about, big impact on freight volumes. We also saw manufacturing activity slowing in Q4, which is another headwind. And, again, as we see one of our Harrison points internally is consumer price index. All index items was up 6.5 percent. And, again, we saw increases in recreation but we saw decreases in the index for used cars and trucks. So, again, spending has shifted away from things related to interest rate and a lot of manufacturing and building things and going, like I said, more towards vacations, like the Cancun and stuff like that.

Scott Luton (24:53):

Yeah. And spending on truck freight services.

Greg White (24:54):

Who’s talking?

Scott Luton (24:58):

That’s right. Man, don’t get me started. Greg, don’t get me started. But, Bobby, spending on truck freight services didn’t fall as much during fourth quarter as might have been expected. I think you mentioned that, too, right?

Bobby Holland (25:07):

Right. And, again, we looked at the numbers and, like I said, 2 percent down – 0.2 percent down in spend, but 20 times that in reduction in shipment, so, 4.6 down. So, again, that’s indicating that the market is still tight and gave us some really good reasons why [inaudible].

Scott Luton (25:27):

Didn’t he though? Didn’t he though?

Bobby Holland (25:30):

He did.

Scott Luton (25:31):

Always still in my thunder over there, Greg White. But, hey, one of the things that Bobby touched on – Enrique, I’m coming to you next – was the manufacturing activity. You know, by a variety of different data measures, the manufacturing industry here in the U.S. has contracted two, three months in a row now. That’s one of the things that Bobby touched on. Enrique, talk to us about Bobby’s key takeaway number three here.

Enrique Alvarez (25:50):

Well, generally speaking, I think another variable that we should consider is more the international aspect of shipping and kind of how the ports are, port congestion, how many vessels are parked outside each port. And I think we didn’t see it as much as we have in other years, of course, with demand spiking. But Chinese New Year always is an important driver. And so, the last quarter of last year, we maybe had a little bit of that in the numbers that Bobby’s talking about.

Scott Luton (26:17):

Yeah. Well said, Enrique. Greg.

Greg White (26:21):

Well, manufacturing has been struggling to get people back ever since March 13, 2020. I mean, they basically shut down, then people were locked down, then they were incentivized not to work. And a lot of the people who had those jobs – the baby boomers – left. An extra ten million of them left during 2021 from the workforce. And many of those worked those manual manufacturing jobs. So, manufacturing capacity has continued to be limited, and to the point that we’re just now back at pre-pandemic levels in terms of manufacturing employment.

Greg White (26:55):

So, you know, there’s a significant discussion around reshoring. I hear a lot about people saying that companies are beginning to reshore. It hasn’t really started to impact manufacturing capacity yet. We’ll see how sustainable that is. I think we all know that there are some significant costs headwinds there. I mean, the reason we went offshore was because labor was too expensive here in the states by orders of magnitude, not by fractions. So, that’s going to continue to be a headwind for manufacturing. But at least they are back at pre-pandemic capacity, so, hopefully, we’ll start to see that stabilize. The strong dollar doesn’t help however, because that lessens the import or the exports of manufactured goods. And believe it or not, we have many that we do exports.

Scott Luton (27:40):

Good stuff there, Greg. Thank you very much. I love your thoughts on manufacturing industry, one of our favorite here at Supply Chain Now. Okay. So, Bobby, we’re already in your fourth key takeaway here where you kind of focus on what’s going on in the Southwest region, I believe. Tell us more.

Bobby Holland (27:55):

Yeah. The Southwest was the only region of the five to have both an increase in shipments and spend. The shipments index was up 0.4 percent over the third quarter. We’re attributing that to a few factors that would help chip the freight volumes. One is that energy production and cross border trade with Mexico as well as Texas port activity. And I was just looking at an article recently that talked about how trucks and cars from Mexico saw some huge increases during 2022. So, we see the results of that in the Southwest Region. We also have things like crude oil production was up roughly 4.5 percent in Texas a year earlier. New Mexico production was up over 25 percent during the same period, with Oklahoma production up about 4 percent. And then, again, just the cross-border movement between Mexico and the United States, it was up 1.5 percent. So, again, you can kind of see how all these factors would contribute to a strong Southwest, and it shows.

Scott Luton (28:55):

Speaking of, you mentioned Texas ports, just the Port of Houston, if you look, a total ton is going through imports and exports coming through the Port of Houston. That alone grew a whopping 27 percent in 2022 over 2021. How about that? Enrique, speak to what we’re seeing here maybe in the Southwest.

Enrique Alvarez (29:23):

Well, we actually have offices in Mexico, and one of the offices we have is in Monterey, Mexico which is kind of towards the north part of the country, very close to Texas. And I think Bobby hit the nail on the head, it’s really oil and cross-border operations with Mexico. The volumes from Mexico to the U.S. have increased, and I would claim that they might actually continue to increase for the foreseeable future. Somewhat in line with what Greg said about nearshoring of the little bit of the manufacturing, there’s a lot of new plants opening up in the north part of Mexico and I think we will continue to see that in particular also, as Bobby mentioned, in the automotive industry.

Scott Luton (30:01):

Yeah. Good stuff there, Enrique. Thank you very much. Greg, weigh in on Southwest and beyond.

Greg White (30:08):

Yeah. Not solely because of this brand, but Volkswagen, of course, virtually every Volkswagen that’s bought in the U.S. is built in Mexico. And they were one of the companies that could actually get a hold of chips. I think we have all moved beyond the conflagration that we’ve had with semiconductors and lockdowns into the first quarter of 2022 effectively for many states. And then, of course, shortage of labor and capacity fully into the middle half of last year. I mean, we were talking about that a lot this time last year.

Greg White (30:45):

But anyway, Volkswagen and other automotive companies do import a lot of vehicles. Volkswagen in particular, just as an example, was able to import a lot of vehicles and put them on sales floors when other brands, including U.S. domestic brands, were not able to. Ford, famously with their inability to complete the F-150 because they didn’t have their own logo to put on their own vehicle. I still remember the greatest question, this is the greatest manufacturing quiz and there’s only one right answer, and that is, how many parts does it take to build a Ford F-150? Scott, do you know the answer?

Scott Luton (31:23):

I do, but I want to give it away. Go ahead.

Greg White (31:25):

All of them. All of the parts are required to complete a vehicle. So, because German engineering, generally, and because of the efficiency of the facilities that have been running for decades, frankly, in Mexico to build some of these European mates, they were able to do that. And I think that had some impact on it on the Southwest as well. Automotive always does, of course.

Greg White (31:48):

Agreed. And speaking of all those parts, these days you got to have lights up under your Ford F-150. You can’t take it off the light until you got all the neon lights up under. I don’t know if that —

Greg White (31:58):

Well, now, behind the wheels also.

Enrique Alvarez (32:02):

[Inaudible].

Bobby Holland (32:03):

[Inaudible].

Enrique Alvarez (32:05):

Well, and on top of that, Greg, there’s now a very strong – I wouldn’t call it trend because it’s the future, but the electrification of cars. Like, there’s a lot of manufacturers that were making chassis before for combustion engines that are now resetting their entire footprints in Mexico to accommodate the electric cars, that you have to change a lot of designs, but you’ll see that. And Mexico is actually a couple years ahead when it comes to doing that. So, I think we’ll start seeing that extra demand for electric cars and the increase in truck between Mexico and the U.S. going through Texas, probably almost everything to Detroit, but a lot of also to the East Coast.

Greg White (32:41):

Excellent point because, again, Porsche, Audi, Volkswagen, all the same company, are way ahead of the other brands in terms of electrification. The commentary in the Freight Payment Index alluded to EVs and that sort of thing as well. So, I think that’s a really good acknowledgement.

Scott Luton (32:58):

Bobby, I think you were about to say something.

Bobby Holland (33:00):

No. I was just going to say, I thought I read something recently as well, the large battery manufacturer putting a plant down there. Again, a lot of change coming, and it rolls over in that regard. But they’re serious about electric vehicles. And, again, it would just be interesting. We’re kind of looking at it also to see how that impacts fuel [inaudible] when electrification of transport vehicles becomes a big thing.

Scott Luton (33:30):

The battery industry alone, we could build a whole series dedicated to all the different topics that this EV demand is driving. And you’re right, Bobby, I think Georgia has won at least three new big battery plants. And, Greg and Enrique, since you’re fellow Georgians, I think two of them are on the scale of the massive – we all remember when Kia came into town in West Point, Georgia which really changed the state, changed a lot of infrastructure. Well, at least two reportedly are on that scale. So, we’ll see how this all plays out and what comes to fruition. There’s still lots of negotiations going on for a variety of reasons.

Scott Luton (34:06):

Okay. So, Bobby, I hate that we’re at the end of your takeaway list. I love, not only kind of the focus part of our conversations, but all the things kind of on the edges that some of the things in the Freight Payment Index touches on. So, tell us about number five where we focus on the West Region.

Bobby Holland (34:21):

Well, the West Region, we saw drops in shipment and spend on the West Coast. And, again, we attribute that primarily due to the continuing to shift toward other ports. West Coast import container volumes fell 23.3 percent in October and 26 percent in November compared with last year or the previous year. Some of that volume is due to lower imports, again, that we talked in previous indexes about. So much retail moved forward in second quarter, that third quarter and into fourth quarter didn’t see as much import activity. But, also, we see a lot of it shifting to the East and Gulf Coast ports. If you’re looking at some of the numbers, you know, Virginia was up 21 percent, Savannah was up 26 percent, Charleston up 28 percent over last year. And most of these ports are well above the pre-pandemic level. So, again, a lot of these decisions that were being made to heal the supply chain and strengthen the supply chain we’re seeing some of the impacts of that now.

Scott Luton (35:29):

Good stuff there, Bobby. Greg, let’s start with you this time, Western Region, some of Bobby’s comments there, your thoughts?

Greg White (35:37):

Yeah. Well, I mean, it largely has to be the shift to the ports. We’ve been talking about this, Bobby. We’ve talked about this for probably three or four of these quarterly updates. And the volume just has continued to grow. Every one of these ports has become that much more efficient. I was just pecking my marine traffic East Coast Port of Savannah freight delay index, and there are ten ships waiting outside the Port of Savannah. That was as high as 37 at various times throughout our previous quarterly updates here. And, you know, all of these ports have gotten very efficient. Charleston had big backups. We’ve already alluded to and talked about Houston and other ports even on the West Coast that received additional volume.

Greg White (36:26):

So, yeah, it has a lot to do with that and it has a lot to do with the fact that companies, first, were adapting. I think when we first started talking about this, Bobby, we saw [inaudible] redirecting ships to Houston. Now, they’re booking them to Houston or to Savannah or to Charleston. So, it has been monumental, and now an intentional, not a backup move. But an intentional shift to other ports around the country. And it’s really set in. And it may be longer term than just during the time of excessive volume and, of course, the excessive inefficiency of LBC and LA ports.

Scott Luton (37:03):

Thank you, Greg. I’m dying to hear Enrique’s take on this when it comes to the West and some of Greg and Bobby’s comments there. Enrique.

Enrique Alvarez (37:11):

Yeah. I actually agree with both Greg and Bobby. I think it’s the reflection of what’s going on in the ocean trade industry. Not only because of what Greg so carefully already described, but during the pandemic, we were shipping all over. It was really more about where can I get a booking to. And the prices in the ocean freight are coming down. They have come down significantly. And I think this is a little bit of a very standard kind of normal “shift” towards what’s the best port to import those days as opposed to let’s just get it somewhere fast mentality. So, yeah, I think that’s kind of what’s causing this. I don’t know how much of that could potentially also, in the next coming quarters, be reflected by the slowdown in manufacturing in China, of course, driven by the slower demand. But we’ll have to kind of wait and see what happens. I think, China will be very important to keep an eye on as we get a better sense of U.S domestic trucking, believe it or not.

Scott Luton (38:09):

Yeah. All right. So, this next question, Bobby, you know we can’t ask you any forward looking questions, as always.

Greg White (38:16):

We can ask [inaudible].

Scott Luton (38:20):

That’s right. You know we got Bobby’s back so we’re not even going to ask.

Greg White (38:24):

Yeah. That’s going to put in the bad spot.

Scott Luton (38:26):

But, Enrique and Greg, you are both fair gain. So, Enrique, I want to stick with you for a second. What might we see in the freight market in the months ahead?

Enrique Alvarez (38:36):

Well, there’s so many different things that could actually trigger this, but in general, and we saw it and Bobby presented it very clearly on the report, that it will vary from one region to another inside the country. So, it’s very important that you, not only get those reports, but actually make an effort to read them. And by the way, I’ll get to the question in a second. But they’re so easy, clean, professionally looking so they’re easy to read is my point. So, it’s not that you will waste any time. They’re very insightful and very powerful and it’s also very easy.

Enrique Alvarez (39:08):

Now, answering your question – and I’m sorry I completely digressed – the Fed is doing a good job, I believe, trying to contain inflation. I think that they might continue to increase interest rates but they won’t actually reach where we initially thought that they will reach. And you’ll probably see that in two ways. One, demand will continue to come down for the next quarter or two, but then prices might actually stabilize kind of following the demand/supply in the country. So, what we’re seeing now on the last quarter’s report, I think we will continue to see something like that for at least the next two quarters. So, prices somewhat staying stable while demand continues to drop to adjust to supply/demand of trucking availability in the country.

Scott Luton (39:56):

Okay. Outstanding, Enrique. Thank you. That’s some bold fearless predictions there. But, hey, coming from someone that knows, Enrique and his team, they got their fingers on the pulse of the international markets, for sure. All right. Greg, I’m curious to kind of hear, not only what’s to come from where you sit, but see if you agree with Enrique about Fed’s actions. Get your popcorn and Diet Coke, this might be good. But, Greg, tell us more.

Greg White (40:19):

Speaking of equilibrium, I feel like the world is back in equilibrium because Enrique and I don’t completely agree on this point. I would not argue that Fed is doing a bad job. And to Fed Chairman Powell’s statement that the job is done, I think they probably went with too low of a lift this past time and that will prolong high prices throughout 2023. But it has slowed the growth of inflation, you know, to the point that people are now outraged by $13 eggs. It used to cost a lot less than that. I mean, of course, that has nothing to do with monetary policy by the way, the eggs. But I think that there are more forces at work here.

Greg White (41:03):

I think all of what we’ve seen here from this discussion talks to the complexity of the supply chain of the commerce ecosystem and the interconnectedness of all of this. And some of it we don’t have very good control over. So, aside from the economy, I think we’ll continue to see retailers and CPGs continue to slow down production and demand. And consumers will continue to slow down demand because I think they just reached a near tipping point. We’re starting to see it with retail investors in the stock market. We’re starting to see it with people rejecting luxury goods and other products in the marketplace that signal those sorts of changes. That upper crust, whatever we want to call them, those one percenters in probably the top five or ten percent of people in the U.S. in terms of economic capability, they started dialing back middle of last year. There are some pressures. That’s a very small portion of the consumption, obviously, in the country, but we’re starting to see that trickle down to the greater population.

Greg White (42:06):

And demand, Enrique said – here’s where we agreed – it will continue to slow and that will have an impact on trucking and that sort of thing. I think companies, however, will continue to slow their production. Some of them are carrying a lot of inventory into this year much as others have in past years. So, we’ll see kind of a mixed bag depending on where you are. There is more upheaval to come. There are other large companies that haven’t done their reductions in workforce yet that still will. And as we’ve seen, technology companies continue to reduce their workforce pretty substantially at a greater rate than even they did last year, which was pretty disruptive to employment.

Scott Luton (42:51):

A lot of good stuff there. And I appreciate where it’s good to be able to disagree and agree in conversations like this and I always enjoy —

Greg White (42:58):

We’re probably both wrong.

Enrique Alvarez (43:00):

We’ll battle it out next time we see each other, Greg, [inaudible].

Greg White (43:02):

Absolutely. Over cold beverage.

Enrique Alvarez (43:03):

I don’t know if you agree with me on this particular point, but I think and I see that there is still a lot of money in the market. And some of those deep pocket companies are probably going to think of investing now. Now that it’s the right time to do so. So, yeah, I think we agree in the demand. The rest, we’ll see.

Greg White (43:23):

Yeah. And I think that’s the entire point here. Look, there are people much better trained than Enrique and I that each have our respected positions, and positions all over the spectrum between and beyond what we’ve just talked about here. And there is a 100 percent chance that none of us will be 100 percent right.

Enrique Alvarez (43:43):

Absolutely.

Scott Luton (43:43):

That’s right. All right. Man, we had a supply chain discussion and an economic debate broke out. How about that? That’s good. We’re all smarter because of it. Okay. So, Bobby Holland, always a pleasure. See what you start each time you join us here at Supply Chain Now, I wouldn’t have it any other way. So, Bobby, here’s another question, how can folks connect with you, of course, how can they get their own copy and sign up to get to the U.S. Bank Freight Payment Index right on time each quarter? Tell us more.

Bobby Holland (44:12):

You can subscribe to it, the link is at freight.us.bank.com. And it’s low obligation. You just fill in a few pieces of information and it’ll be emailed to you on our publication. Connecting with me is as simple, my LinkedIn is updated, is up to date, so reach out to me, bobby.holland@usbank.com if you have any questions or anything I can try to help with.

Scott Luton (44:38):

Well, I appreciate what you, and Dan, and Andy, and the whole U.S. Bank team does because you do make us all smarter, more informed for decisions we make in supply chain and elsewhere. So, really appreciate what you do.

Scott Luton (44:49):

All right. So, before we let our guests go, Enrique, hey, let’s make sure folks can connect with you and Vector Global Logistics. And briefly mention, if you’d touch on, if folks that want to get involved in helping to send the humanitarian aid to Ukraine and Poland and beyond. How can folks find all that information?

Enrique Alvarez (45:03):

Yeah. I mean the easiest way to do so is look me up on LinkedIn if you want to contact me personally, Enrique Alvarez, Vector Global, and I should pop up. And then, if you want to learn a little bit more about what we’re doing in our company, just go to our website at vectorgl.com. And you mentioned Ukraine, we’re still going. But then, there’s now a new disaster, the Turkey, Syria earthquake, and we’ll probably jump into that and try to help people in both Turkey and Syriac because they really had it very bad.

Scott Luton (45:34):

Oh, man. Thank you for mentioning that. And more importantly, thank you for what you do and your team does. Maureen and Christie and Astrid, and the whole team over there. Thanks for being here with us, Enrique Alvarez from Vector Global Logistics.

Enrique Alvarez (45:47):

Way cool. Very cool.

Scott Luton (45:48):

All right. So, Bobby, Enrique, thank you both. Folks, reach out to them and we look forward to reconnecting again very soon.

Scott Luton (45:58):

All right. Greg —

Greg White (46:00):

[Inaudible] and then back in. It’s like a double swoosh.

Scott Luton (46:03):

A little extra time. A little extra time. It’s never a bad thing. Just to level set, I think folks should know this, but Bobby Holland there, Director, Freight Data Solutions, U.S. Bank, and Enrique Alvarez, Managing Director and Cofounder at Vector Global Logistics, two salt of the earth individuals. Greg, I want to give you an opportunity, I’ll mention one thing then I’m going to get your final thought, kind of your favorite thing that came out of today’s conversation.

Scott Luton (46:30):

Enrique mentioned, of course, the tragedy that has taken place in recent days in Syria and Turkey. Folks, if you can find a way to help out, please do. I think our production team is on it. We’re nailing down some special guests for Monday’s Supply Chain Buzz at 12:00 noon Eastern Time. I believe we’re going to have, not only Koray Kose from Gartner, who’s jumped right in – he’s got family there – in some of the relief efforts, but also Turkish organization that is leading the charge in recovery. So, stay tuned. Join us, Monday at 12:00 noon Eastern Time for a lot more there.

Scott Luton (47:01):

Greg, on a much, much lighter note, talk to us. We had a full conversation, holistic, full. We touched on a whole bunch of different things. What was your favorite part, most valuable part you would suggest to our listeners about today’s chat?

Greg White (47:14):

Cancun, Isla Mujeres, and tacos. I’m not joking. But not the most important. I think we learned a lot. One is, what an incredibly important trading partner Mexico is. Mexico may single-handedly save us from the tyranny of China, not just within their own country, but their manipulation of trade between the U.S. and China. And probably single-handedly is overstating it, but an enormous contribution. And I think the synergy there is really important, and that is the uplift of the Mexican economy by virtue of driving more and more goods into and through that area, hopefully, enabling the government there to take charge of their own country and make it a safe and economically viable place to live. That economically viable is a critical part of making a country good and safe place to live. So, I think whatever we can do to contribute there, will be returned in the state’s tenfold. Probably let Enrique speak to this. He’s both Mexican National and U.S. citizen, so he knows, obviously a lot more about this than any of us do.

Greg White (48:23):

But the other thing that really struck me, Scott, was this new format, which I hope that our community loves. But I love because we’ve got to experience and talk about the complexities as we did of the supply chain and how it’s interconnected with economics, and how it’s interconnected with international relations, and things like that. And how all of that, even things outside the borders – because Vector is an NVOCC. They do international freight shipping. Enrique’s purview is way beyond the boundaries of the U.S – and the impact on freight in the U.S. comes from far beyond the boundaries of the U.S. So, I think that was important.

Greg White (49:03):

But, also, to understand the kind of insights that we just extracted here that Bobby shared with us because of all the hard and good work that his team does on this thing. I think that’s so incredibly important. And, to me, even though we’re going into the fourth year of doing this, this really represents what an important and valuable bit of information that Freight Payment Index is. And I mean, you and I have always learned something from it, but I think this new way of presenting it and discussing it really helps us to address the why’s and wherefores, not just the what’s as well. It allows Bobby to get involved in that aspect of it without having to be a fortune teller, which, of course, because he works for a bank, he’s not allowed to do.

Scott Luton (49:49):

All right. Well said, Greg. And I think that’s a great way to cap today’s episode. I’ll tell you, folks, if you got 46 billion anything, you better leverage it. And in this case —

Greg White (50:01):

Growing 24 percent and you’re already 37 billion, you are doing something right.

Scott Luton (50:08):

And you know what? You can get these insights each quarter. So, y’all check it out, freight.usbank.com. And, hey, while you’re at it, big thanks again to our production team. Because as Greg mentioned, we revamped how we have these conversations, hopefully, to make it more valuable for you. We want to hear from you. Let us know what you find most valuable about this livestream discussion, the information we share, the U.S. Bank Freight Payment Index, you name it, we’d love to hear from members of our global community.

Scott Luton (50:32):

Okay. Folks, scroll there to sign up for the report. We also dropped link in the chat about finding more information about Leveraging Logistics for Ukraine. Over 670,000 pounds of vetted relief aid has been shipped as a result of that communal effort from folks across our ecosystem. Okay. Folks, on behalf of Greg White and our entire team here at Supply Chain Now, Scott Luton signing off now, challenging you if you heard anything, do good, give forward, and be the change. We’ll see you next time right back here at Supply Chain Now. Thanks everybody.

Intro/Outro (51:09):

Thanks for being a part of our Supply Chain Now community. Check out all of our programming at supplychainnow.com, and make sure you subscribe to Supply Chain Now anywhere you listen to podcasts. And follow us on Facebook, LinkedIn, Twitter, and Instagram. See you next time on Supply Chain Now.

Featured Guests

Bobby Holland leads the Freight Data Solutions team at U.S. Bank where he focuses in analytics and data-related product management for the freight industry. Bobby has more than 36 years of broad-based data processing, software engineering and consulting experience. He has leadership in multiple industries including insurance, large-scale billing, customer care services and banking. At the bank, Bobby leads efforts to produce the U.S. Bank Freight Payment Index. The often-cited Index is a barometer for freight shipping trends on both the national and regional level. The index source data is based on actual freight payment transactions from across the country. The pioneer in electronic freight payment, U.S. Bank Freight Payment processes more than $46 billion in freight payments annually for corporate and federal government clients. Connect with Bobby on LinkedIn.

Enrique Alvarez serves as Managing Director at Vector Global Logistics and believes we all have a personal responsibility to change the world. He is hard working, relationship minded and pro-active. Enrique trusts that the key to logistics is having a good and responsible team that truly partners with the clients and does whatever is necessary to see them succeed. He is a proud sponsor of Vector’s unique results-based work environment and before venturing into logistics he worked for the Boston Consulting Group (BCG). During his time at BCG, he worked in different industries such as: Telecommunications, Energy, Industrial Goods, Building Materials and Private banking. His main focus was always on the operations, sales and supply chain processes, with case focus on, logistics, growth strategy and cost reduction. Prior to joining BCG, Enrique worked for Grupo Vitro, a Mexican glass manufacturer, for five years holding different positions from sales and logistics manager to supply chain project leader in charge of five warehouses in Colombia.

He has a MBA from The Wharton School of Business and a BS, in Mechanical Engineer from the Technologico de Monterrey in Mexico. Enrique’s passions are soccer and the ocean and also enjoys traveling, getting to know new people and spending time with his wife and two kids Emma and Enrique. Learn more about Vector Global Logistics here: https://vectorgl.com/