We can become part owners of the companies that enrich our lives and improve the world. So why wouldn't we?

-David Gardner, Chief Rule Breaker at The Motley Fool

Episode Summary

In Shakespeare’s comedy plays, it is the Fool – a Motley Fool in As You Like It – that gets to speak the truth to the king and queen. There was so much power and freedom that came with such a seemingly lowly station. That is why David Gardner, his brother Tom, and fellow co-founder Erik Rydholm started The Motley Fool, a source of honest, educational, and entertaining information about the stock market. In this episode of Logistics with Purpose, David joins co-hosts Enrique Alvarez and Kristi Porter to talk about the personal connections and professional aspirations at the heart of this unique source of business information.

Episode Transcript

Intro/Outro (00:00:02):

Welcome to Logistics with Purpose presented by Vector Global Logistics in partnership with Supply Chain. Now we spotlight and celebrate organizations who are dedicated to creating a positive impact. Join us for this behind the scenes glimpse of the origin stories change, making progress and future plans of organizations who are actively making a difference. Our goal isn’t just to entertain you, but to inspire you to go out and change the world. And now here’s today’s episode of Logistics with Purpose.

Enrique Alvarez (00:00:34):

Good morning, good evening, and good afternoon. And welcome to another episode of Logistics with Purpose. I’m here with Christie. Christie, how are you doing today?

Kristi Porter (00:00:42):

I’m good. I, this is a totally different kind of interview for us today. So even on our pre-recording, we had some great conversations, so I’m excited to see where this goes. What about you?

Enrique Alvarez (00:00:53):

No, I’m very excited as well. As you mentioned, it’s someone, uh, very successful, very interesting, uh, great radio host, it seems like. And, uh, it will be, it’ll be fun. And as you said, it’s something different. He, I think, is gonna bring a different perspective to what we usually talk about in supply chain and

Kristi Porter (00:01:10):

Logistics. Yeah. So we’re gonna figure out how to, uh, tie finance and investing to supply chain. That will be, I guess, kind of our goal today because we’re welcoming David Gardner, the co-founder and chief rule breaker. What a great title. <laugh>. I may have to adapt that, um, at the Motley Fool. So probably lots of people have listening. They have an enormous following. Um, and so we’re delight, David. We’re delighted to have you with us and to hear all about how, um, investing in finance and how that shapes the world, and especially for those of us who are more intimidated by it and how you break it down.

David Gardner (00:01:44):

Well, thank you Christie, and thank you Enrique. And I do think most of the weeks, and I’ve listened to your podcast, uh, most weeks you ares see cer you are seeking people who have wisdom. And this time we are going a different direction. We’re going very foolish <laugh>.

Enrique Alvarez (00:02:00):

We

Kristi Porter (00:02:01):

Welcome all types,

Enrique Alvarez (00:02:02):

<laugh>. The, uh, they’re very close one and the other. Right. Wisdom and foolishness. Very,

David Gardner (00:02:06):

I feel like this is a safe space for me. Thank you.

Kristi Porter (00:02:09):

It is. Yes. One question could be wisdom and one question could be foolish. You, you just don’t know on the day. <laugh>,

Enrique Alvarez (00:02:15):

Thank you so much for being here, David. It’s a pleasure and, uh, thanks for everything you do and your team is doing, cuz it’s not only very relevant, but very important. And I’m sure like a lot of people out there, uh, really appreciate the service that you guys provide. So, first, before we deep dive into so many different questions that we have about you and your career and your personality in general, why don’t you tell us a little bit more about yourself and, uh, your childhood?

David Gardner (00:02:38):

Sure. I, I grew up, um, the son of, uh, a dad who was a lawyer, a banking lawyer in Washington, DC and my mother was an artist and homemaker and dad’s one requirement of his three kids of whom I’m the eldest. I have a younger brother, our C E o Tom Gardner. And my sister Mackie Macari, his one requirement of his three kids, kids is you can’t be a lawyer, <laugh>. And so we basically listened to him. We, we didn’t, I think dad felt as if his work was not as creative or productive. Uh, and we have some wonderful lawyers of Motley Fool, and I know they’re beautiful lawyers listening to us right now. So this was just one dad’s take. But that did influence us. And you know, we did have, on both sides of our family, we had grandfathers who were entrepreneurs. And I have to admit, graduating the University of North Carolina Chapel Hill in 1988. I’m not even sure I knew what the word entrepreneur meant. And I was an English and creative writing major, so I knew a lot of words, but it wasn’t imprinted on me or ever impressed that our grandfathers were these people. But they were, they were successful business people and entrepreneurs. And so I think that some weird mix of d n a family cultural background and then a desire to have fun in life, take some risks and try stuff, somehow shake it up, somehow exploded into the Motley Full cocktail. Mm,

Kristi Porter (00:04:03):

That’s terrific. So you, it sounds like, okay, so you had the lawyer and then you had the artsy mom. So you had a great combination already in your house of left brain, right brain, um, and which is also going to, as you talked about, shape your career path as well. But I’m curious if there are any stories from your early years, anything that stands out that really kind of outside of don’t be a lawyer, <laugh>, um, outside, you know, outside of that, what really helped shape what you do now and really had kind of an impact on you?

David Gardner (00:04:31):

Two things come to mind, Christie. The first is that, um, I remember at summer camp we were sent away to Sleepaway camp for like the whole summer. Wow. We were 10 when we were 10 from Washington DC where I grew up and lived today to Maine. And I remember that at the end of that first year, the Camp Hall of Fame Awards, and it’s still there in Raymond, Maine at camp to Monte on the plaque, I won most cheerful. And I didn’t even know that that was a thing that you would aspire to. I didn’t know it was gonna be on a plaque anywhere. But I think that that says something about the beautiful environment in which I was raised. Um, every family has its odd eccentricities and, and sometimes problems, but at least for me, I felt pretty well shielded from that as a kid.

David Gardner (00:05:15):

And I just grew up thinking I’m a kid in a candy store and this is a, this is a beautiful place that we’ve all found ourselves and how can I make the most of it? So I think that optimism was just really ingrained in me. And that was a quick example. Yeah. One other example, uh, from my youth that certainly was influential even though it was just a few weeks, it was a lark, but we had a stock market competition in fourth grade. Wow. And, uh, you know, it was, I mean, these are the days back when before the internet. Do we remember this? Where newspapers had stock price listings? Let let you know how the stock did the day before <laugh>. So I had opened up the newspaper. Of course things were in fractions back then. It wasn’t 57 66, it was 57 and three quarters or whatever.

David Gardner (00:05:56):

But so, so this was, um, this is how I grew up of course. And we had to pick stocks, uh, for just a few months. And it was mainly an exercise. There was a math exercise to open up the newspaper once a week and see where the stock prices are and write them down and calculate some math and see how we’re doing. But I think like most other kids in that fourth grade all boys class where I went to school wearing a tie and jacket, we don’t do that too much anymore around the Motley Fool. But that was me in fourth grade, I think. Well, I think everybody else’s parents were picking their stocks for them too. I know my dad picked mine <laugh>. And, and this is a short term experience.

Kristi Porter (00:06:33):

The truth finally comes to light. Yes.

David Gardner (00:06:35):

It’s it’s true. It’s true. Christie. And you know, I wanna make it clear in any short term, uh, thing, this is just random seemingly, but I actually won the stock market competition. Uh, again, I take no

Enrique Alvarez (00:06:48):

Credit. Your dad won it.

David Gardner (00:06:49):

No personal credit. My dad won it <laugh>. But what I remember was that gigantic oversized Hershey bar that I won in fourth grade for my dad picking stocks for me. So, so those are a couple

Kristi Porter (00:07:02):

Did you share it with him is the other

David Gardner (00:07:05):

Question? You know, that’s a great question. I likely did not. Yeah. That was a lesson I would need to learn later. <laugh> Yeah.

Kristi Porter (00:07:10):

Sharing did not come into that. Yeah.

David Gardner (00:07:12):

<laugh> it is the right question. I I try to dodge, um, you know, targeted powerful questions like that. I can’t though. I have to base that.

Kristi Porter (00:07:19):

Well, we’re hard hitting here. Yeah. <laugh>,

David Gardner (00:07:21):

<laugh>. So anyway, those are a couple of of memories that I have that in some ways I think speak to who I am today.

Kristi Porter (00:07:26):

Absolutely.

Enrique Alvarez (00:07:27):

David, a a kind of follow up question on that. I mean, is there something in particular that maybe you have great grandparents as well that maybe your grandparents or your parents told you some like saying or some kind of piece of advice that you still remember them telling you over and over?

David Gardner (00:07:43):

Well, I think most of all, I, you know, my, we actually in one of our books wrote a chapter called The Tale of Two Grandfathers. One of our grandfathers died at the age of 72. I was six, Tom was four, so he barely knew him. Mm-hmm. <affirmative>, uh, uh, he, he was in Pennsylvania. He, he, he started the co he started the company that, that became DeWalt tools. So if you know that DeWalt branding today, um, he sold, he, he, he partnered with DeWalt himself and then sold that to a m f Voy the conglomerate back in like the seventies or fif sixties or something. Anyway, he retired early and didn’t have as much of a calling from that point later in his life. That was my dad’s dad. And my dad always felt like his dad died young because he didn’t really find something purposeful that would, was really driving him past that point where he’d been so successful into his forties.

David Gardner (00:08:34):

So that’s one grandfather. The other was the one who died when he was 98. He kept walking to the office until he couldn’t walk anymore at 92. But he was a very successful, he had his own insurance company here in Washington DC He had come down from, uh, upstate New York as far up the state of New York as you can be without being in Canada. He’d grown up playing baseball against Native American kids. He was the 10th of 11 children. He came down to Georgetown University, um, probably on scholarship and ended up being the athletic director as he graduated back in the 1920s. Being athletic director wasn’t as professional or big a calling as it is today. But he ended up parlaying that eventually into bar borrowing money and buying part of the Washington Senators baseball team.

Kristi Porter (00:09:18):

Wow.

David Gardner (00:09:19):

So this is another huge, huge part of my youth. And I feel like we’re gonna go off too much of a tangent here. So I’ll, I’ll just say that the Washington Senators eventually became the Minnesota Twins. And when I was born in 1966, we were part owners of the Twins. This is a big part of my youth because I love sports and I love baseball. I gotta be bat boy and have wonderful experiences that I was unfortunately not able to provide my kids cuz my grandfather sold out in 1984. But he, he led a very, uh, successful life here in Washington DC and he led a long life. And it, so it’s a reminder, I think to us all to find your flame and let that flame burn for as long as you possibly can. I saw the difference.

Kristi Porter (00:10:00):

Yeah. Striking difference too. That’s really incredible. Um, and you alluded to the University of North Carolina earlier and it sounds like from, you know, the cheerfulness award to the stock award technically won by your father. We’ll put an asterisk by out <laugh>. Um, and then, you know, moving into, you said you studied English and creative writing, now of course you’re known for finances and investment. So you’ve kind of always had that dichotomy playing out in your life. So I’m curious though, why you, of course, like many of us spent your time studying one thing and then ended up going in a completely different path. So what, was there a moment? Was there a series of of things that led up to that, but why the pivot?

David Gardner (00:10:42):

Well, that’s a great question, Christie. I think, I didn’t think of my college major as a vocational work that I would eventually go straight from college into something else. And I think that’s, that kind of humanities mentality is still out there enforced today. But I would say it’s probably lower or lesser than it was 30 or 60 years ago. There are so many engineers today, so many talented people at math and science who come straight out of their major, either go right toward a PhD or into, I don’t know, supply chain, older school view of education. We’re there to challenge our minds and connect and lead a more interesting life and other things that, you know, oh, and by the way, I’m majoring in English. Kind of, that was sort of my mentality. Yeah. But I think that the reason it really wasn’t a pivot for me is because we had been taught the stock market again from my fourth grade award where I tried to figure out why I’d won to seventh grade went or 12th grade as our dad was teaching us how to read financial statements. Mm. Um, our dad, part of the reason he said don’t be a lawyer is cuz he always loved macroeconomics in the markets. And I should use the present tense cuz he’s still alive today. So dad has always been such a student of the game of the markets. Wow. And, uh, and so he, he conveyed that to us. And an important moment as I started my freshman year at UNC Chapel Hill, um, he said, oh, you just turned 18. Here you go. I’ve been investing for you from your birth. Wow.

Enrique Alvarez (00:12:08):

Wow.

David Gardner (00:12:09):

Here you go. This is all you’re ever getting from me. So anything that I have left when I die will go to your kids skipping in generation, which can be tax efficient. And so there was this aspect of always being an investor that was true Yeah. Of in our family’s youth. And I’ve tried to do that for my kids who are now no longer kids. And I think it, I think it works. I think if you get young people thinking about what are the businesses that we admire, what are the products and services that really enrich our lives? And if you play it forward 10 years, do you think those companies are still gonna be thriving? Mm-hmm. And if, if you do, you should be a part owner of them through the stock market. And that’s such a wonderful gift that we have in our culture. So many people worldwide don’t have anything like that. Right. But we can become part owners of the companies that enrich our lives and improve the world. So why wouldn’t you? Especially as early as you can. So again, that was done for me, tried to do that for my kids. I hope everybody hearing, um, we’re all in different places. Uh, some of us are up to our ears and student debt and it’s not even practical to think that you could do that yet, but that’s the direction to be swimming.

Enrique Alvarez (00:13:14):

No, that’s great piece of advice right there. And of course very successful one, uh, especially coming from your dad to you and from you to your kids this year. Big, big milestone. The monthly fool will celebrate 30 years. I mean, two part question. Can you believe it’s been 30 years? <laugh> the first one, and congratulations of course. And then of course for the audience that may not be as familiar with, uh, with The Motley Fool and what you guys do, could you tell us a little bit more about your company, your mission, why, why you started

David Gardner (00:13:46):

It? Sure. I mean, the purpose of the Motley Fool is to make the world smarter, happier, and richer. When we started, uh, as an a o l site keyword fool, for those who remember the AOL days and keywords, which is how you navigated the internet, which was a phrase that wasn’t even used back then. It was online and online services. And I think the older hands listening right now can remember that ungodly sound coming through your phone that let you know your computer and connected to someone’s server somewhere dial up. So we started in the dial-up days before people were using the phrase Worldwide web. They would very quickly after though we started, as you just mentioned, Enrique, in 1993. So, you know, 19 95 6 is really when kind of the worldwide web as a phrase started coming on. So I, I would say that, um, from our earliest days we had this mentality.

David Gardner (00:14:34):

In fact, the very first page of our print newsletter, which is how the Motley Fool started in July of 1993, the very first page said, we’re here to educate, to amuse and to enrich. In my undergraduate studies and, uh, of well literature, I remember that part of the goal of literature is to instruct and to delight, to educate and to amuse. And I thought about those things and I thought, you know, there’s one more thing that we could add to that, that I think would make it more well-rounded and maybe more commercially successful. Not just to educate and to amuse, but how about two enrich. So that was the phrase that we had right up on our AOL site back in the day. That’s still a phrase you’ll see around the Motley Fool. But if you think about our purpose statement now, which is, you know, I think we’ve been using this one for about 10 years now.

David Gardner (00:15:26):

You, you’re supposed to redefine yourself from time to time. So we’ve done that. But if you think about a world that’s smarter, happier, and richer, then you hear what happens if you educate smarter, amuse happier and rich, richer. And so really in today’s Motley Fool, the earliest seeds of what we set out to do are right there. And, and really we’re thinking more about you, our our members than about ourselves. Cuz when you say, I’m here to educate two music and two rich, that’s about me. That’s about what I’m doing. But if you think about the outcomes of what you’re doing, that’s how the Motley Fool thinks today. Now I do want to add that the stock market has been incredibly unkind for the last couple of years. So I feel bad because I feel as if a lot of people, especially people who just started investing, they think about us and they think we helped them lose money, which is really what the stock market did last year.

David Gardner (00:16:14):

The Nasdaq lost one third of its value. Now we’ve been doing this for 30 years, so we remember years that were worse than last year, where our crazy subscription business asks you to pay us on an annual basis and we hope you’ll re-up from one year to the next. And one year in three market history shows us one year in three you will lose money. The market goes down one year in three. So one year in three we’re asking people to pay us and lose money along with us. So this is, uh, an unfortunate aspect to the Motley full business. But the good news is two years in three, the market goes up. And when you take all three of those years and you average them, the annualized return is typically nine or 10% annualized, which over three years or three decades leads to remarkable things for people who are willing to be persistent and truly invest in a world that’s really not investing much of the time. It’s just trading, jumping in and jumping out. So that’s a little bit about our history and a little bit about our philosophy.

Kristi Porter (00:17:18):

Well, and you started it, you mentioned you started it with your brother Tom. So what were you both doing at this time to think, let’s start a print subscription newsletter about, I mean, clearly you had some of the background, you had it in your family, you had examples of this growing up, but it’s a whole other thing to really dedicate this kind of time to it. So what were you both doing and then why did you think this is what we really need to jump into?

David Gardner (00:17:44):

Thank you Christie. Well, Tom was a graduate student. He had just driven West. He was intending to to go all the way to California. But he stopped in Montana cuz he started thinking, this is a really cool place. So he was in Missoula, Montana, the University of Montana, uh, moving toward two master’s degrees. Um, I had just quit my only job coming out of college, which I’d only held for about six months cuz I started realizing in month three or four that this is a toxic workplace. I don’t want to be here. Uh, and I don’t mean it to reflect negatively on the person I’m about to mention, but some will remember the name Louis Ru Kaiser, who had a very successful long running show called Wall Street Week on p b s Friday nights at five or six people’s parents would typically tune in.

David Gardner (00:18:26):

This is kind of pre-internet again. Mm-hmm. You know, how did the markets do this week? And who is Lou Ru Kaiser on p b s interviewing on a show Wall Street Week? Um, so the company I was working for was not Ru Kaiser specifically himself. It was a publishing company that was publishing a newsletter, um, that had his name and brand on it. And my own work was, I got the back page of that newsletter. I was allowed to pick my topic and write it up. And I started realizing this is what’s happening. Every month I would pick a topic that I loved, like let’s say Discount Brokers, which back in 1992 were brand new. Like Schwab, this new ilk of not having a broker who trades for you, but actually a lower discounted broker where you do your own trades and there’s this new thing called online mm-hmm. <affirmative>.

David Gardner (00:19:12):

Um, so I would pick that topic and then I would write a one page, um, thought about why you should look into it and maybe do this. And I would find that my page was edited. The first half of what was on the final product was what I’d written with any color jokes or funds stripped out and gone. The second half was freshly written by my editor. All the reasons you would not wanna do whatever. I was advocating in the first half, and I was, this, this now makes sense to me. But I was, it was explained to me that, hey, we’re journalists. You gotta, you gotta paint both sides of the fence here. And David, you’re tending to pick something that you like and you’re just showing the positives and yeah, you’re throwing in humor and jokes, but this is Lou Ru Kaiser’s newsletter.

David Gardner (00:19:52):

This is not your newsletter, so we need to contrast with it. And we’re journalists. I was like, okay. So all the creativity and fun and things that I like for the guys, you know, for Mr. Most cheerful I’m gone. And so I’m out and I’m gonna take my plaque and run. Yeah, that’s it. Exactly. Christie. And so, so this was, um, this was a lark, a fallback position. I’m like, okay. Uh, I just quit that. Um, my brother and I have a friend named Eric Ride Home, who was our third co-founder. And Eric, who went to Brown with my brother, very well educated, still said, you know, I learned nothing in my Ivy League University about investing. Like nobody taught me about could, could I come over and listen to you, Dave, talk for a couple nights about how to invest since you’re doing that.

David Gardner (00:20:32):

And after two nights of that, Eric’s like, we should start a newsletter. You just quit a newsletter. Wow. Um, you just showed me how to invest. Let’s start. And that’s the way the Motley Fool Print newsletter, which was $48 a year for our parents friends. They were the only ones who would actually subscribe. Our friends sure weren’t gonna pay us $48 a year for our stock market musings, but that’s how the fool started. And the name comes from Shakespeare. Um, I’m the one who picked our name from a book of quotations one night as I was flipping through

Kristi Porter (00:20:57):

Time back that literary. Yeah, there you go. You put your whole agree into practice right there.

David Gardner (00:21:01):

That’s it, Christie. And, you know, I love the the court jesters, who doesn’t love Shakespeare’s Fools in Shakespeare’s comedies. They’re the ones who can tell the king or queen the truth. They use humor. Um, and so that was the name and phrase and you know, initially people were like, uh, fool, why would I wanna a fool in his money or soon pardoned? Why would I wanna subscribe to something that says it’s a fool? And a lot of people still, when they hear us for the first time or hear our name, which maybe some people are today, they’d still wonder why would I subscribe to that? But I hope they start to understand where we’re coming from and what we’re doing. And that we’ve been around now for a few decades, I think helps as well. So. Right. I think I went too long on like where I was before we started the Fool, but that’s, that’s how it started.

David Gardner (00:21:43):

And I’ll tell you in earnest, a o l started to promote us and what we were doing. Wow. And all of a sudden we got written up in the talk of the town in the New York New Yorker magazine, and we had agents and publishers. We had W S B, um, the Atlanta based radio station, the Cox Enterprises Company say, Hey, we’d love to do a coast to coast radio show with you guys. And one thing led to another, we were on the cover of Fortune Magazine in the summer of 19 96, 3 less than three years after we started a newsletter for our parents friends. So, wow. These really, really heady days, it shows nothing much about us necessarily, but that we were a big fish in a small pond of great interest about this new medium that was coming, coming along. And who are these guys wearing full caps talking about stocks on internet chat rooms, which is how a lot of people thought of the internet back then. Yeah. Random chat rooms. But, so that was, those were early days.

Kristi Porter (00:22:36):

That’s very

Enrique Alvarez (00:22:37):

Cool. Yeah. That’s a great story. And uh, hey, congratulations again for all the success that you guys have.

David Gardner (00:22:42):

Thanks. And all the failure too. And I think every entrepreneur listening to us knows that you have to go through both. You really have to lose to win constantly. That’s also true as an investor. Mm-hmm. <affirmative>, I just said one year and three friends, you’re gonna lose money that doesn’t feel good to people who’ve saved their money and invested, all of a sudden it goes down. You could have spent it and had fun with it. So, but this is actually such an important point mm-hmm. <affirmative> for all our fellow humans to realize. And I think a lot of the older hands especially will appreciate that you have to lose to win in many cases. And both entrepreneurship and investing. True. Any

Enrique Alvarez (00:23:15):

That’s right. Any particular kind of mistake or loss or example of something like that in your life that you had to kind of overcome and thrive through?

David Gardner (00:23:24):

Too many, too many Enrique, but I’ll, I’ll flash one out that comes to mind quickly. It was, it was how my investment philosophy really shifted as a young person. So I had been raised again by a dad who gave us, you know, value line, which was a big black tome with lots of numbers about American public companies. And, uh, and he loved that. And so it was like a math exercise to invest for me. And so I would calculate kind of where I thought the price should be, and I will only buy that stock if it gets to that price. Otherwise I’m making a small f foolish. That’s always the bad kind of fool. A small f foolish decision to buy it if I bought it above a certain price. So in the golden age of Yahoo, back when Yahoo was an early kind of pre-Google monster brand, and everybody used Yahoo to search for things on the internet, the stock was around 29 and a half.

David Gardner (00:24:19):

And I decided that if it went to 26 and a half, I would go ahead and recommend it on the Motley Fool site. And even in those first days, our recommendations, other people would follow them, right. People are actually subscribing in order to say, well, David likes this, or Tom likes this, I’m gonna buy the stock. So we felt the, I would never say pressure. I, I would just say we felt the gravitas of what we were doing. And so I was there going, should I recommend Yahoo? Should I, man, I really, I mean, it feels like a big thing, but it’s not a 26 and a half. And so history will show, and this is post split, but history will show Yahoo never did get down to 26 and a half. Instead it went to the equivalent of 1000. Wow. Over the course of the next six years.

David Gardner (00:25:04):

And there I was the small f fool, the knit wit going, you know, I’ll buy it if it, if it hits 26 and a half, because that’s what my math tells. So that was a really important moment of failure in order for me to recognize that it’s not so much about valuation exercises. For some it is, and there are many different schools of investing and thought here, but for me it’s about asking where are we headed? Who’s gonna win and shape the world in the future? And even if I have to overpay for a stock or like a venture capitalist, lose a lot, be wrong. A lot to win. If you nail Amazon or you nail Tesla, or you nail Netflix at the right moment, I’m very happy to say I’ve nailed all three of those and I’ve held them for 10 to 20 years in every case, then all your mistakes, your other mistakes don’t matter. Mm-hmm. <affirmative>, they get wiped out by those huge wins. So it’s, it’s that venture capital mentality that I think I adopted after waiting for Yahoo to drop $3 so I could buy it and recommended and feel like I’d done something. Right.

Kristi Porter (00:26:08):

That’s your next book title, waiting for Yahoo

David Gardner (00:26:11):

<laugh> <laugh>. That’s pretty good. Chris title. That might at least be a, a chapter. My, I, I actually think I will read the book and if, if I do in the next year or two, it’ll be called Rule Breaker. Yes. And that’s actually, you mentioned my title at our company mm-hmm. <affirmative>. But that’s a really, this is a very important concept. We can go there and not, I don’t want to go too long on this beautiful podcast, but breaking the rules, um, when others are trying to make the rules or enforce the rules, breaking the rules is what I’m all about in investing business in life. Mm-hmm. <affirmative>,

Enrique Alvarez (00:26:42):

No, that seems, uh, seems a good strategy and you learn a lot from it whether you win it or lose it. Right. And you’re constantly learning, you’re constantly pushing yourself. So it seems like a good mentality, good mindset, not only for investing as you pointed out, but just in life in general. I mean, you’re never gonna reach something if you don’t risk something to get it.

David Gardner (00:27:03):

I, I agree. And you, you really do have to be willing to lose and feel the pain of that. And, and you know, it, and it, it hurts to think about all the many ways that I’ve lost cuz I’d be so much more awesome if I’d won more often. <laugh>, the good, the good news is that, um, often you are able to refashion yourself or your own philosophy or mentality or actions based on those learnings. And of course, rather than stick your head in the sand, but actually look up and acknowledge and look in the mirror and say, I blew that mm-hmm. <affirmative>, um, you can certainly accelerate your learning and growth a lot more. I do really favor people who disrupt and break rules. And again, I don’t know the supply chain and logistics business in the way that you do, but if I were looking at it as an investor, I’d be starting to ask who’s the innovator?

David Gardner (00:27:50):

Especially at scale, like in almost any industry in my career, over 30 years, I picked stocks. That’s what I did. I I don’t do that anymore for the fool, but I, I’ve loved doing it and I have a long record of success at it, but in every industry, I’m always just asking who’s the innovator? Because you, if you just draw a circle around that company mm-hmm. <affirmative>, and it doesn’t matter whether we’re talking about fast food like Chipotle or, um, D V D rentals, which is really how Netflix started even Right. Free streaming Amazon, the list goes on in every industry. Who is the most innovative company? And again, within that group, you’re gonna have some that totally fail. Mm-hmm. <affirmative>, they looked awesome like pets.com, but it just didn’t go happen for them. But you’re also gonna find in that mix amazon.com and, uh, and so if we just stay focused on the leaders, uh, a quick line that I’ve often used, I know I’ve swiped this from somebody else, like most of my great lines, <laugh>, if you’re not the lead husky, the view never changes. I’m always looking for the lead husky in the Iditarod of any industry because those are the companies that are out front and taking us in unpredictable and amazing directions sometimes. And so I, I’ve always stayed focused on those, but you also have to like a VC just be fine looking like you’re a total idiot that you invest in and this or that thing That didn’t work out

Enrique Alvarez (00:29:12):

Well. David, changing gears a little bit here and probably a little bit more on the, uh, on the side of the amusement part of things, uh, you’re also have two podcasts mm-hmm. <affirmative>. So you’re, you’re a podcast host, very successful one, one The Monthly Fool Money, and then the Rule Break Investment. And you were talking a little about Rule Breaker and the potential book that might be coming out or not, uh, in the future. Could you tell us a little bit more about this, uh, podcast and why you thought the podcast kind of, uh, medium, what’s important for you and, and interesting to you?

David Gardner (00:29:44):

Yeah, and uh, obviously here I am very self-consciously talking on a podcast. I think it’s great what you both are doing. And I, I think that the more that we can invite in interesting people and then share out learnings with the people that we’re tied to, whether it’s professional or industry affiliations, like I think is fair, fair to say this podcast is what we’re about or, you know, personal growth, there’s all kinds of different podcasts, but I think we live in an age of sharing and the opportunity to share at scale in ways that were just never even imaginable. Like, I, I sometimes think back to somebody like Ben Franklin, if Benjamin Franklin had had the internet, think about how much smarter and more amusing the world would’ve gotten. That’s true. The United States started that way cuz we had Ben Franklin. But he, if he was influencing China through his podcast, uh, it would’ve been, I think we’d live in a better world today.

David Gardner (00:30:33):

Anyway. I I really do appreciate the, this medium, Enrique and Christie, you both obviously get it. Um, at The Fool. We started in early days, um, 15 or 20 years ago with our first podcast, and that’s the one we continue to do today. Motley Fool Money. Mm-hmm. Um, I don’t host that one. That is a Motley Fool production, it’s a daily podcast and, uh, on the weekends we usually talk to a C E O or an author of some sort. Um, and it’s, it’s, it’s kind of a top 10 business and investing podcasts. Like, it’s, it’s our big flagship. I run my own little one called Rulebreaker Investing. Uh, it is certainly a passion project for me. I’ve done it every single week since July of 2015 with no repeats and no weeks off. So I’m for baseball fans and I’m certainly one, I’m trying to be a Cal Ripkin figure out there and always be back in the batters box even if I’m playing hurt.

David Gardner (00:31:22):

Um, and so I’m now into my eighth year of just, that also means that I’ve talked way too much. Like if you actually have to get in front just yourself a lot of the time, every single week for eight years just transcribing that is, uh, you can get buried underneath the, the, the text language that you’ve put out there in the world. But, but I really do enjoy it. And again, um, rule breaking obviously is such an important thing to me. And I’m not here just to celebrate the rule breakers, uh, of, of people doing wrong things. I’m here to celebrate people who, who know the rules and know the game in the first place, and then know when to break the rules to help the world or, uh, their company or whatever the context is. You need to know the game before you can really start to, to monkey with it.

David Gardner (00:32:09):

And so, but I love, I love the monkeys out there <laugh>. And, uh, and I, and I’ve tried to invest in them and our company as, as an entrepreneurial driven, uh, purpose-driven enterprise has tried to be a monkey. And it’s not ha hard to be, uh, a, a standout, um, feisty little pokey creature when you’re actually facing Wall Street, especially Wall Street in the last few decades, which you can make a lot of jokes about things that have happened on Wall Street. We have, you can also celebrate some of the great things that Wall Street does represent, not be a cynical about it. Uh, and I think being an integrated person and being able to see both when you should make the rules and when you should break the rules. And for me anyway, my podcast is at one-third investing, one-third business, one third life. And I love to to integrate all three of them.

Kristi Porter (00:32:56):

I love that. Well, in the podcast of course, there’re just two of the many free resources. You have lots of free resources, you have premium subscription. Tell us a little bit about what else you have available for people.

David Gardner (00:33:08):

Sure. Well, I mean, you know, anybody who goes to full.com, that’s our website and that’s where it’s been. Nobody wanted that URL when we bought it 30. What

Kristi Porter (00:33:15):

They do now. They do now.

David Gardner (00:33:19):

Well, um, so I mean you’ll see that we do, we have a lot of research. We have many, many articles, um, steps to get started investing, um, ways to open up accounts, uh, these days. We also have, uh, mutual funds. Uh, we have a venture capital fund. We’re, we’re kind of a more fully featured financial services company. Mm-hmm. <affirmative>, um, certainly just starting out as a a page on a o l, we couldn’t have imagined or dreamed what would come. And yet I still feel like we’re in an early days of our company mm-hmm. <affirmative>, uh, we have expanded internationally. We have, um, you know, of our subscription base, which is over a million people who pay us, uh, on some recurring basis, on an annual basis. Usually those premium services, Christie and Enrique, you are getting stock market advice. We’re saying we recommend this stock. And an important thing that we do with the Fool is we keep score so you’ll know when we’re right or when we’re wrong.

David Gardner (00:34:08):

Or you can see how often or how badly we’ve been right or wrong. Um, and that’s really important. Transparency is a big part of the Motley Fool and our brand. Mm-hmm. Um, and yeah, I I think that we, we kind of run the gamut from getting started for free. E e-newsletters or other things, whether you’re talking about personal finance or investing, whether you’re talking about what box to check on your four oh [inaudible] plan, or you’re into more, something more intense like wills and estates. We try to be there to meet you and be relevant. Um, it’s, we’re a tiny fish and a gigantic fishbowl at this point, whether you’re thinking about the internet, which is how I initially thought about our company or financial services, which is also how I think about our company today. But we are, we have 600 employees. I used to say we were centered in Alexandria, Virginia, but we’ve gone hybrid.

David Gardner (00:34:55):

So we’re spread out all over the place. And that’s an interesting, uh, journey as well that we’re all in the middle of trying to figure out the future of work. I think one thing we’re good at the fool is sharing out what we’re doing, whether it’s our stock picks or, um, things that we’ve learned, uh, in human resources that we can share about corporate culture. Or I know we’ve got some, um, conscious Capitalism fans here. Enrique, you and I have met at the CEOs Summit, um, in Austin, Texas. This is an important thing for me, last 10 or 15 years of my life. So I, I think that it’s really important, as I said earlier, I’m speaking of podcasters here to try to find interesting insights and people and then just share it out and do it on a dependable recurring basis so I I can come to trust you. Mm-hmm. <affirmative> over time. I think that works, especially in finance where there’s not often trust, but I think ultimately it works in every business supply chain. I can only imagine how important trust is.

Enrique Alvarez (00:35:48):

Mm-hmm. <affirmative> very, very similar I guess to finance when it comes to the, um, what transparency would do to a company. Right. Would know you put it, you put it very, very clearly. I think transparency is key. Your company and you and your team have always been transparent. You’ve always been, you own when you did do something wrong and you celebrate and just keep pushing. So I, we, this has been a great interview, so thank you so much. You also have a, a foundation. I, I will love to talk a little bit more and you brought up, uh, conscious capitalism, which we’ll talk a little bit a as well. But moving into the foundation, uh, making the world a better place, kind of trying to make a possible impact in the world. What was, um, what was the, uh, thinking behind creating this foundation and, uh, follow up to that as, um, how is this foundation impacting people’s lives?

David Gardner (00:36:39):

Well, thank you Enrique and Christie, I’ll just give you the 62nd elevator pitch for the Motley Fool Foundation. So we found that over the course of time, we built up a large subscription base of people who did have capital, who did have money. Why were they seeking out the Motley Fool? Because they wanted to know what to do with it and how to make sure they invested it well, that leaves most of the rest of the world not at our campfire. The campfire stories that we can tell are beautiful stories that people who have been ar with us for 18 years and we’ve totally been with them through good and bad markets and they’ve found financial freedom today. And we do not lack for remarkable testimonials. That means so much to me and Tom and all of our employees. And yet it’s still a largely, uh, you know, kind of one third of America.

David Gardner (00:37:25):

Uh, not even to think about the rest of the world here, but one third of America that is financially healthy, that leads two thirds that aren’t there. They’re not at our campfire yet. So the Molly Fool Foundation is our effort to broaden who we get to talk to and who we get to trust and build, uh, relationships with over time. So our aim, and again, this is a small scrappy startup just like the Motley Fool was 30 years ago. So I can’t talk about our many remarkable achievements or anything cuz we just launched on April Fool’s day of last year. We’re still in our first year, but the aim is financial freedom for all. Something that will certainly not be achieved in my lifetime. And even what that means is open to, um, active conversation. But for us, we’re really focused on the one third of America in the middle, uh, the missing middle.

David Gardner (00:38:11):

Some people use that phrase. These are people living paycheck to paycheck. They’re just, they’re so close to saving their first true dollar and being able to invest. Um, one third of America is financially vulnerable. That’s a large number of people. And a lot of issues have come up a about that set of people over the course of the last few years in particular, we’re a small scrappy startup. You need to pick your focus for us. And the Motley Fool, it makes a lot, lot of sense that we can provide advice to people who are just right, right near becoming investors. And so that’s really our, our focus. And we have a two-pronged approach. One prong is we’re in investing, we’re giving our own capital like venture capitalists, investing in others who are doing remarkable innovative on the ground work across the five drivers of financial freedom, which are basically your health, your home, your employment, your education.

David Gardner (00:39:05):

And yeah, the fifth one is money itself. These five things all have to be in place going the right direction for you to be financially free. You can’t be financially free if you don’t have a ho house over your head or if you don’t have your health. So what we’ve realized and learned in our couple of years of research that we’ve paid for ourselves to learn about what really creates financial freedom is that there are five drivers and we can identify people in those areas and fund them. That’s prong number one. Prong number two is trying to bring those five together in a place-based experiment here or there, maybe around America. We haven’t picked our first site yet. If you’re familiar with Blue Zones, which are areas of the world that have extreme longevity, some of you will be nodding your head. You know, this work done by Dan Butner, who’s a wonderful conscious capitalist himself.

David Gardner (00:39:52):

But anyway, blue Zones are pockets of humans who live way longer than the rest of us. And so Dan Butner sought out why, what is it going on in those communities? Uh, a Seventh Day Adventist group in California, um, farmers on Crete, what is it that unites these blue zones? So if you think about that, but you, you change it from health to financial health, why are some zip codes crushing it and why are others being crushed? What are the factors underneath the hood that are really driving financial freedom? And we’re not talking about the richest zip codes, we’re talking about the ones that are, that are succeeding just above where you’d wanna be. And can we focus on the ones that are near there and maybe start to build some of the social capital and other things in place that need to happen to really enable financial freedom. So I said that was my 62nd. I think that was more like four minutes, but I hope it was elucidating.

Kristi Porter (00:40:51):

Very

Enrique Alvarez (00:40:52):

Interesting. Very interesting. For sure. No, thank you for approach. Yeah, thank you for sharing for sure.

Kristi Porter (00:40:56):

Yeah, for asking. Uh, I look forward to seeing you’re at this stage in your infancy. I look forward to seeing what comes next for sure. For your team and um, the stories that you’ll impact and uh, yeah, the Blue Zones is a great example. Yeah.

David Gardner (00:41:11):

Full foundation.org for anybody who wants to see a little bit more about what we’re doing and how we’re thinking about it. And again, scrappy startup, we’re not gonna overpromise and underdeliver, we’re gonna underpromise. We don’t know what the heck we’re doing, but we’re trying

Kristi Porter (00:41:25):

<laugh>. Yes. Uh, which is always a great starting approach too. And you also mentioned Conscious Capitalism. I know know that’s how we got you here today. You two met at the Conscious Capitalism c e o summit, we’re certainly fans of that movement. You mentioned you’ve been involved for 10 or 15 years. So, um, I’m curious as to where that origin story came from. And there are probably people listening to who haven’t heard of the movement. So if you wanna give an explanation as well.

David Gardner (00:41:54):

Sure. And you know, I feel like a number of times in our conversation, I’m talking about the old days and I’m about to do it again. And I’m starting to wonder, am I old <laugh>? I’m 56, I dunno

Kristi Porter (00:42:03):

If I so many good days ahead, <laugh>.

David Gardner (00:42:06):

But 2009, the founder of Whole Foods, John Mackey, uh, who would eventually sell his company to Amazon and then eventually step away and start a new company, which I think is exciting called love.life. But anyway, John Mackey was coming through town and we’re based in Washington DC just outside in Alexandria, Virginia. And so when people come to town, we, we’ll drop ’em a note sometimes and say, Hey, would you like to come to full hq? Would you be so kind as to speak for free to our employees? And we’ve had some great people say yes to that over the years. John Mackey was one of them in 2009. A couple years later, Elon Musk would say yes to that in about three weeks after he did that in 2011, I recommended Tesla stock and I’ve held it ever since. So we’ve had some game-changing appearances at Full hq and John Mackeys was one of them.

David Gardner (00:42:50):

He said to our employees that business is good. Not bad. Don’t be cynical about business. It’s not. It’s not. The rich get richer and everybody else gets poor. It’s actually the story of humanity over thousands of years. We buy and sell from each other. You’re good at this. I buy from you, I’m good at that. You buy from me. Trading ideas, commodities, um, uh, food, uh, preferences. There’s all kinds of benefits to us working together. And in fact business, the private sector is such a bigger employer than the public sector in our country and many others today. So business, the power of business to elevate humanity is unparalleled. John Mackey said to our employees, and as I listened to ’em that day, I was thinking, you know, I’ve always been picking stocks intentionally of companies that I think are doing good. And uh, and you know, we’re all faulty.

David Gardner (00:43:45):

Uh, you can debate whether Apple or Starbucks is good or bad and those, that’s always a fun conversation for anybody. I think they’re good. I think Amazon is amazing and these are many of my best stock picks that have done well over the only term that counts, which is the long term. I don’t really care about short term, even a bad year, like 2022. I don’t care too much about cause I’m investing for my whole life. So these were some of this messages we were hearing from John Mackey and he called it Conscious Capitalism. That was a new phrase for me. And then he invited us to his annual summit, which I went to that year 2009. And I’ve pretty much been going back every year since. That’s where I got to meet Enrique Alvarez. And we’ve certainly enjoyed each other the last couple of years.

David Gardner (00:44:24):

And you know, this is a group of people who recognize that you need to win it for everybody. You can’t sit there and say, this is just we’re trying to maximize our stock price in the short term. Mm-hmm. <affirmative> get my bonus as as c e o and get out of there. The average c e o today only works at their company as c e o three years or so. It’s often you finally made it up the final rung at the age of 65 and you’re gonna be out at 68. This is not true of every business. Um, in fact, some of my best stocks, you have the c e o like Jeff Bezos in place for several decades. That’s something that I favor. But anyway, really when you’re there winning, not just for your shareholders, but if you focus of course, first of all on your customers and then you think about the wellbeing of your employees and then you try to be a good partner to your partners and suppliers and you’re good for the environment or you, you work with your local communities and you’re winning for all of them and you have a win win win mentality.

David Gardner (00:45:20):

And I see both of you nodding your heads cuz you get it, but it turns out this is still a real minority viewpoint in the world. And so I would call this capital F foolish, which is good. That means it goes against conventional wisdom. It goes against traditional human practice and it wins. And once I find something like that, yeah, I sit up and pay attention and I start to share it out myself. So I’m on the board today of Conscious Capitalism. I talk a lot about it on my podcast. I’m glad you you, you’ve given me the opportunity to connect with you both today. You get it. Another big part of conscious Capitalism, I know it’s gonna go too long, so I’m not gonna go on about this <laugh> but purpose. Here I am on logistics with purpose. Purpose is really often what separates conscious capitalism companies from those that aren’t purpose-driven.

David Gardner (00:46:03):

A clearly stated purpose, a beautiful purpose. Something that everybody would say that is true, that is an authentic purpose. It’s not just greenwashing or you know, printed and laminated out and put out there, but people aren’t really following through. I mean, these are, these are companies that you can invest in or work for mm-hmm. <affirmative>, um, that really are living their purpose in beautiful ways today. And there’s so many of them. They often don’t make the headlines cuz the financial media tends to focus on Enron, um, you know, the Enrons of the world. But the truth is that so many great multi-generational, often family businesses are doing great work. And I know the logistics and supply chain business is no exception to this long-term good work being done that’s trying to win for everybody. And by the way, when you’re winning for everybody, your shareholders will by default also win too. You don’t have to manage toward them, just manage what you’re doing. They will love you for

Enrique Alvarez (00:46:53):

It. Absolutely. No, very, very well said David. And thanks again for bringing it up. Uh, conscious Capitalism’s a great organization. I definitely will put the, on the notes of this interview, the links to their website and the organization so people can learn a little bit more about what they do and how they do it. And to your point, I think purpose is a, a key competitive advantage, right? I mean, this decade in particular, we’re going to see, and this is probably my prediction on companies out there, which is something you should be doing, not me, but <laugh> purpose-driven companies will actually, uh, become more successful and continue to successfully compete against others. And honestly, I see by talking to my children, uh, 13, 15, 12 year olds, they’re, they’re only gonna buy from companies that actually represent something more than just maximizing stock prices or shareholder, uh, equity.

David Gardner (00:47:45):

I agree completely Enrique. And I’m conscious that, um, because you’ve had me as a guest, I’ve talked too much during this hour or so, um, when you and I are over a campfire in Austin, Texas, uh, you are just as full of as many wonderful stories and insights as I am. So you both are very generous to give me a platform to rant at different points. And Christie, it’s been a lot of fun getting to know you and meet you for the first time, but I I, I want everybody listening to this podcast to know that you’re in very good hands with people who understand what really wins in business and life, I would say as well. And so, yeah, for me, most of the best people that I know are conscious capitalists. They are remarkable value achievers on behalf of their communities. Uh, not just their families, but all of the families of their employees.

David Gardner (00:48:34):

And that’s another next level thought. Um, a lot of people include employees or team members as stakeholders in their business. And that’s great. In fact, I think a century ago, people were often unionizing regularly because they didn’t feel as if they were being cared for by many of the businesses around back then. And yet, if you wanna go next level, especially in a hybrid post covid or even still Covid world, start thinking about the families of your employees. Are you recognizing or including them? Are you thinking about how to win for them? And for each of us in different industries and businesses, that might mean something different. And for big companies, they can do something special. Probably they have the budget for smaller companies, sometimes just a thank you note or showing that you care. One thing we’ve tried to do is we occasionally will write thank you notes, not to our employees, but to their spouse or partner on behalf of the work that they’ve done over the past year or whatever. So these kinds of thoughts will typically occur to human-centered organizations. And, um, while a lot of us might think supply chain is this big, um, industry that is dehumanizing, it’s all about, you know, moving stuff from one place to another on big boats. It’s really not true. Every, uh, industry is human-centered ultimately. And the winners are the ones who center best, I think. And so, uh, thank you for nodding your head and, uh, I think agreeing with my minor rant there, Enrique

Enrique Alvarez (00:50:02):

<laugh>. Abso No, absolutely. Well said, well said. This has been, again, we knew that this was gonna be an incredible interview and we knew that it was gonna be slightly different and you have clearly not disappointed. We’re thrilled to have you here and definitely looking forward to listening to a little bit more of your, what you call rants, which I think are very good life lessons. <laugh>. So, uh, Christie, I, go ahead. I think you have a good question as well. Yeah.

Kristi Porter (00:50:27):

Well, <laugh>, you ha we’re sort of eyeing the future now. You talked about, I’m, I’m speaking to the past a lot, but you are sort of, we’re sort of turning outward now and looking ahead. And so I, you have, as we talked about, through conscious capitalism, through your own model, even on your philosophy page, it says a business is good because it creates value. And you mentioned that you’re 30 years into this, but you still feel kind of like a, you know, a startup and a baby company from that perspective. So what are some of those, you’ve got almost a one year old foundation. What are some of those future plans that you have your eye on?

David Gardner (00:50:59):

Well, I think first of all, future is my favorite word. So I’m glad we’re hitting it now. Cause I do feel like the, the old man, some of my older stories,

Enrique Alvarez (00:51:09):

Cause

David Gardner (00:51:09):

They’re true.

Enrique Alvarez (00:51:09):

The Enron reference didn’t help you much by the way, <laugh>. I’m like,

Kristi Porter (00:51:13):

When you walk seven miles in the snow, my

Enrique Alvarez (00:51:15):

Kids are not gonna know what Enron is. I’m gonna have to tell them that <laugh>.

David Gardner (00:51:19):

So future is an important word. In fact, it is my vanity plate here in Washington, DC If you ever see a Tesla driving around with the license plate future, that’s me,

Kristi Porter (00:51:28):

<laugh>. Oh wow.

David Gardner (00:51:29):

This, this word means a lot to me. I try as a stock picker, I’ve always tried to live in the future and think backwards. Uh, William Gibson, the sci-fi writer ha, has a great line you all may have heard before, but it’s the future’s already here. Mm-hmm. <affirmative>, it’s just not evenly distributed. So there are people doing things in labs right now that you and I don’t know yet that are amazing. Mm-hmm. <affirmative>. And my belief is that the world will keep getting to be a better and better place to live in. And I think things like chat g p t for those who are paying attention, uh, AI chatbots and other things are remarkable developments that will really advance the human race. So I’m kind of all about the future. I’m sick of talking about the past and we’re near the end. So we’re not gonna talk long about the future, Christie.

David Gardner (00:52:14):

But I will say that, um, the more that we can lead a life of trying out stuff and having a very open mind about how things might play out, the better we’re going to do. Mm-hmm. <affirmative> as a company at the Fool, we’re always experimenting and trying new things. I mean, the foundation is a great example of that in the last year that you just referenced. And one thing I’ve learned about the future is it’s increasingly hard to predict. So I don’t spend as much time trying to predict the future. I just try to live in it and, and, and be there. And I really do that on behalf of all of my stakeholders, people of the Motley Fool. Like I feel as leaders, it’s incumbent upon us to not predict the future. I mean, if we can do that, great, but, but to be there, to have our mind there and to have our interests there, and again in different industries, that means different things to all of us.

David Gardner (00:53:04):

But for me, future is all that matters when you’re an investor because how that stock did over the last 10 years or yesterday, doesn’t matter when you buy it tomorrow, all that matters is what happens from that point on. I will say that one of my insights about the future is, um, the very opposite of the financial disclaimer you hear all the time. The financial disclaimer that we hear all the time is past performance. You with me here, friends past performance is no guarantee of future results. But I believe that past performance is probably the single best indicator that we have of future results. So somewhat ironically than I guess as I think about the future, I often take who’s already awesome, who’s already winning, and for me I’m often reinvesting and re-upping and those things not trying to balance out by investing the stock that’s died for me or it doesn’t seem to be doing well anymore.

David Gardner (00:54:00):

A lot of people add to their losers. I’m always trying to add to my winners, but I really do believe that the best way for us to thrive in the future is often by looking at the people that we’re hanging with now and the ideas that are in our heads and what’s working out there in the marketplace or in the supply chain. And assuming that probably it’ll evolve and it you’ll have to adapt, but the same probably people and models will often be thriving in the future. Amazon is a great example of this over 30 plus years or Netflix if you think about how it started and where it is today. So I basically as an investor, seen this happen over long periods of time, which is the only period of time that matters to me. And uh, and so that’s my thought that those are some thoughts about future. Mm-hmm. <affirmative>

Enrique Alvarez (00:54:43):

Makes sense and thank you. So before we, before we let you go, and again, this has been a, a delight, um, I wouldn’t be doing my job here, I didn’t ask you, uh, the person in charge of picking stocks and being so aware of the market to tell us a little bit more about or give us some advice about this year, this year in particular with the post covid recession kind of blooming and, uh, things like that. Either in the supply chain market, if you can, or just in general, what would be your, uh, advice on investing this year?

David Gardner (00:55:15):

Um, three, three bits of advice. The first is it’s not about one year. So whatever I’m about to say, if I’m completely wrong, it, it shouldn’t matter because truly we should be making a lifetime commitment either to our careers or our investment portfolios. It’s all about being in the game all the way through, not how we do in one year. I still of course totally respect and honor the one year question, Enrique, cuz this is the year we’re living in, right? And it’s a fascinating year, but I would be remiss if I didn’t start by saying, it’s not about this year at all unless you’re about to retire in six months and then maybe you really do care about, about this year. But so that’s thought number one. Thought number two is that for me, um, I have watched the stock market get taken out and shot repeatedly, especially the companies that I favor.

David Gardner (00:56:01):

The rule breakers, companies that are very innovative, a lot of these companies are way down. I mean, um, even though they’re up by the way, over five years, check Tesla five years ago, see where it’s today. Pretty remarkable. But Tesla has lost more than half its value in the last six to nine months. So we’re living in 2023 at a really interesting point where if you, you dial it out, which is really helpful, you’re gonna see who’s winning in the longer term. And I think that usually will continue. But if you narrow your focus, you see, wow, these things have really been badly sold off. And sometimes for very good reasons by the way, and sometimes they shouldn’t have been as high as they were in the first place during that huge covid run in the summer of 21. Mm-hmm. <affirmative>. So that’s thought number two is this is a really unusual place and for me, thought number three comes down to, as an investor and as a business person, I am just going to be methodical and regular as an investor.

David Gardner (00:56:58):

I’m not gonna wait for the market, the recession to come. I’m not gonna, you know, if it even does. There’s constant speculation about where the Dow will be in the fall or these kinds of things. And what matters most I think is that we save money every two weeks and we put it in our four [inaudible] plan into an index fund if you like, or if you’re like me directly into stocks. C as you admire, it’s that regular persistence that wins in investing, not guessing where the Dow’s gonna be at any given point. And I think the same is true of business. So I think those who are out there, the X’s and o’s blocking and tackling who um, who are probably not allowing themselves to be too influenced by, uh, threats are nearer term thoughts, but really have a model or a structure that can scale and repeat itself.

David Gardner (00:57:50):

Um, that’s where I’m gonna try to invest or betting. And those are the businesses or supply chain dynamics that I would be favoring. I also wanna say out the other side of my side of my mouth very briefly, that I also favor the rule breakers. So if you’re not the innovator in your industry or your context, who is, and I hope you will be or try to be, and it’s not always about being the number one innovator that’s very subjective. But can you say honestly that we are ready for anything or we are focused on the future, living backwards from there? Are we positioned to do what the human race has done for thousands of years? And that is to adapt. And I think that adaptation and in the adaptive capacity is, as Warren Bennice author of many great books on leadership said, that is the number one factor in his opinion.

David Gardner (00:58:41):

And I’m gonna say mine too, cuz I’m a fan for leaders for who’s a great leader and who’s not as great a leader is that adaptive capacity. So to me it’s much more about boots on the ground, being ready to, to with eyes open change or pivot than it is about, um, anything else really. So, and I think the, the future and the sp speeding up of technology, uh, requires us to not have, uh, five year plans like the Soviets used to have, but not even necessarily plans, sometimes just purpose and intention and adaptive capacity.

Enrique Alvarez (00:59:17):

Wow. I, I, I love that and I think there’s a better way of actually ending this interview than with what you just said. So thank you so much. Thank you for all the things that you shared for amazing trajectory and more importantly for the future as you said, uh, that I’m sure, uh, will be interesting and exciting for everyone out there. So how can our listeners connect with you, David, and learn more about the Motley Fool, how I’m sure a lot of people are excited to learn more about what you’re doing?

David Gardner (00:59:46):

Two ways. My email address is david gia fool.com, that’s what it’s been for 30 years or so, and I answer all my own emails, so if anybody actually wants to just connect directly with me, that’s always worked. Um, uh, and then of course if you just wanna tap in but not email me, then I have a weekly podcast that I’ve not, uh, shirked for one week for eight years in counting. It’s called Rulebreaker Investing. It’s of course available where this wonderful podcast is on all the different podcasting platforms. So, um, you’ll hear me mix it up from one week to the next, sometimes investing, sometimes business, sometimes life, sometimes guests, and sometimes just me talking to myself on the microphone, sometimes picking stocks and sometimes reviewing what works or not in business. So that’s it. That’s

Enrique Alvarez (01:00:29):

Good. David, thank you so much, Christie. Amazing interview.

Kristi Porter (01:00:32):

Yes. Yeah, really good. I’m gonna have to go back and listen again for sure. So thank you for everybody who’s joined us today. And again, if you wanna learn more about the Motley Fool, then fool.com. Nobody wanted it, David got it. And now everybody wants it. So go to fool.com. Thank you David, so much for being here. We appreciate your time so much and um, look forward to staying in touch.

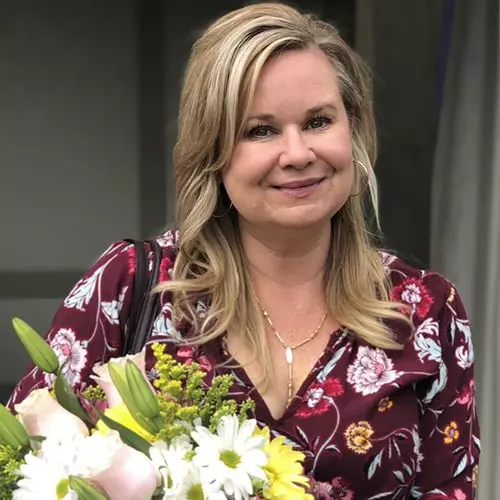

Featured Guests

David Gardner is Chief Rule Breaker at The Motley Fool, a financial services company he co-founded in 1993 alongside his brother Tom. He also serves as the Chairman of The Motley Fool Foundation. The Motley Fool’s purpose is to make the world smarter, happier, and richer. To that end, for 28 years David picked stocks for a worldwide membership through the company’s flagship service, Motley Fool Stock Advisor. From inception in March 2002 through May 2021, he generated returns for members of 20.6% annualized, vs. the market’s S&P 500 average of 9.1%. David also picked a few hundred stocks for Motley Fool Rule Breakers as part of a larger team; Rule Breakers returned 16.2% annualized vs. the market’s S&P 500 average of 10.6%. Believing in both quality and quantity, David made 13 accountable and market-beating picks a month for 15 years. David hosts a weekly podcast, Rule Breaker Investing, which has published a new episode every week since July 2015. Spending equal parts on his three great passions – investing, business, and life – he regularly welcomes world-class authors, renowned conscious capitalists, game designers, and all-star athletes. The show is most of all driven by his listenership, which shares constant feedback that he tackles in month-end Mailbag episodes. Rule Breaker Investing reaches a monthly listenership of 90,000. David and his wife Margaret both graduated as Morehead-Cain Scholars from the University of North Carolina at Chapel Hill in 1988; he is a recipient of UNC’s prestigious “Distinguished Young Alumni Award.” He plays games of all kinds, especially board games, having a collection of hundreds of them, which the Gardners have played a lot over the years with their three (grown) children. David served on the Individual Investor Advisory Committee of the New York Stock Exchange for 15 years and the Folger Shakespeare Library board for 10 years. A native Washingtonian, he particularly enjoyed his 2019 graduating class for Leadership Greater Washington. He currently serves on the Board of Directors of the Conscious Capitalism Institute and is a Co-Founder of Conscious Capitalism DC. He is “Limited Partner #1” in the Motley Fool Ventures debut fund, and continues to love investing in all forms. Connect with David on LinkedIn.