Supply chain disruptions are everywhere now in the news. I think there's a much better understanding and awareness among consumers, which can also be very tricky by the way, because we need to make sure the product is already there in advance of their demand.

- Patricia Gabriel, Vice President of U.S. Customer Service with Mondelez International

Episode Summary

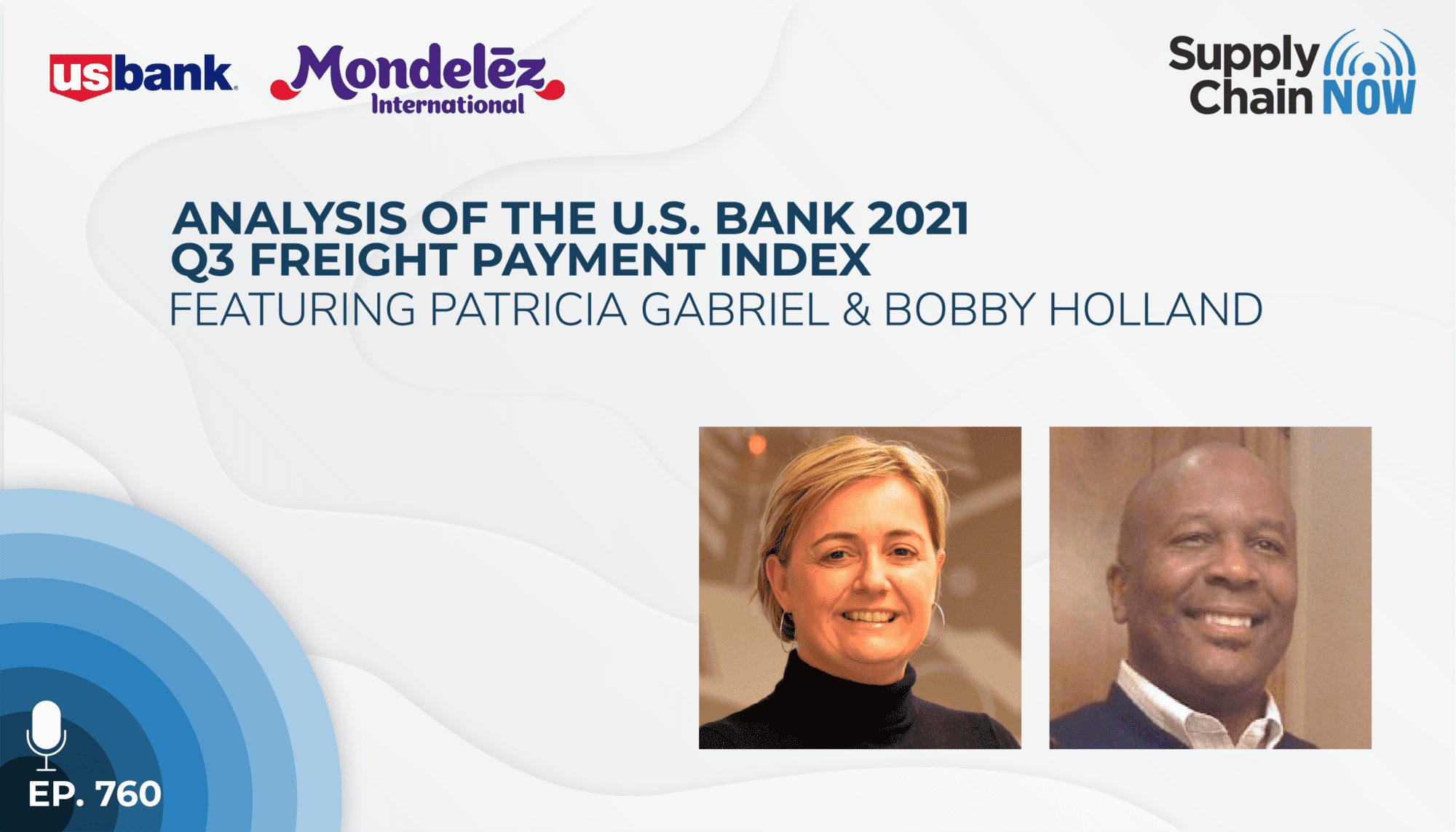

U.S. Bank processed $29.7 billion in freight payment transactions in 2020. Those payments and the data that accompanies them are analyzed quarterly by Bobby Holland VP/Director of Freight Data Solutions at U.S. Bank and his team. The FPI report includes quarter over quarter, year over year, and full-year data and analysis.

According to a summary released by U.S. Bank, “The U.S. Bank National Shipments Index showed growth, but at a slightly slower pace in the third quarter, compared to the preceding quarter, and year-over-year, reflecting several headwinds. This included an increase in the COVID-19 Delta variant, general supply chain constraints and auto plant slowdowns/shutdowns due to supply chain and microchip shortage issues.”

In this interview, Bobby is joined by Patricia Gabriel, Vice President of U.S. Customer Service with Mondelez international, to share the results of the Q3 2021 report with Supply Chain Now Co-hosts Greg White and Scott Luton, interpreting what they may mean for the economy and the shipping industry in the short and longer term.

- The sources of the ‘index headwinds’ that Bobby and his team saw evidenced in this quarter’s report

- How a lack of return freight from the Northeast region of the country is making it harder for shippers to get drivers to head in that direction in the first place

- Localized issues beyond the regional level, such as weather events and city-specific traffic congestion, that are having a widespread impact on rates

Episode Transcript

Intro/Outro (00:03):

Welcome to Supply Chain Now, the voice of global supply chain. Supply Chain Now focuses on the best in the business for our worldwide audience, the people, the technologies, the best practices, and today’s critical issues, the challenges, and opportunities. Stay tuned to hear from those making global business happen right here on Supply Chain Now.

Scott Luton (00:33):

Hey. Hey. Good afternoon, good morning, good evening based on wherever you are in the world today. Welcome to Supply Chain Now. Scott Luton and Greg White with you today for a great, great show. Greg, how are we doing?

Greg White (00:44):

We’re doing great. You know, I just thought about it, whenever you say that it could actually be tomorrow somewhere that we’re talking to. We’re up noon here. Right?

Scott Luton (00:54):

Continuing the theme, Greg [inaudible].

Greg White (00:57):

Do we say happy tomorrow? It’s today there.

Scott Luton (01:01):

We’ll, have to ponder that question through the weekend.

Greg White (01:04):

Yeah. Let us.

Scott Luton (01:06):

But, folks, today once again, not only do we have the one only Greg White back, who’s had his hands full lately. We have an outstanding show teed up all around the ever shifting, ever evolving, ever challenging world of freight. So, on this episode, we’re going to be sharing key insights from one of the leading transportation industry resources – y’all know it – it’s the U.S. Bank Freight Payment Index, but this time for Q3 2021. Greg, hard to believe we’re already talking in the rearview mirror about Q3, huh?

Greg White (01:38):

It’s true. I was just talking to somebody the other day and they said, “It is almost November.” I mean, this year – unlike last year, which shall not be named – has flown by it feels like. Doesn’t it? I mean, does it to you?

Scott Luton (01:55):

Undoubtedly. Undoubtedly. And, of course, I can only remember just a few of the headaches we’ve all experienced here in 2021. But all that said, we have a slew of new best practices, new learnings, new takeaways that supply chains around the world are applying, but a lot of them come out of conversations, like the one we’re going to have here today. We’re going to be gaining key takeaways from Freight Payment Index from two business leaders with extensive experience in the transportation markets. So, Greg, before we introduce our guests and before we say hello to a few folks, and Peter, and Susheel, great to see you all here today, tell us about this ongoing collaboration that we’ve had now with U.S. Bank because they’re one of the leading financial institutions involved in powering global supply chain, especially transportation. So, tell us about why U.S. Bank.

Greg White (02:47):

Well, so it turns out, Scott, when people ship things, the people who ship them for them want to get paid.

Scott Luton (02:55):

What?

Greg White (02:56):

What a brilliant concept that is. And, of course, there are hundreds, thousands, millions of shipments all over the world all the time, and U.S. Bank is one of the key resources for funding that, for making sure that those payments happen. $31.4 billion worth of transactions in the last year – last year, remember that year that shall not be named. And, of course, that gives them an incredible amount of insight into where things are going, how many shipments are being made, what the cost is, whether that cost is fluctuating up or down.

Greg White

And Bobby Holland – who almost everybody knows. And those of you who don’t, you soon will, Bobby’s brilliance – and what he and his crew do is, they put together this index that shows us how things are trending, how they compare to the last quarter, how they compare to the last year, and that sort of thing. And it’s a really important service, particularly now. And I got t say, no spoiler alert here, but it’s really a little bit jumbled this time around. And I think people will be interested to see how things and why things, trends mostly have shifted. So, it going be interesting to go through this, this time.

Scott Luton (04:14):

I can’t agree with you more. I really enjoyed the prep-shows and all the prep-work that goes into some of these things, the U.S. Bank team in particular, gosh, to put out something as comprehensive as the Freight Payment Index. They went into overdrive over this last few weeks. I want to say hello, Greg, to a few folks and then we’re going to welcome in our guests here today. So, Peter Bolle, all night and all day, always with us. He’s off in 15 minutes, he says, to get supplies to install the under cabinet lighting in the kitchen. How about that for a project?

Greg White (04:42):

Has he shown his kitchen since he finished it. And I hope those lights are LED, Peter. I mean, not just for the environmental factor, but back when you could only get halogens, halogens create a tremendous amount of heat underneath your cabinets. We had under cabinet lighting that was halogen, just astounding the amount of heat that generates.

Scott Luton (05:05):

Man, one minute I’m sitting next to Greg White. The next minute I’m sitting next to Bob Vila. Nothing, nothing that Greg does not offer expertise on. Hey, Peter Bolle, great to have you here today and really enjoyed your popping in yesterday as well. Susheel is with us via LinkedIn. Susheel, great to see you here today. Looking forward to your POV. And, folks, we want to hear from you. We’ve got two experts – really three, I’m going to throw Bob Vila in there as well that you’re going to be hearing from throughout the hour. But we want to hear from you as well. So, hello, Susheel. And then, Geoff LeRoy, a great friend of the show. Geoff leads one of the supply chain organizations down in Savannah. And you talk about a growing Mecca for all things logistics and transportation, Savannah is a dynamic market, right?

Greg White (05:49):

Yeah. Harder and harder to brag about not having the container and ship jam like the West Coast. I’d love to hear if Geoff’s got eyes on that and kind of where that stands.

Scott Luton (06:01):

That’s right. Geoff, all the best to you and your family, and great to see here today. We welcome your perspective. And, yes, just to knock off the important things here, Peter says, “Yes, low voltage LEDs.” All right. So, Greg, are you ready to welcome in our two esteemed guests here today?

Greg White (06:18):

Yeah. Particularly today, because one of them represents several of the world’s favorite foods. So, we’re [inaudible] all of that.

Scott Luton (06:26):

Yes. We’re going to establish that because you’re absolutely right. I want to welcome in Bobby Holland, Director, Freight Data Solutions at U.S. Bank, and Patricia Gabriel, Vice-President U.S. Customer Service with Mondelez International. Hey. Hey. Bobby, Patricia, how are we doing this afternoon?

Bobby Holland (06:45):

We’re doing well. How are you?

Scott Luton (06:47):

I’m doing wonderful here in the home studio on this gorgeous Metro Atlanta afternoon. And we have got some wonderful hardworking folks just on the other side of the wall. Y’all might can hear them, I don’t know. But it’s got to be a gorgeous day to be outside making stuff happen. But, in the meantime, Greg, we’re really excited as y’all heard to tee up this episode here today, focus on the Q3 Freight Payment Index and continuing our work with the U.S. Bank team. And Patricia, gosh, as Greg alluded to, Mondolez is one of our favorite companies. And, Greg, go ahead and let the cat out of the bag. Why is that?

Greg White (07:24):

Because Mondolez, among other things, makes Oreo cookies – the greatest food on the planet – and Toblerone, and a ton of other products like that. So, we’ve hit kind of the U.S.-centric with Oreo and Toblerone, of course, known worldwide. And I can’t even list all the others. But how would we survive without you, Patricia?

Patricia Gabriel (07:44):

I will for you, Greg. And many more.

Scott Luton (07:49):

And we enjoyed our prep conversations with you both, Patricia in particular. I think we talked a little bit about chocolate and beer, one of our collective favorites. But for starters, before we dive into the Freight Payment Index, let’s get to know y’all a little bit better. Let’s start with Bobby. Bobby, of course, you’ve been here, sat in two appearances with us. We’ve always enjoyed those. Refresh our listeners’ memory of who Bobby Holland is.

Bobby Holland (08:15):

Well, I’ve been with U.S. Bank for five years. I come from a long software engineering and software development background. So, being at data-related, data science oriented – metadata scientist, data science oriented product manager, this is kind of my wheelhouse.

Scott Luton (08:33):

Wonderful. And, Greg, no one cuts through the tidal wave of data to offer real signals and things you got to pay attention to, like Bobby. Even if he says data science oriented, I’m with you, Bobby. I can’t own anything science-related. But, Greg, Bobby is one heck of resource, huh?

Greg White (08:53):

Yeah. Well, I mean, if you’ve ever seen this Freight Index, you’ve seen his handiwork and, of course, the handiwork of the entire U.S. Bank team. But making sure that we distill this – and what I love about this thing – it’s perfect for me to analyze. And I think a lot of people will like – probably like Patricia – to analyze because you can get through it so quick. It’s visually engaging. The explanations are complete but concise. And you don’t feel like you’re reading a novel every time you read this thing. And every single time, you know, there’s something surprising in this, and this time around is no different for sure.

Scott Luton (09:31):

Well said, Greg. Speaking of Patricia, Patricia, same question for you. Tell us a little about yourself here.

Patricia Gabriel (09:37):

Yes. So, my name is Patricia. I am working at Mondelez International. As you see, it’s much more brands than the one you referred to. Although, Oreo is, obviously, iconic and Toblerone as well, but we also sell Sour Patch Kids, we do Ritz, we do Milka chocolates. I’m working there as, really, into the transportation, logistics, distribution, customer service. So, obviously, my life over the last year-and-a-half have been very exciting, the challenges that we are going through as a market and across, actually. I’ve been in supply chain, like, for more than 20 years – we’ll say 20 year plus. And not only into chocolate, but also into the beer industry. Which, as a good Belgian that I am – yes, I’m not French. I know I have the French accent but, actually, in Belgium we speak French as well. So, as a Belgian, having been part of my career in the beer party industry and [inaudible] the chocolate, I think it’s a good strategy. I’ve been doing distribution, logistics, customer service for a long time now. Very exciting to be there and discussing the Freight Index.

Greg White (10:51):

We’re glad to have you. You just throw waffles into that mix and we’ll have the entire country covered. You have everything.

Scott Luton (10:59):

So, Greg, talk about passion. Goodness gracious,Patricia and Bobby has got it in truckloads as measured every quarter here on Supply Chain Now. So, Patricia, welcome. Big fans of the Mondelez team. And by the way, let’s confirm, Geoff says, yes, “Savannah Port does have plenty of container congestion and backlog.” As we all know, for a long time, that was one of the main alternatives.

Greg White (11:24):

That’s right. People were coming through the canal to Houston, and Jacksonville, and Charleston, and Savannah. And I think they’re all starting to stack up. But let’s just pause for just a moment, I think Bobby’s taking notes here. He’s going to be looking into that for the next Freight Payment Index Quarterly Report.

Scott Luton (11:44):

That’s right. He doesn’t miss anything either.

Greg White (11:46):

After, you might get a phone call in the name of research.

Scott Luton (11:52):

So, Greg, with Bobby and Patricia here, where are we going next?

Greg White (11:54):

Look, aside from what we talked about before we brought you both on, $31.4 billion worth of transactions that U.S. Bank facilitates, Bobby, tell us a little bit about why you do this, kind of how you accumulate the data. And just give people, again, a baseline for how the index works.

Bobby Holland (12:17):

Well, Greg, as you mentioned, the $31.4 billion in freight transactions, shippers and carriers, generates a lot of data. And we want to be able to provide value to our customers using that data. And so, one of the ways that we’ve done this in our first project from my product team was the Freight Payment Index. And we wanted to, first, add our perspective to the marketplace. We’re not saying that we are the end all and be all of indexes or indices. We, basically, wanted to provide another perspective to give our customers and the market large and other data points. And so, that’s basically what the Freight Index was, another data point helping their decision-making and it provides our perspective. We wanted to add the regional perspectives since that wasn’t represented in the marketplace. And so, that’s what we brought to bear.

Greg White (13:12):

Well, you might not say you’re the end all, be all, but I will. I mean, $30 billion worth of transactions speaks to it. And as you said, you capture a lot of volume and you had added, of course, the regional breakdown is really important and I think particularly interesting this time around.

Greg White (13:30):

So, Patricia, maybe you can give us some insight how you at Mondelez use this index. You know, we love to have professionals who are on the ground or, you know, in the marketplace seeing what the data represents. And it’s great to understand how you all use it.

Patricia Gabriel (13:48):

We definitely use it a lot, obviously, because, to what Bobby was saying, it provides us a very good market indicator. Definitely, understand also how we are performing and how our rates are in line with the markets. The regional breakdown is also very insightful for us, as obviously we are moving product across the United States, so we definitely use and leverage really to understand some indicators that are helping us. The data set and the visualization is very, very insightful. We are also using, obviously, other data and analytics, I think, especially in the current circumstances to understand more the leading indicator. Because at the end of the day, it’s also for us understanding the past to also predict or forecast how the next quarter is going to be as well, because this is a part as well of the big questions for us how to stay agile.

Greg White (14:47):

Yeah. I think that’s pretty common. I mean, when we started doing this – Bobby and Scott, I know you remember – we had the VP of logistics at Home Depot, and very similar, it gives you both an indication of what just happened – which I think is a feeling a lot of people have right now – but, also, it does give you some indication as to trend and the regional part of it, especially for someone who ships nationally and, of course, internationally as you do. I got to imagine that that is having an impact on your business regionally. And it has to be impacting margins differently in different areas of the country. So, knowing that breakdown is really important.

Scott Luton (15:29):

Well said. Well said. And, Patricia, I bet you’ve got some big time to-dos on that board just over your left shoulder, right?

Patricia Gabriel (15:38):

That’s the one of my daughter.

Scott Luton (15:40):

That’s your daughter’s.

Patricia Gabriel (15:41):

We have an open space policy here, an open office policy.

Greg White (15:45):

Does one of those say study for the SAT? Because we know you have that coming up also, right?

Patricia Gabriel (15:54):

This one is only in seventh grade,look at her to-do list.

Scott Luton (15:57):

Wow. Man, we’ll have to see if we can get her into the supply chain industry. She’s clearly a planner and a doer. Well, kidding aside, Patricia, I appreciate that. And by the way, I want to give a shoutout to Larry Klein down in Albany, Georgia, I believe. Larry, hope this finds you well and great to see you here today. Whether you’re Jeff, Peter, Susheel, you name it, all the other listeners, I want to hear your take on freight markets, global supply chain, you name it, some of what we’re talking about here today. All right.

Scott Luton (16:24):

So, Bobby, I want to circle back to you. I want to ask you starting with the Q3 Freight Payment Index, what is this one telling us? Let’s start from that national point of view, give us that overview.

Bobby Holland (16:36):

Well, nationally, we saw growth, but it was a slow growth, slightly slower pace than the third quarter. We’ve found or believe this is largely due to things like, you know, COVID-19 impacts, particularly from the Delta variant, where we’ve talked to and alluded to supply chain constraints. Some of which include auto plant slowdowns and shutdowns due to things like the microchip shortage and other components and other input components to the manufacturing process. And then, we also had storms. So, all of these things we called them out in the index as headwinds. But then, on the other side, we had drivers such as the port traffic that we’ve talked about. We still had solid home construction activity. Consumer spending has still been pretty robust. Traffic has still been moving across, you know, Mexico and Canadian borders. And then, we also, in some non-automotive sectors, had improved factory output. So, basically, it just results in an overall growth but, again, not as robust or as fast paced as it was in second quarter.

Scott Luton (17:47):

Outstanding. And we’re sharing some of the visuals there. Of course, to sign up for this report for free, check out freight.usbank.com and you’ll get your own copy each quarter. Before we go region by region with Bobby, Greg, and Patricia, any initial takeaways? Greg, I’ll start with you. Any initial takeaways just kind of speaking to that overall bigger picture?

Greg White (18:14):

Yeah. I mean, when you think about it from the large picture standpoint, it’s hard not to be surprised that the impact of constraint – I think this speaks to this largely – it largely speaks to the constraint of the workforce. Because the reason that semi-conductors are not available and other things is because people aren’t back at work yet in the states, many are not. So, I guess I was really, really surprised at the impact that that continues to have. And you start to see, and people will see it as we go through the rest of this report, the circularity and kind of network effect of that on the supply chain. One thing affects the next and the next and the next, and that comes back all the way around. So, that was probably the biggest takeaway I saw at a macro level.

Scott Luton (19:10):

Quite a cycle. And, Patricia, anything to add on the frontend before we go down region by region?

Patricia Gabriel (19:15):

We have seen definitely a third quarter with a very strong demand across the markets and, obviously, the capacity. And we’re going to discuss this in the regional insights, but the capacity didn’t really improve. We still have the driver shortage, the new trucks not coming in, and so on. So, we have seen, obviously, the impact for us as an industry, and the pricing, and how difficult to secure capacity. Not even talking about price, it’s how do we get trucks and access to trucks. So, it really gets into the fight for capacity right now, even beyond the pricing.

Scott Luton (19:55):

Wonderful. I appreciate that, Greg and Patricia. So, Bobby, with that said, let’s go down region by region and give kind of some of your key takeaways. And then, we’ll get Greg and Patricia to offer up some color commentary. Let’s start with the Northeast Division. And really quick to our listeners, so the Freight Payment Index is broken up when they dive a little deeper to five regions, Northeast, Southeast, Midwest, Southwest, and West. And we’re going to work these from East Coast to West and get a little more lower altitude, a little more specificity in what we’re seeing. So, Bobby let’s start with the Northeast.

Bobby Holland (20:30):

Okay. So, what we saw in the Northeast, it had its largest quarter to quarter gain in more than two years. And, of course, that covers the heavy COVID-19 period, where the Northeast got really hammered in that regard with the shutdowns. But it was up 5.1 percent from Q2. It has one of the most population dense areas. And so, with that, retail sales have a big impact on shipments. And then, on the other side of that coin, we see that housing starts slowed. So, the housing prices are going crazy, it appears I can personally attest to. But it’s not new stuff. It’s selling old inventory. So, housing starts, basically, flat. So, again, moderate growth in the shipment side. And then, the spend index was up about 2.1 percent.

Bobby Holland (21:27):

And, again, as we’ve been talking about, and you’ll kind of hear that, as you pointed out earlier, Greg, it’s a recurring theme of higher diesel prices and tight industry capacity. One of the things that we started to see more this quarter than previous quarters is the impact of, not only the truck driving shortage, but actually the truck shortage. There were some allusions to it back, I think even as early as like the Q4 of last year, start to inkling about it. A little heavier in Q1. But now, to your point earlier, it’s making a more severe impact across the board because all the clever and creative things that both shippers and carriers and all associates had to do to accommodate these things, that’s basically one other item that’s kind of being slowly taken off the table or at least impacted heavily.

Scott Luton (22:24):

The hits keep on coming for sure there in the Northeast. Any commentary there, Greg or Patricia?

Patricia Gabriel (22:30):

Yeah. I think, first, I agree with what Bobby said. I think as shippers, we still see limited capacity in the Northeast into New England and so on. There’s a lack of return freight, obviously. So, it’s hard to get carriers moving some of the loads because, to be honest, they cannot return and then they will prefer to to move the loads on another vein. So, we definitely see that impact.

Patricia Gabriel (22:56):

And we touched base a little bit on the shortage of drivers, but overall, the shortage on labor also in the warehousing and in the trucking industries is also very prominent in the Northeast. [Inaudible] impact in some of [inaudible] and warehouses in that region.

Scott Luton (23:15):

And, Greg, I’m going to give you the last word on the mighty Northeast.

Greg White (23:19):

Yeah. So, Bobby, probably you acknowledge this, too, when Patricia said it, the lack of back haul freight is a significant issue in the Northeast all the time. And we’ve talked about that in previous reports as well. But, now, I would imagine with the rates being where they are, that’s stunting that demand even further, which is making it harder to find carriers to go into these more – I don’t know if I’d say remote, but whatever – less populated areas, because they’re less likely to find a return haul out of there.

Scott Luton (23:54):

Well said. And that is certainly a recurring theme. I want to bring in a comment here from Kelly Barner. So, some of y’all may know Kelly Barner leads our Dial P for Procurement and also Buyers Meaning Point. Kelly says, “I know one of the ideas that has been floated is bringing the National Guardian to help drive trucks. That is going to be a challenge here in the Northeast -” where she lives. “We have some of the strictest vaccine mandates in the nation. So, the National Guard has already been called up to drive school buses, work in hospitals, prisons, state police, you name it.” So, that is a great perspective there, Kelly. Thanks so much for sharing.

Patricia Gabriel (24:30):

I can confirm that we have a shortage of school bus drivers here as well. Families understand the challenges we have in terms of checking capacity and [inaudible].

Scott Luton (24:45):

Thank you for sharing that, Patricia. We can’t let one of these shows take place without calling out the need to hug on those truck drivers. They have such a tough, tough job and lots of burnout there, lots of, as we learned firsthand, mistreatment, and they’re the backbone of the industry. So, thank you for sharing that, Patricia. Okay. So, from the Northeast, let’s keep driving here to the Southeast, Bobby. What are we seeing in the Southeast?

Bobby Holland (25:13):

Okay. The Southeast Region was one of the ones that, from a shipments perspective, that contracted slow, about 2.9 percent from the previous quarter. The Midwest of the other contracting region with shipments. But we know that the Southeast was impacted by severe weather as well as fluctuations due to COVID-19. But they’re also impacted by auto production, which declined as well for all the reasons that we’ve previously discussed. But on the other hand, housing starts are still elevated there. And we’ve talked about that in previous versions of the index where the cycle is catastrophe, insurance, and then rebuilding, truck freight increases. So, we’ll be looking to see if that cycle repeats itself here. But, again, shipments down and spend up.

Scott Luton (26:10):

Yep. And really quick before we get Greg and Patricia to respond, Kelly says, “Having the National Guard drive trucks is a fabulous idea, Supply Chain Now, and much less scary than driving a school bus.” All right. Good stuff there, Kelly.

Greg White (26:26):

You can protect the load as well as haul the load.

Scott Luton (26:29):

So, continuing on Southeast, let’s go to Patricia first. Anything else stick out to you, Patricia?

Patricia Gabriel (26:36):

I think the storm and the weather has definitely impacted the third quarter for the Southeast. Not as bad as some other years. To be very honest, I think it was not as bad as we anticipated. But for the rest, yes. And, also, like the Northeast, there’s also a lack of a return freight into the Southeast, obviously putting a lot of pressure on the capacity.

Scott Luton (27:02):

Yeah. Thank you for that, Patricia. Greg?

Greg White (27:04):

I’m only speculating, but I think one of the things that the particular case of the Southeast and the Midwest – which we’ll talk about in a second – makes me believe is that, the cost and availability is suppressing demand. Because while shipments are down, I know there are plenty of shipments that there’s probably latent demand out there. Things that can’t be shipped because there aren’t enough drivers. And so, the attempt or the transaction of a shipment payment never actually occurs. So, that was a bit of an epiphany for me, is that, at this point, the limitations of capacity are actually suppressing demand. Bobby does that kind of jive with what you’ve seen in the data?

Bobby Holland (27:55):

It’s possible. Like I said, the usual things that our customers have to do to manage around these obstacles seem to compound. And, you know, you can only go so far with shifting things around. And we were even reading articles and seeing things about cannibalizing truck fleets. So, after a point, there’s only so much you can do, and then you just have to work with what you have. You can’t get more clever. And so, that’s basically an indication of what you just stated that, once you reached that limit, you’ve just got to let it ride out with what you have.

Scott Luton (28:35):

Well said. All right. So, that was the Southeast. And, Bobby, from there, we’re going to start to move our way westward and we’re going to talk about the Midwest. So, what are we seeing there in the Midwest?

Bobby Holland (28:49):

Midwest, as I stated, was the other region that was down from a shipment’s volume perspective. It was down, basically less than 1 percent, 0.7 percent. The spend, however, grew 3 percent from the second quarter. So, again, less things happening. And auto production is big in the Midwest and it was off more than 30 percent from a year earlier, again, because critical aspects of the supply chain for our auto manufacturing were missing. The microchips are the ones that make the news and that everybody’s familiar with. Because not only is it the auto manufacturing, but a lot of the freight that comes out of the Midwest is auto-related, there’s an impact to that as well. But the spend-wise, the fuel prices are still going up. One of the things we quoted in the index was that diesel rose about 3 percent, almost 4 percent in the third quarter. And, basically, it’s up almost 44 percent from last year. So, you can do the math and just see that’s why spend was so much with so many orders of magnitude over what the shipment volume increase or the shipment volumes were.

Scott Luton (30:06):

All right. So, coming to you first, Greg, when we talk about in the Midwest, some of what Bobby has shared versus maybe other things you saw in the analysis, anything stick out?

Greg White (30:15):

Well, what started to stick out as I went through this analysis myself was that, this is a familiar tune. There aren’t enough trucks. There aren’t enough people driving the trucks. And fuel prices are very, very high. They were at 40 percent in the Southeast. So, basically, fuel prices are up 30 to 44 percent across the nation. So, just to give you an idea, anything that costs you two bucks before, now costs you $2.67, and diesel fuel is much higher than that.

Bobby Holland (30:52):

I think it’s about $3.70 now.

Greg White (30:54):

Yeah. Yeah. I saw a bargain yesterday, Bobby, $3.45.

Scott Luton (31:03):

As you’re driving a truck through Atlanta, Greg.

Greg White (31:07):

Well, I was just checking out all the fuel prices to see how high they were and then I went to Costco. But I think this was the point about the third of regions that I started to analyze that it’s the same story nationwide. You’re going to hear it, but there are certain other impacts as well. And I think one of the things we need to recognize is that, trucks, just like cars, they expire. They have extended their useful life. Bobby said, you can only get – I want to say cheeky – but you can only get so clever with trying to keep these things on the road. And then, eventually, you’ve got to get it off the road. And there aren’t enough trucks there to replace it. So, even if we do have the drivers, we don’t have the trucks. And we don’t have the trucks because we don’t have the workers in the factories. And we don’t have the workers in the factories because people aren’t going back to work.

Greg White (31:59):

So, that will, I believe, start to abate because now that the federal pandemic unemployment insurance is going away, people have rolled to their respective state unemployment insurance. And, now, with the actual requirement of having to actually look for a job to keep getting it. So, people will have to start going back to work, but it is, I have to say, much slower than I expected at any job, not just driving.

Bobby Holland (32:32):

A slow ramp back up to repair the damage to the supply chain. So, it’s not just going to pop that way as soon as people start going back to work.

Greg White (32:41):

Yeah. That’s a good point.

Scott Luton (32:41):

Agreed. The challenges certainly will keep coming. Patricia, your thoughts when it comes to the Midwest.

Patricia Gabriel (32:49):

Yeah. I think what we have seen that we didn’t talk yet about is, obviously, it’s the congestion that we see on the intermodal around Chicago. And, obviously, the congestion is well-known. It’s there for quite some time. But it definitely got worse even in the third quarter. And then, everybody’s converting, obviously, to trucks and this put even more pressure, I would say. So, that’s definitely something that was also experienced from our side and from the market side.

Scott Luton (33:21):

That’s a great call-out, Patricia. I read somewhere that in one of the big rail yards, a 25 mile backup for rail cars to get into. Man, holy cow. By the way, Larry Klein says, “More loads, smaller trucks.” Simple solutions, maybe. We’ll see Larry. Well, you know, along those lines, Greg, one company – speaking of more load, smaller trucks or smaller loads – Roddy, of course. I cannot remember who acquired them not too long ago –

Greg White (33:50):

UPS.

Scott Luton (33:50):

UPS did. That’s right. So, you know, freeing up the trunk of a sedan to make a delivery, fascinating times we live in for sure.

Greg White (33:59):

It’s hard to fit [inaudible] sedan, however. Believe me I’ve tried.

Scott Luton (34:02):

You beat me to it, Greg. You beat me to it. We do love our Oreos around here. Okay. So, that is the Midwest. And by the way, I’m going to share Joshua’s comment here. He says, “I can’t wait until we get to the West Coast where diesel prices are out of control. And the ports are clogged with empty containers.” Joshua, excellent point, and looking forward to your POV as well. All right. So, from the Midwest, Bobby, let’s move from the Midwest to the Southwest. So, tell us what you see there.

Bobby Holland (34:35):

Southwest shipments rose about 2 percent, 1.9 percent, over Q2. About 4.3 percent from a year earlier. And what we see in the Southwest is still high retail sales levels, housing starts growing, consumer consumption is also growing, even though there’s a surge of COVID-19 Delta variant in some places in the Southwest. The interesting thing we’re seeing, crude oil rig counts jumping almost 10 percent from the second to the third quarter, which is helping bolster shipments. And then, the same with the cross-border shipments from Mexico rising. And since the Southwest has one of the largest number of land ports across their border, again, it’s helping to buoy up their shipment traffic.

Scott Luton (35:36):

So, Greg, talking about the Southwest, what else comes to mind based on what you heard Bobby say and what the data is telling? As well as our fingers on the pulse across supply chain?

Greg White (35:48):

Well, I believe it was last quarter also, energy shipments are largely doing this segment of the country. Because oil prices are higher, people are apparently putting in more wells. Though, I have to say, Bobby, that was a surprise to me, 10 percent increase. But that’s what’s moving. At the same time, all of that goodness is just barely getting growth into the system quarter-over-quarter and year-over-year and yet prices are still rising dramatically.

Bobby Holland (36:26):

Yeah. The spend index was up almost 6 percent, which in these modest rises is a pretty good sized one, especially for the Southwest.

Greg White (36:37):

Yeah. Well, almost 27 percent year over year as well. I mean, so we’re continuing to see that inflation – there it is – in shipment costs and spend grow. I think overall, Bobby, not as much as Q2, but still pretty significant in terms of rate or spend increase.

Scott Luton (37:08):

Great. So, coming to you next, Patricia, when we look at the Southwest, what we’re seeing there, what comes to mind?

Patricia Gabriel (37:16):

Yeah. The capacity is very tight on the cross-border, as Bobby mentioned. There’s a clear imbalance between the export and import, so very hard to find trucks. And then, for the international shipments, we can’t go into modal so much because it get congested in the Midwest. You go back to truck loads that your consumer find out of Laredo and the Texas border. So, this is about trying to find the capacity moving from one problem to another problem. And when we get most probably on the West, we’re going to discuss on the port congestion, so it feels like a little bit of a domino effects you’re trying to fix somewhere. And then, it appears somewhere else.

Scott Luton (38:00):

Peter to pay Paul comes to mind in many ways there. So, Joshua knows where we’re going. We’re about to move to the West Coast where we’re seeing some big things. He says, “I heard that the Port of Oakland has excess capacity. How feasible would it be to redirect shipments up north?” I’ll tell you, as we’ve seen, Greg, here on the East Coast, folks have moved from Savannah to Charleston. Which, I don’t know how many nautical miles that is, but Charleston has been benefiting from some of the congestion in the Savannah Port. So, Joshua knows where we’re going. So, on that note then, Bobby, let’s talk about the Western regions. What are we seeing there?

Bobby Holland (38:39):

The West had one of the largest gains, especially on the shipment side. They’re up 13.8 percent from the second quarter. And we’ve been talking about it in bits and pieces about the significant activity in the West, which is reflected in high port volumes and lots of tracking activity. Attempting to move that from the port into the state and into the country. However, from a shipment perspective, there was a slowdown in housing starts up over last year, but still fell from the previous quarter. On the spend side, it was up almost 16 percent from second quarter, which was a second straight gain, about 44 percent over this time period last year. Again, strong freight rates for all the reasons that we’ve talked about.

Bobby Holland (39:29):

One of the big ones is in the port congestion issue – we talked about it a little bit in the last index call – which is the retailers trying to replenish their stores as well as to prepare for the holiday season in this quarter. And so, again, they’re trying to get as much in as they possibly can. And then, on top of that, you have high fuel prices. Diesel was up 5.6 percent over Q2 and 37 percent over a year earlier. So, it’s all the same theme, putting pressure on all the activity that is attempting to rectify previous problems.

Scott Luton (40:13):

Hey, really quick, of course, it feels like a year round peak. Amanda was telling me – Amanda, Jada, Clay, and Allie, I appreciate y’all’s production work here today – that target has rolled out an incentive encouraging folks to buy now. And if there’s a discount later as we get into the holidays and first of the year, they’ll just offer up that refund based on where that discount was. I think it’s interesting to see how that will play out, Greg, and Patricia, and Bobby. But let’s talk about the West for a sec. So, based on what Bobby has shared there, Greg, what else sticks out in the wild wild west?

Greg White (40:51):

So, I think the increase in shipments shows that they are actually getting goods through the ports, finally. Even though we talk a lot about port congestion, and it’s always about Long Beach and LA, they must be getting goods through to have that level of increase in terms of shipments. You know, the pricing is confiscatory, of course. But, I mean, this is the market that we live in. And by the way to answer Joshua’s earlier question, if the capacity is there, somebody ought to test it. Unless there’s something fatally flawed about the Port of Oakland, then, yes, it is absolutely feasible. Because, Joshua, a lot of those shipments are actually going through the canal to Houston, or Jacksonville, or Savannah, or Charleston, as Scott was talking about. So, I would think Oakland would be much more feasible for at least a certain number of shipments than doing all of that.

Scott Luton (41:49):

Well said. Confiscatory, that’s a new one for me, Greg. Gosh, I’m going to have to bring my dictionary to these conversations. All right. Patricia, so a lot shortage of things going on in the West, what sticks out to you?

Patricia Gabriel (42:02):

Yeah. Not much more. By the way, I’m not even trying to say that word. It’s impossible for me.

Greg White (42:08):

I bet it sounds great with a Belgian accent. It sounds much more intelligent.

Patricia Gabriel (42:15):

I think the point that we are all making, indeed the retailer brought a lot of the seasonal products as ahead of time as they could. Of course, the big unknown is how much the consumer will also react to the supply chain disruption that we see buying ahead of the holiday season, the Christmas gifts, and Thanksgiving. This is definitely also a potential shifting to some of the behavior that we see because the supply chain disruptions are really everywhere now in the news. And I think there’s a much better understanding and awareness of the consumer, which can be also very tricky by the way, because we need to make sure the product is already there. So, this is really, for us, the preparation of the season.

Scott Luton (43:04):

Excellent point, Patricia. Excellent point. Gosh, no shortage of things. It feels like we need a couple extra hours as always, Bobby, and Greg, and Patricia. All right. So, Greg, where are we going next with this esteemed panel?

Greg White (43:18):

I think it’s time to ask the big question and the one where Bobby has to recuse himself. But before we do that, Bobby, whatever you can share with this that is either analytic, historically, or indicative maybe of the future, or whatever you can share, I’d love to hear kind of what is your big takeaway here?

Bobby Holland (43:41):

The big takeaway, I think, is just that the problems that are being experienced, I think that they will be handled. But I don’t think the impacts of the solutions are going to be immediate. I think that, ultimately, we’re going to crest this hill, but it’s going to be a long cresting. It’s not going to be, like, things are going to bounce back or snap back in Q4, even by Q1. Because, again, the fact that the supply chain is so severely impacted, it can’t snap back in one or two quarters. So, 2022 should still continue to be an interesting year with a lot of contradictions.

Scott Luton (44:23):

Excellent point. And, Greg, speaking of not being able to snap back, there’s some systemic things that must be addressed in order to mitigate future situations like this. The ports, of course, has been a main theme here. And you look from Gene Seroka to many others that know ports best, we’ve got some catching up to do in terms of how data and visibility is shared multi-party. Greg, you and I have talked about kind of the fiefdoms that are created and that coopertition between the ports that takes place. How can we systematize that in a much more holistically, efficient manner? The truck driver situation that we talk about every time we have this show, we talked about here. I mean, how can we change the role there? How can we change how that profession is also treated within industry? No shortage of really systemic issues that aren’t going to be resolved overnight. But, Greg, what’s your key takeaways? You and Patricia, what else are you thinking here before we move into wrap-up?

Greg White (45:24):

To the point that Bobby made earlier, even when we do get people back to work, even when the government stops paying people to stay away from work – and largely has to their credit, finally, at this point – it is going to take a while because people have not just stayed away and collected money from the government. They’ve stayed away and rethought their priorities. And it was hard enough to get drivers before COVID. The incoming generations of workers are not inclined to be long haul truck drivers. What we’ve seen is, to some extent, I’ve seen some reports of actually baby boomers coming out of retirement to become drivers, because they’re willing to do that job or whatever. But that’s not going to be enough.

Greg White (46:13):

So, to the point that I think everyone has made, this will not be a rapid recovery. We will probably see ebbs and flows like this. We’ll see differing regional effects. I mean, winter is about to come to the Northeast – where Bobby lives into the upper Midwest – and that will start to impact things. And with so many people in supply chain already on their heels with uncommon supply chain disruptions, like government intervention, then when the natural disruptions come, like weather, they’re less equipped. As Tommy said, they’re doing all these clever things to fix the problems they have today. They have to adapt those clever things when the natural occurrences of storms and weather and seasonality of peak occur. So, I think that the big takeaway is, we’re a long way from seeing any kind of stability. I would argue even indicative trends or changes in the data here, and certainly on the ground. But I’m not on the ground, so I’d love to hear of it.

Patricia Gabriel (47:29):

I think, Greg, you’re spot-on on the drivers. I think it was already difficult before. It is going to be even more difficult, I think, to find drivers, especially for the long haul distances. This is really not an attractive job, like it might have been in the past. I think that we are entering this fourth quarter, the supply chain employees wherever they are, whatever they are working on, transportation, on the warehousing, on manufacturing, people are exhausted. Let’s be very honest, they have gone through a lot of the COVID challenges, obviously, but also the fact that the demand is there and the economy has picked up and so on. We keep asking more, but with less actually. So, I think it will take time before we start resuming a little bit of – and I cannot even say normality because I think it will never go back to the same normality that we had before.

Patricia Gabriel (48:29):

But then, I agree with what you say, Bobby, I mean, we do expect still that it’s going to improve. But definitely not in the next two quarter, I think. And especially this quarter is going to be really challenging, the holiday season, the storms, the snow, we sure have our fair share as we always had. It’s just that you don’t have the capacity, you don’t have the same agility. So, that’s why for us, as a shipper and especially in the consumer goods industry, it’s really thinking about the consumer first and how can he get the product on the shelf is the right and the most important thing, despite the challenges.

Scott Luton (49:10):

Well said. Keeping it frank with an optimistic spin. I think you’ve got to be optimistic to be a supply chain practitioner based on some [inaudible].

Bobby Holland (49:18):

Definitely. Definitely.

Scott Luton (49:20):

So, we got some great comments. Unfortunately, I’m not going to have time to get through all of those. Bobby, we enjoy these quarterly conversations. And, Patricia, as busy as you are in the Mondelez team thrilling your consumers around the world, again, Oreos and milk. Just keep the Oreos and milk coming and the world will stabilize things.

Greg White (49:39):

In a better place, that’s right.

Scott Luton (49:41):

That’s right. I want to make sure, Bobby, let us know the easiest way beyond the link, freight.usbank.com, that’s how folks can sign up for this quarterly information that never disappoints, huh?

Bobby Holland (49:54):

Yeah. It’s a free link or free subscription, and you’ll get it delivered in your email box quarterly.

Scott Luton (50:00):

Wonderful. And we’ve got that link also in the show notes of today’s episode, so you all check that out. And as a follow up, Bobby, I’m sure you get keynote requests and interview requests all the time, how can folks connect with you?

Bobby Holland (50:13):

[Inaudible] freight.usbank.com link, which is the subscription link, but then, also, my information is on LinkedIn and it’s current, bobby.holland@usbank.com. And I’ll be happy to answer whatever questions I can.

Scott Luton (50:28):

Wonderful. I appreciate that, Bobby. And Patricia, the same question, when you’re not solving the world’s supply chain issues, you and your dynamic team there, how can folks connect with you?

Patricia Gabriel (50:41):

Through my LinkedIn profile, obviously, I think is the easiest one.

Scott Luton (50:47):

I agree with you. I tell you, LinkedIn is making things very easy for us. Well, big thanks, Bobby Holland and Patricia Gabriel. Before they go, Greg, this is always a very informative data-driven conversation. Now, as Bobby Holland said, not data scientist – how’d you put it Bobby? Data science oriented. I’m going to completely steal that phrase from you, Bobby. That is wonderful. Greg, these are really fun and important conversations we have. We love how we take kind of the voice of the data, so to speak with Bobby Holland and then pair that with a leader from industry that is leading and doing it out there. Your final word, Greg, before we bid our guests, ado.

Greg White (51:30):

Well, all of this has made me think of a grocery store visit I made just some weeks back and the good work that Patricia and her team at Mondelez are doing. I think we even had the photograph that I took on one of the shows of the full shelves of Oreos of many varieties. So, there are people persevering and succeeding even in this difficult environment. And I’m sure that it’s taking back flips and all sorts of unnatural acts to try and figure out how to make this go. Clever acts, as Bobby coined the phrase. And I just want to applaud everyone who is doing that because it is important and it is about the consumer. And, Patricia, great that you acknowledge that. My saying is, the supply chain begins and ends with the consumer. It does. If not for them, we’re not needed. So, I just want to acknowledge the work that everyone’s doing to get there.

Greg White (52:31):

And, also, to encourage consumers to be patient. This is not going to be the holiday of your youth or even your recent past. Goods are going to be hard to come by. Many of them won’t land. Many of them intended for Christmas won’t land until after Christmas. A lot of those ships that are in port now, those are ships that are delivering goods for the spring fashion season. So, if the goods aren’t here, they may not be here for Christmas. And I would just encourage everyone to make an alternate plan besides consumption.

Scott Luton (53:08):

PTK every day, Greg – patience, tolerance, and kindness. We’re going to need loads of that. Hopefully, loads not stuck in cargoes to get through the end of year season.

Greg White (53:18):

No doubt.

Scott Luton (53:19):

No doubt. All right. So, on that note, big thanks again to Bobby Holland, Director, Freight Data Solutions at U.S. Bank. Always a pleasure, Bobby. Thanks so much for your time.

Bobby Holland (53:28):

Thank you. Thank you very much. I’m glad to be here.

Scott Luton (53:32):

And best of luck this weekend, too, Bobby, by the way. Let us know. We need some pictures. And joining Bobby today was the one and only Patricia Gabriel, Vice-President, U.S. Customer Service and Logistics with one of our faves, Mondelez International. Patricia, always a pleasure. Thanks so much.

Patricia Gabriel (53:48):

Thank you. It was a pleasure for me.

Scott Luton (53:50):

Have a great weekend. Thank you, Bobby and Patricia. Thanks so much. There’s always something else. It’s just one additional thing I want to bring into the conversation, but always messes with our timing. But I’ll tell you what – just keeping it frank and transparent – Bobby and Patricia – gosh – we could sit down and solve many of the world’s challenges, huh?

Greg White (54:13):

Yeah. No doubt. And here’s evidence that Patricia is already solving. Let me see if I can get this to focus. There we go. Patricia is already solving some of the world’s challenges because that is the store shelf that I was alluding to earlier. So, it can be done. And it probably does take a lot of magic and witchcraft to make it happen these days, but it can be done. And, again, also, I think it’s a great opportunity for people to just kind of sit back and people have been reevaluating what’s important to them for 19 months now. So, it’s probably a good time to reevaluate what’s important to you about the holidays and how you’d like to spend them, because it may not even be possible to get what you or your loved ones want for the holidays.

Scott Luton (55:05):

Excellent point. Excellent point. Enjoy presence – spelled differently, I think, this year. Big thanks to our production team, I appreciate all that y’all do. I really appreciate Bobby, Dan, and the whole U.S. Bank team for all the work they put into a very helpful piece of research each quarter. And big thanks, of course, whenever we get a chance to pair all of that with a senior leader from supply chain, like Patricia Gabriel, which it’s like a passion. It came out in the prep meeting, it came out today, she loves what she does, and we need lots of enlightened and innovative leaders getting us through these times like her, right?

Greg White (55:45):

No doubt. Yeah. Doing great work. And I love the insights. I think U.S. Bank wants to have these insights from the people who are doing the doing, from the people who are making these transactions and these shipments happen. So, I think that’s a great and important point of view for us to expose there.

Scott Luton (56:05):

Agreed. Agreed. Well, big thanks to you, Greg. Appreciate you joining me here today. Great to have you back in the saddle. I know things have been busy. It’s a busy, busy fourth quarter for all these days. Big thanks to all of our listeners that tuned in here today. Sorry, we couldn’t get to everybody’s questions and comments. Lots of data and perspective to get through as always each quarter with our friends at U.S. Bank.

Scott Luton (56:28):

Hey, folks, have a wonderful weekend. Hopefully, the weather is as nice where you live as it is here in Metro Atlanta. I think those leaves have been blown around just as much as they could possibly be blown around earlier today. I’m glad I didn’t lose a connection, but always a pleasure. Most importantly, folks, do good, give forward, and be the change that’s needed. And with that being said, we’ll see next time right back here at Supply Chain Now. Thanks everybody.

Intro/Outro (56:56):

Thanks for being a part of our Supply Chain Now community. Check out all of our programming at supplychainnow.com, and make sure you subscribe to Supply Chain Now anywhere you listen to podcasts. And follow us on Facebook, LinkedIn, Twitter, and Instagram. See you next time on Supply Chain Now.

Featured Guests

Bobby Holland leads the Freight Data Solutions team at U.S. Bank where he focuses in analytics and data-related product management for the freight industry. Bobby has more than 36 years of broad-based data processing, software engineering and consulting experience. He has leadership in multiple industries including insurance, large-scale billing, customer care services and banking. At the bank, Bobby leads efforts to produce the U.S. Bank Freight Payment Index. The often-cited Index is a barometer for freight shipping trends on both the national and regional level. The index source data is based on actual freight payment transactions from across the country. The pioneer in electronic freight payment, U.S. Bank Freight Payment processes more than $46 billion in freight payments annually for corporate and federal government clients. Connect with Bobby on LinkedIn.

Patricia Gabriel is US Vice President Customer Service and Logistics for Mondelēz International, a global company leading the future of snacking with 2019 net revenues of approximately $26 billion. In her role, Patricia leads Supply Chain Planning, Logistics Operations including both the Direct Store Delivery Operations and Warehouse Delivery Operations, as well as Customer Service for the US. Patricia is passionate about the role the Supply Chain plays in driving competitive advantage, through Customer Centricity focus and End to End Supply Chain Collaboration. Patricia joined the company in February 2018 from Anheuser-Busch InBev where she worked in different areas of supply chain for 11 years, including building the International Supply Chain organization and operating model, to support the growth of the Global Brands internationally. Prior to her time at Anheuser-Busch InBev, she worked at Accenture in the Supply Chain practice for FMCG and Retail Customers. Along her 20+ years of experience in FMCG, Patricia developed strong expertise in Supply Chain, delivering best in class results through operational excellence focus, customer centric approach and passion for building high performing, diverse team. She has deep experience in delivering impactful business results through leading business transformation programs. Patricia has extensive international experience and has worked in North America, Europe, Latin America, and Asia. A native of Belgium, she earned a Master degree in business management from Solvay Business School in Brussels. She attended 2 AB InBev Executive Programs, one in Stanford university and one at MIT. On a personal note, Patricia lives in Westchester, New York with her family. She has a passion for Gourmet Food and Cooking, and can spend a full day in the kitchen to prepare a meal, and then share it with Friends and Family. Connect with Patricia on LinkedIn.