Episode Summary

“I am shocked by how infrequently founders and CEOs will reference check investors. I mean, you have to do that. You’ve got to ask the investor for references and then you go find your own. And you just have to do it because you’re not going to find out otherwise, unless it’s somebody who is really well known. That’s the first thing I would do.”

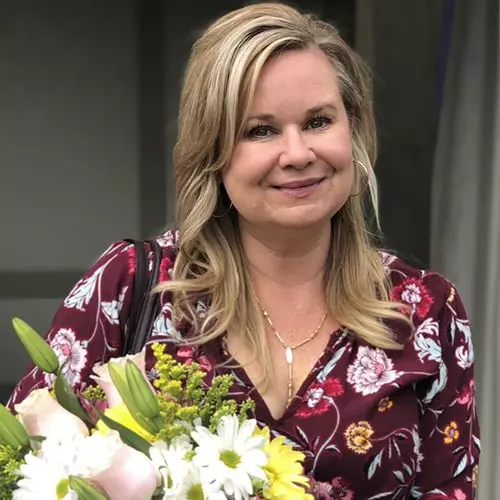

-Robin Gregg, CEO, RoadSync

Fresh off raising $30M in Series B funding for RoadSync, a logistics payment software company, CEO Robin Gregg sat down with us to share her wisdom on what it takes to find, and win over, the right investors at every stage of the fundraising process. Don’t miss this master class on everything from perfecting pitches via Zoom to spotting genuine investor interest, navigating “frothy” markets, finding ways to still have a little fun, and much more.

Episode Transcript

Intro/Outro (00:03):

It’s time to wake up to TECHquila Sunrise. Greg White here, and I have spent my career starting, leading, deploying, and investing in supply chain tech. So, we take a shot at top founders, execs, investors and companies in this hot industry. If you want a taste of how tech startup growth and investment is done, join me for another blinding TECHquila Sunrise.

Greg White (00:30):

Hey. Welcome everybody.

Robin Gregg (00:32):

Hey.

Balaji Gopinath (00:34):

Hey there.

Greg White (00:35):

Robin Gregg and Balaji Gopinath, our usual judges. We’re going to turn the tables a little bit. This is our Summer Splash edition of TECHquila Sunrise, Take Your Shot. So, usually what we do is we introduce you to some startups and we let them pitch. If you remember our epic, epic show from last month, we went almost two hours. We’re going to try and keep it a little bit shorter. But, look, this is your opportunity to watch companies pitch and talk about their companies and share their vision with the marketplace and learn from our judges. So, we highlight these founders and we get insights from our judges. And, of course, this is a part of our collaboration between Kubera Venture Capital, Link Labs – our little supply chain-focused incubator – and we’re about to land here in the ATL there, and, of course, Supply Chain Now – thank you for giving us this platform and allowing us to focus on these supply chain techs.

Greg White (01:37):

Now, look, this is a really special show this time because we’re turning the tables a little bit. So, Robin who’s usually on the judge side, she gets to judge people and observe, she’s going to share a bit about her experience in going through a raise. So, what we’ve done in the past – if you haven’t joined us before – is we’ve watched founders do their pitch, three minutes or less. And then, we, as a panel, have evaluated their pitch, asked them questions, given them guidance on some opportunities within their business. But the culmination of what we’re trying to teach people with this show is to raise funds and to be able to build a good business to do so, and to expand that business.

Greg White (02:20):

So, guess what? Robin had to jump off the last Take Your Shot because she was in the middle of a raise, and just raised $30 million for RoadSync, the company of which she is CEO, a supply chain payments, FinTech. She hit all the key words and that probably made it easier to raise. But she just completed this raise. She’s actually about a month into making good use of those funds, being a good steward of the investor’s money. And so, we’re going to learn what that process was like for her, what the market is like in general, and what is going on at RoadSync since this next stage of growth. So, again, if you can call us judges, Robin, I guess it will be me and Balaji this time, but mostly let’s just consider this kind of a fireside chat. But welcome to both of you. And I’m glad to have you here. This is going to be fun [inaudible].

Balaji Gopinath (03:22):

At some point, we have to all do the tequila shot.

Greg White (03:25):

Yeah. That’s right. Do you have one handy, Balaji?

Balaji Gopinath (03:27):

I don’t. But it’s also a bit early in the morning for me to start the day in that way.

Greg White (03:33):

That’s true. I also think it might be illegal to do it live, FCC regulations and all that sort of thing. I don’t know.

Balaji Gopinath (03:40):

Who’s to say it’s tequila?

Greg White (03:42):

Who could find it? Who could find us anyway? So, you will be amazed on how many people insists on doing the shot on the show. There’s a few that I thought were maybe a little bit too blue blooded to do it. And they actually insisted on doing the shot. Robin, are you ready?

Robin Gregg (03:58):

Yeah. I mean, who know what’s in my tea glass? The conversation will get really interesting if I went that direction.

Balaji Gopinath (04:07):

Yeah. But before we get going, Robin, huge congrats on the raise. That was difficult regardless of the climate. And it takes a lot of work. It becomes a full-time job for many CEOs, as those who are in the process of raising no and those who have raised always know. So, huge kudos to you and the team to be able to get that done.

Robin Gregg (04:27):

Thank you. I really appreciate it.

Greg White (04:29):

Well, I can’t wait to hear, because you and I had an opportunity to talk just a little bit preparing for this and – gosh – it brought back memories – good memories. But, you know, I know it’s a heck of a workout.

Greg White (04:43):

All right. Before we get started here, let’s see who’s joining us. So, we have people from all over the world joining us. So, thank you, Manish. Srinivas, of course, from India. Always good to see you. And I have to quote Scott Luton, Peter Bolle, all night and all day from Quebec. Another Peter, Peter Matheka. And Scott Luton, who’s taking the afternoon off, he is just observing right now. We have folks tuning in, Samuel from Panama, Monday from Nigeria. You guys, we better be good. This is a worldwide audience. I’m not not saying anything in particular, no pressure. But we’ve got Kenya. We’ve got Pakistan. Musawer from Pakistan.

Greg White (05:36):

All right. So, let’s jump into it. So, appreciate you doing this, Robin. I know this is just the start of things. I think a lot of times people think that the hard work culminates when you get funding. But the truth is, now, you have a certain responsibility to your investors – as if you didn’t before. But, now, even a longer list of investors. So, we know that the work is hard and that you’re taking some valuable time for us. So, let’s start with something just really basic. I think, the question we’d all like answered every time we are pitching or we see somebody pitching or someone has pitched successfully, and that is, what did the investors see in your business? What did your pitch or your discussions with them communicate that they loved so much that they just had to invest here?

Robin Gregg (06:30):

Yeah. I mean, I think first of all, let’s share with people what we do. So, we’re in the business of automating the routine business expenses that truckers face to complete their loads. And we believe once we’ve done that, it will actually create a platform, an opportunity, to provide a broad set of financial solutions to the vendors that serve the transportation industry, to the truckers themselves, and then to the people employing them. And so, that’s really what our platform is about.

Robin Gregg (07:00):

But, you know, where we have started is by automating expenses and making it easier to get paid and pay for things that drivers encounter in the course of their load. So, you know, it could be anything from a warehouse unloading fee, a late fee, to heavy truck repair, towing, you name it. For drivers, everything is a business trip.

Robin Gregg (07:21):

But unlike us, when we go out on business trips, they can’t use AmEx to pay for a flight or a hotel. They really have a bunch of other things that they pay for that may or may not accept cards. They may or may not have the funds readily available. And it just makes it very, very complicated in the industry. So, that’s really what our platform is focused on.

Robin Gregg (07:43):

A bunch of other industries have spend management solutions. The transportation industry really doesn’t. And so, that’s really our aspiration is, to power those expenses and make them easier. And then, you know, like I said, there’s lots of other financial transactions that could be automated in the ecosystem as well.

Greg White (08:00):

And you’re aiming for some of those as well, right?

Robin Gregg (08:03):

We are. Yeah. Yeah. I mean, there’s no reason to stop at just the business expenses. I mean, once you serve those, you can start providing some other financial solutions on top of that.

Balaji Gopinath (08:13):

So, given that, Robin, I’m just kind of curious as to going into the investor question. Do you lean more positioning yourself as a FinTech company or a logistics company or a FinTech place serving logistics?

Robin Gregg (08:27):

Yeah. So, the category that’s really hot right now is embedded payments or vertically specialized software that have payments embedded in them. And so, you see in other industries, people like Toast – Toast, for folks who aren’t familiar what that is, it started as a restaurant point of sale system. And they now provide a suite of solutions to run a restaurant. And they all started with a point of sale that was purpose-built for restaurants. I think they filed for their IPO and they’ve managed to build a giant business in the space – that’s sort of an example of sort of vertically specialized software with payments embedded in it.

Robin Gregg (09:04):

And that was this category that we sort of positioned ourselves as. So, we didn’t necessarily say, “Hey, we’re looking for logistics, investors.” It certainly made it easier to talk to people who understood logistics because you just spend forever describing the problem, and the ecosystem, and the complexities. And even the lingo gets really painful if people don’t have any exposure to logistics whatsoever. So, I would say, we positioned ourselves as mainly FinTech with the vertical specific software wrapped around it.

Balaji Gopinath (09:38):

Got it.

Greg White (09:39):

So, as you presented this, what do you think really hooked the investors? I mean, I see a lot of companies trying to approach a business solution for the transportation industry. But it seems like payments getting paid is a great entree for that. And then, building out furthermore. I mean, is that or something else?

Robin Gregg (10:04):

Yes. And the reason why it’s sort of software anchored to payments or other financial solutions is so impactful and so interesting to investors is because people really care about how they get paid. And so, how you’re taking in your money is a high engagement piece and sticky piece of what you do as a business. And so, if you’re really providing a person with solutions to get paid faster, to get paid easier, to track the revenue, you really can make the argument to an investor that that is a good anchor point and platform to deploy other solutions because they’re using it every day.

Robin Gregg (10:45):

And that’s really what people want to see, especially if you’re going to go for a platform play where you’re going to try to deploy multiple solutions, they really have to believe that you are important enough to your customer that they’re going to want to do more with you. And, you know, part of the reason you do that is you say, “Hey, they’re using this every day. This is how they get paid,” and it’s really sticky, so I think it’s an important part.

Balaji Gopinath (11:11):

So, Robin, again, just a little more on the FinTech side of things. I know you have a great background in that space. How much of this is partner-driven or relationships that you brought to the table? And how much of it did you bespoke or build as part of RoadSync that provided that unique offering to the market?

Robin Gregg (11:31):

Yeah. I mean, most of it is very unique. We publicly announced that we are partnered with WEX relatively recently, who has 50 percent of the over the road fuel card market. We accept their fuel cards at all of our merchant locations and instantly accept their fleet checks. So, that was a really important partnership for us. I think the fact that I’d come out of the fuel card industry was helpful in being able to land that. And, you know, they don’t easily partner with other platforms. And so, I think having credibility and a relationship was important to do things like that. But a lot of what we built is very custom, because even integrating with someone like of a WEX, it’s not like integrating with Stripe or something that’s sort of more off the shelf. I mean, this isn’t something they’re doing every day by a long shot. And so, you’ve got to understand and build a lot of custom stuff.

Balaji Gopinath (12:26):

And that goes back to something that Greg and I always talk about, the moat that a company has as it’s going through the fundraise as evaluated by investors, that’s a significant moat in terms of being able to enter the market and how you’re tightly integrated to an existing player. All those really helped a lot in the fundraise. And then, I think you’ve done that very, very well. It gives you a huge head start in terms of how you look at things versus other companies who, to your point, think they can build these things by integration with Stripe and all these other players. And, frankly, that’s easy to do and not a huge barrier to entry.

Robin Gregg (13:08):

Yeah. I mean, I think there was two interesting things to investors about that relationship specifically. Which is, one, it’s hard. It was hard to do. And it was hard for us to both get it done sort of from a build standpoint as well as just navigating that organization and sort of getting them to be a partner with us, so a gigantic company. But also the credibility of brands. I mean, their brand name is everywhere in the industry, and that’s helpful. Frankly, I think the transportation industry is quite skeptical of new technology and new players. And so, kind of having some folks to sort of –

Greg White (13:51):

How do you get that impression [inaudible]?

Balaji Gopinath (13:53):

Is that true, Greg?

Greg White (13:56):

I’ve never heard of that. No.

Robin Gregg (13:59):

And I think our are general approach – and I think this is something that resonated with investors as well – has been, we have to be very respectful of where our customers are. Like, there’s reasons that this industry has not been able to completely undergo digital transformation. And it’s not because they’re not sophisticated or savvy business people. And there’s just other fish to fry. And so, it’s extent that we are respectful to work within their existing business processes, work within their existing workflow, just makes it a lot more palatable. And that positioning, I think, was really interesting to investors.

Greg White (14:36):

So, you’ve said three things so far – I hope I can remember them all – that have really nailed it, that I think every company needs to think about. One is stickiness – we use that term all the time – being used every day. And especially for something as core as payments is a critical way point. I see a lot of companies who go at different angles of the company and then want to add payments later. And they do it via a generic solution like a Stripe or something like that. But you have actually positioned yourself to become the de facto, potentially, payments solution for the industry, especially with your connection to WEX.

Greg White (15:12):

The second is the integrations. Integrations aren’t typically a strong suit. They’re not typically a motor differentiator. But the integration that you have with such an exclusive player who has such exclusive taste with who they partner with, that is a huge leg up. That’s much more important than, again, as you talked about with Stripe or something like that. And then, the last is meeting your customers. This is not the last I’m sure we’ll hear. But the three that I’ve heard so far, the last is meeting your customers where they are. Solving the problem that they want solved, not projecting the problem that you want to solve. Don’t be a hammer in search of a nail, we say that all of the time. But instead find what the market need is, what is a compelling problem that they are running fast away from, and be the best and separate and differentiate yourself in that position in the market. And that’s how you win.

Balaji Gopinath (16:08):

Yeah. I think even simpler put, we also talked about revenue solves a lot of problems. If you’re helping people find revenue, that in and of itself is a huge value prop to the market. And we see a lot of efficiency plays. We see a lot of people addressing it from that standpoint. And all that is valuable. But the fact that you’re bringing revenue to the table is huge.

Greg White (16:32):

Yeah. No doubt. So, was there anything as you pitched that investors expressed concerns around? I mean, the market or your positioning or anything like that? I mean, it can’t have been all roses and daffodils, right?

Robin Gregg (16:46):

It was definitely not roses and daffodils. You know, just to share with folks, this is the third round of capital I raised for the company. So, I’ve done a seed round, a series A round, and then this was our series B. And I had really different experiences each and every time. And so, I learned a lot. I may have made the same mistake more than once, but tried not to. I think that the hardest part – and this has been consistent through all three rounds – is to make sure that people understand, one, understand the market, so the lingo, the structure, the problems that they have. If this is not an active investor in supply chain or logistics type of technology, it’s super duper hard. It doesn’t make a lot of sense to people.

Robin Gregg (17:31):

I think the second thing that was difficult was, the way we go to market is primarily through direct sales. And me and investors don’t like that. I mean, they don’t like hand-to-hand combat. They are like, “What do you mean you have sales reps call everybody?” And like, “Hey, this is not a market that has time to sit around and Google stuff,” especially if you’re kind of defining a new category and a new service. And, you know, I think part of that’s on us that we need to sort of start to figure out more digital ways to reach our customers, and we’re certainly on that path. But those are probably the two biggest things. So, just how we sell and then just understanding structurally the market, and the problems, and the lingo, I think were the two biggest challenges that I’ve faced every single time I’ve raised money.

Balaji Gopinath (18:15):

So, two questions to follow on, Robin. One is, I always get asked how many investors had I talked to. It’d be great to kind of give the audience a gauge of the fact that, you know, it’s not all daffodils and roses here. That you’re talking to lots of people before you actually find the people that get you and kind of grok what you’re doing. How many investors do you think you’ve talked to in the three rounds you’ve helped raised?

Robin Gregg (18:42):

Geez. Across three rounds probably, like, 150 to 200. I think in my seed round, I talked to just under a hundred, and that was by far the hardest. I mean, for most people, that’s the case. You know, for this last round, we did not talk to very many at all. We got lucky this time – and I won’t say got lucky – but we had a very tight compelling story and it went faster this time around, so we did not talk to that many people.

Balaji Gopinath (19:07):

So, you mean key point to all the early stage startups, don’t be dejected. It takes a lot of kissing frogs to find the right investment partners to kind of work with. And you have to remember that many investors want to say yes. Everybody wants you to win. But everything has to be aligned with what they know, what they invest in, how they can help, as well as timing, which is key. The second question, I think, which would be great for people –

Robin Gregg (19:36):

I actually wanted to say something else, the other thing I think I got smarter about is, learning to identify genuine interest. So, you said something interesting, an investor’s job is to look at deals. So, that’s their job. And their job is to, like, consider that deal. And so, I’m pretty sure they aren’t interested. Also, to learn about the market. I mean, you could have all sorts of objectives in terms of having a conversation with you. And it feels like genuine interest. So, some people, if you’re not used to it, because you’re like, “Oh, the conversations are going well. I’m going to the next phase.” And so, it probably took me the second or third time I raised to understand when somebody was genuinely interested and how to suss out who’s serious and who’s just shopping. And so, I think that’s important to learn too.

Robin Gregg (20:26):

I think the difference was, where I could find it and suss it out is, I really made them ask questions or come back to me on, like, what specifically they’re concerned about, or interested in the business, or how they wanted to dive in further. And that usually helped me understand validate interest. Because if the questions were good and very specific to me, then I knew that they’d been thinking about it. If they were kind of more like, “This is such generic questions we ask everybody,” that was usually a good indicator to me.

Balaji Gopinath (20:52):

Yeah. And just to give you a Kubera perspective on that. If we’re talking to people more than three meetings, we’re typically interested, but we don’t always do the deal. And that’s because of the size of the fund, the type of investment valuation, all those things do matter. But aside from that, I’m curious, as your company has progressed, what are the big things you’ve gotten done company-wise that helped set you up from a seed to series A and series A to series B? And what insight could you give people there in terms of things to look at? A question I get asked a lot is, “When should I bring in the CFO? When should I bring in a VP of sales, chief revenue officer?” I’m curious as to what you did and how you built your team to help you accomplish what you did.

Robin Gregg (21:41):

Yeah. And it changes at every stage, right? I mean, you guys are investors, you can correct me if I’m wrong. The story I was telling at seed stage was really sort of the stick dream. What’s the narrative? What’s the big dream? And then, what are the indicators? What are the customer pilots? What are the early signs of revenue? What are the indicators of momentum that we were really genuinely onto something? So, I felt like that was sort of, you know, what the story is around. So, you really are about like, what do you have in market? How much committed interests do you have, contracts? What is it that they’re interested about? How well do you understand the problem? And can you kind of describe what you do for these customers? And then, where does that take you? What’s the big dream?

Robin Gregg (22:24):

I think for our series A, there was an expectation more of how good is the company getting at sort of improving the product and product cadence. Are we starting to build that out and build out more feature sets? How sticky is the product? We now have enough data to know, do our customers stay with us? Do they like it? Do they love it? Are they raving? Are they doing testimonials? Are they referring other people? And then, what are the early indicators that we have a repeatable sales process? And I think on series B it’s, can Robin hire people? Can Robin build a team? Is she starting to build a bigger organization and structure? That’s when we hired a CFO. I think, for us, it might’ve been a little on the early side because we are a FinTech company, so the financial side of it is super, super important. We’re handling other people’s money. But I think, you know, the story starts to change as you kind of get to each stage.

Greg White (23:20):

Hey, I have a quick question from the club seats here. So, in as much as you were given some evaluation of interest, I’m curious if you have any other qualities that you kind of look for in an investor.

Robin Gregg (23:35):

Yeah. You know, I like to look at, one, the individual that you’re working with is super important and how they can help you, and how they can advise you, and whether or not they’re going to be with you through thick and thin. You are going to have some awful conversations and bad news you’re going to have to deliver to your investors. Like, you know, I don’t know of any CEOs who don’t have that experience. And so, getting a sense of who’s going to have your back, and be supportive, and give you advice, and that is productive, I think, is super important. And so, I think it is important to understand what your personal relationship is like and what you can expect from your investors.

Robin Gregg (24:13):

And, also, kind of the help you need. Different people need different types of help. So, you know, some of the help that I was looking for is, I’ve been a professional running and scaling business for quite some time, especially in FinTech. So, I didn’t need necessarily FinTech help. But I was in Atlanta and it was hard when I got started to raise capital outside of Atlanta. So, I was looking for investors who are really good at helping me raise capital, and helping me network, and extend my network, and we’re well respected and could connect me to the New York or San Francisco capital markets where, you know, there’s just a lot more capital available. So, it just depends on what you need and you have to be thoughtful about it. And it changes by stage of business.

Greg White (24:56):

So, if I was Scott Luton, I would have read that question before I put it up there, but I’m going to do it now. So, James Malley asks, “Are there any qualities you look for in an investor?” So, that’s why I asked Robin that question, for those of you who are not on video and can’t see it. I think, you know, one of the other things you have to acknowledge and you have to discern in the process is – and I’ve told a number of investors this both being on their side and the founders side of the table – every investor has the same pitch. They’re all former operators. They all have all these value added teams and things like that. And they all, essentially – as I’ve told many of them – your differentiators are precisely the same as all of your competitors. So, those things that you looked for, how did you discern that they were real instead of just the kind of typical pitch you get in a meeting?

Robin Gregg (25:51):

You know, I am shocked by how infrequently founders and CEOs will reference check investors. I mean, you have to do that. I mean, I’m very surprised. And I think, you know, you got to ask the investor for references and then you go find your own. And you just have to do it because you’re not going to find out otherwise, unless it’s somebody who really is well-known. That’s the first thing I would do.

Balaji Gopinath (26:23):

I agree with that. And I also think there’s bit of matching. I think at the various stages you’ve raised – and you’ve probably seen this – there are those investors that are true builders and partners with you at that stage, and will dig in, and be an extension of your team and work with you to do what needs to get done in many ways. And then, there’s the next levels of growth and scalers that take you beyond where the builders can take you. And the DNAs are different and it really is a partnership. And the way we like to talk about is that, you’re letting somebody into your family, they’re going to sit at your dinner table, and you don’t want that unruly uncle, like Greg, to show up because who knows what Greg’s going to say at the dinner table that day. [Inaudible].

Greg White (27:10):

[Inaudible]. I can guarantee you that.

Robin Gregg (27:14):

I’m not a knock on multi-stage investors or anything. But, like, in the early stages – I’m sure you guys will like this advice – I do really love having dedicated seed or series A investors with you, as kind of who you would pick. Because they are more like, let’s say, have smaller portfolios. They’re more dependent on your success. And you’re just going to get more from them. And they’re going to help you raise the next round because that’s what they need to do. And I think the alignment of incentives is just much, much better if you kind of find those folks.

Robin Gregg (26:49):

I mean, I know it’s hard to turn down a really great brand name multi-stage investor. But, you know, that can go wrong and you’re just going to get less help. And then, I think the other thing I’d say to founders is like, be honest with yourself about whether or not you actually want help. So, you know, if you’re just going to ignore, if you have like, “Hey, we want to help and get really involved early stage investor,” and you’re just not open to it, then that’s not going to be very productive.

Balaji Gopinath (28:15):

Great advice.

Greg White (28:16):

That’s a big, big part of it. I think it’s really difficult to conceive how complex this process is because you could have someone like Kubera, who is a perfect fit who really wants to and can help. But if you don’t fit the investment thesis, then you could go three, four meetings, and realize that there’s not a deal there. And it’s equally as frustrating for the investor as it is for the founder and the team. But, I mean, that is why a hundred contacts is necessary. It’s not just because someone can or even wants to or will say yes. It’s you’d need the right fit in so many ways to say yes. While you want is a check, then you just need to be honest with yourself and acknowledge that I don’t really care about it. Or, specifically, as you said, want someone helping me. I know what to do. That feels like a dangerous path having been a founder and an investor. But, I mean, there are some people, really experienced founders, who they may not want or even need that help. You have to be very, very introspective as well. You have to understand if you really should have the help, even if you don’t want it.

Greg White (29:43):

As you started to go into this, having come off two previous rounds, that’s obviously very helpful. But how did you prepare for this round? I mean, how did you get the team prepped, the pitch prepped, grease the skids in terms of relationships with potential investors, that kind of thing.

Robin Gregg (30:03):

Yeah. I mean, ideally, you’re pitching to people that you’ve been checking in with quarterly or regularly, and you don’t have to start from scratch. And some of those people are people I had pitched in earlier rounds. Some were people that I’d kind of gotten connected to subsequent. So, probably six months in advance, you ought to be having some conversations with people just to be able to suss out who your high priority people are. So, I’d done that. We did this during the pandemic. I did not do a single investor meeting in person. And so, we had to do it all over Zoom, which was crazy and it felt very different. It just allows you to sort of get your fundraising process be really, really compact and fast. And so, you can kind of iterate really, really, really quickly and have a bunch of meetings one on top of the other, and be pretty time efficient.

Robin Gregg (31:01):

I need to practice. I’m one of these people that need to practice a lot. I tend to get to, like, operating, “Let me tell you about all the stuff we built and what we just did.” And so, to kind of get –

Greg White (31:15):

Here’s how the money goes through.

Robin Gregg (31:19):

Yeah. I get like that. So, I need to practice, sort of so I’m staying on the story and kind of making sure that I have the right energy. So, I had to practice a ton. I recorded myself. I practiced in front of my kids, who were really mean, and that was really productive. So, it’s just practice the pitch. Have a really sort of structured pitch. And then, I also had a totally ready to go kind of light diligence analysis ready. So, everything was ready. So, for us at our stage, you do things like cohort analysis, sales analysis. There’s just some stuff that investors want to do. We had everything, the data ready, the financials ready, little pack, ready to go. So, if we had an investor who’s super interested, we could move quickly and we sort of removed some of the work for them.

Balaji Gopinath (32:10):

Robin, one of the things I’ve noticed with my peers in the investment space is that – I think, during the pandemic and probably even moving forward in a lot of these, Zoom has been so tremendously helpful on an efficiency standpoint – how much did the product demo matter? Because I find myself more focused on the demo and how well the product flowed and the customer experience. And I’m able to dig into a lot more earlier on because of that. How much did that play into your pitch during the pandemic and helped you get to where you were?

Robin Gregg (32:44):

I think it’s certainly important. I think we were late enough though. What was more important was our metrics and our sale – that’s a very funny comment, by the way. We were more focused on our metrics and sales momentum, and sort of more of how the business was performing and sort of the early signs of results and traction and momentum. But I think it was important. You know, I think it would have been way, way, way more important in the earlier stages.

Greg White (33:11):

So, the practice thing, I think, is really key. I mean, you say it jokingly, your kids were pretty hard on you. But, you know, my experience has been those that love you the most beat you about the face and neck in an appropriate way. I mean, I want and I do often, if I want an opinion, I go to Balaji and I know that I’m going to get it. Or go to my buddies and say, “Hey, here’s what I’m thinking in there.” You know, they will undoubtedly say, “Boring. I don’t get it.” You know, the truth is, because investors do talk to ten or a dozen companies a day, that you have a very little opportunity to get their attention. And you have to be concise and you have to be on point to do that. And that’s not unlike speaking to someone who doesn’t know the industry at all, or doesn’t know investing at all, or doesn’t know your company or your story at all. Because, you know, it’s kind of like a cocktail party. You know, when you describe what you do to your friends, it’s totally different than the way many people try to describe it when they’re in their marketing when they’re developing their marketing messaging. So, it helps to have people who have that blessing of naiveté because as an investor, you’re only dialed in looking for kind of bullet points, not consciously, sometimes just subconsciously. And when those bullet points hit, then you really dial in and start to dig deeper. So, that practice is really critical.

Robin Gregg (34:45):

It is. And I think it’s even more important when you’re doing it over Zoom. Because I think Zoom flattens you a little bit, flattens your tone, you just become less complex and interesting as a human. You don’t have the pre-game chit chat while you’re kind of all getting settled and sitting around the room. So, you got to, like, bring it. You got to be ready to have great energy, super crisp presentation. And that takes a lot of work to do. And so, that I think was super important.

Robin Gregg (35:14):

And the other thing that I did was, I always had another member of my team on the call. Because the other thing you don’t get to see is the feedback, what the faces looked. It’s really hard to sort of read the room when you’re doing a pitch over Zoom. And so, to have somebody else who’s like scrutinizing the little Zoom squares and figuring out what the facial expressions are, and sort of remembers the questions, and all of that was absolutely critical. I don’t know that we can’t iterate and get better. I think it’s a harder environment to get that feedback and to kind of – I don’t know – just sort of to bring your best version of yourself over Zoom.

Greg White (35:59):

In the end, did you like it better than [inaudible]?

Robin Gregg (36:03):

I did. Oh, gosh. I hated, like, driving around Sand Hill Road.

Balaji Gopinath (36:08):

[Inaudible].

Greg White (36:12):

The road. You just hated the road. It’s [inaudible] and windy.

Robin Gregg (36:13):

I just hated the road. I mean, you know, it was just super inefficient. You know, some people in downtown San Francisco, some people out scheduling everything. It just took so long. And you try to plan all around a trip. And I loved doing it over Zoom. The efficiency was fantastic. You kind of had to realize in what ways did it kind of – not cripple you – where is it going to sort of make it harder to sort of function and have a really good pitch.

Balaji Gopinath (36:48):

I think there’s a mixed bag. I know a lot of investors that have found it difficult to make investments virtually because they’re so used to meeting the entrepreneur, because it gave them data points and a sense of the company, of the founders. And many people have had to adjust on the investor side to doing the same thing, because it’s been difficult for them because they’re used to people coming to them anytime. And this is a whole new paradigm, where they can see a lot more companies, but they have to find the same type of cues they have to understand. They’re doing the same analysis on their end to try to figure out is this the right investment, the right team. And many times, particularly the backgrounds, a company can look huge versus being in somebody’s garage. And so, there’s always a bit of consternation around that as well. So, I think it cuts both ways. And I think, hopefully, the future is someplace in the middle where we find some efficiency as well as get back a little bit of face-to-face. But if you can stack your meetings, I think that’s better for everybody.

Robin Gregg (37:51):

Yes. Well, it’s easier to manage a process, right? Some of the things I see, especially early stage founders do, is they’re like, “I had five great conversations this week.” And I’m like, “Okay. Well, you probably got to do 50.” Being linear about it just prolongs your fundraise process, which means there’s more time that you’re embroiled in it. And it’s a time not spent actively managing the business. So, being able to be efficient and really compact about it, I think, is just good for everybody.

Balaji Gopinath (38:21):

So, in planning out the future, Robin, given the fact that the world is getting even more distributed in terms of teams and the fact that we look at future work as part of our thesis, we’re very interested in how companies of your size and stage are looking at how do you grow your team on a national global level. Is distributed workforce a nature of the beast? Are you trying to bring that brain trust to you, ideally? What is the mix from your perspective?

Robin Gregg (38:53):

Well, first of all, I’m very lucky that we are based in Atlanta, which is a fantastic town for FinTech and logistics talent. So, we very much view Atlanta our home. We believe to be competitive. We need to provide flexibility about where people work. And allow people to not spend five days a week and in the office, that doesn’t sell. But for certain roles, we’re also more open to having them be in other markets and other geographic markets, particularly engineering roles. But for the most part, we really want people here. And so, it’s here with flexibility. We will opportunistically hire some folks in other markets. But the times we’ve gotten the team together – and we’ve gotten a chance to do it a little bit. We’re partially back in the office mainly with our sales organization – and the energy’s amazing. You can’t replicate that, I think, over just Zoom and having a remote workforce.

Robin Gregg (39:51):

And I also think the business is going to lean one way or the other. And so, having us be primarily in person with lots of flexibility is probably the right model for us. And I think you’re going to see businesses sort of pick one or the other. But, you know, we’re kind of moving fast. We want to have a fun culture. We want it to really be sort of well-learning. And we have a relatively [inaudible] our sales team, you know, two to five years of work experience. It’s just much easier to kind of do some of that when you’re in person.

Greg White (40:27):

I think it’s interesting that what I’ve seen is strong leaders, like you, taking that balanced approach so many years back when it was open office or nothing. I think, now, so many companies go that way because of fashion. And like you have done, you have to understand that dynamic. Sure, you need a dark part of the office for the [inaudible] cage for the developers, that’s where they’d prefer to be anyway. You need another dark part of the office where things can fly around the room for the marketing people. And then, you need a well-lit and quiet part of the office for the accounting department. And it’s similar in terms of how you domicile people for their roles.

Greg White (41:12):

And, frankly, we’re in a market where I think we can all confess, it is definitely a candidates market right now. So, you have to be more flexible. But I’m a huge believer and I think having seen it – we talked about our buddy, Paul Noble – I have visited his corporate office and I’ve visited the corporate office at Flourish, both here in Atlanta as well, and the energy and the opportunity for interchange that really up levels the business is unmatched in a virtual environment.

Greg White (41:47):

So, just a couple more things before we wrap up here, but I want to talk about frothiness. So, for anyone who’s not familiar, if you are in the startup industry or you are an investor, the key word of the month or the last few months is frothy. Is it not, B?

Balaji Gopinath (42:07):

Yeah. Frothy is the term you typically see the insiders use. I think another term is unrealized exuberance. There’s a lot of exuberance. That’s not necessarily based on fundamentals of many decisions and that leads to that term frothiness. And that’s partly due to the fact that there’s a lot of money about looking for a place to land. And in markets where money is cheap – and it’s used to stimulate the economy – these things tend to happen across many areas, not only startup investments, but if any of you that own homes are thinking about selling, know that the price of your home has gone up considerably. It also comes into play in many other industries when money is cheap.

Greg White (42:56):

Yeah. And, arguably, we’re in kind of an everything bubble. And frothiness, frankly, is a dual-edged sword. Because investors who have FOMO, fear of missing out, they want to get in on good deals in hot spaces like supply chain and FinTech. But at the same time, to kind of temper the fancy of our audience here, you had better be performing really, really well because while there are a lot of deals out there, I think investors have started to have their eyes looking forward for when the market starts to retreat a little bit. And they are starting to look at the best deals out there. Those really fast-growing companies with good teams, and good products, and good market positioning, and a good moat. So, I’m curious what you saw in regards to that, because you are in two markets that are frothy [inaudible] both FinTech and [inaudible].

Robin Gregg (43:58):

First of all, I’ll start off with my investors got a spectacular deal because we are amazing. And whatever they paid, we’re going to blow it out of the water.

Greg White (44:13):

[Inaudible] like a true diplomat. Very well done, Robin.

Robin Gregg (44:16):

So, I think you sort of alluded to this, not everyone experiences the froth. And I think, you know, I want to feel the founders out there that are like, “Where the heck is all this money? Because I can’t find it.” Like, it’s a relatively limited set of folks that are experiencing, what people are calling, frothy market and over exuberant market. It is gravitating to people with certain backgrounds and experiences and businesses to certain profiles. And so, you know, for some folks it’s business as usual, trying to find capital. And so, the story around frothiness is intensely frustrating and, you know, can be a little bit de-motivating. But that’s not everybody’s experience, right? So, it’s a kind of an abnormal experience to experience the froth.

Robin Gregg (45:10):

What does happen, especially if you’re in hot markets, is this thing that I talked about at the very beginning, which is, everyone will look. And I had this experience in the beginning too. Like, for me, I am a woman who came out of a really well-known successful commercial payments company in a hot market in logistics and FinTech. And so, everyone would have a conversation. And a lot of those conversations were just an interest in the space and all this other stuff. And that wasn’t actually interested in our business so they weren’t really were going to invest. And so, I do think the frothiness can be a disadvantage to some investors – not investors – to some founders because it’s just, “Hey, I got to look at everything now.” And you’re not getting the weeding out and sort of the qualified interests that you would get in a different market.

Balaji Gopinath (46:08):

Yeah. Just to play on the frothiness a little bit, I think one of the challenges with entrepreneurs, particularly at early stage, is that they see the success of other companies that look similar. And they believe their valuations should be in the same ballpark. Whereas, no two companies are necessarily alike. And to your point, there’s a lot of facets that get looked at in terms of the team, the experience, the domain expertise, the product, the traction, the stickiness, all the things we look at in terms of trying to evaluate a company. And that can be frustrating because from the outside, “We look just like them, why aren’t we getting the money?” But the reality is, there’s a lot more to unpack. And if you become valuation focused, particularly at the early stage, I think you’re doing yourself a bit of a disservice versus just continuing to build and finding that success.

Robin Gregg (47:05):

And I think the thing that some people need to understand, too, is, sometimes people get irrational offers. I mean, they may fall into a pot of money and a valuation that they just hit the right person at the right time. An investor lost a previous deal and really feels like they need this deal. I mean, who knows? There could be all these sort of magic to it.

Balaji Gopinath (47:28):

Luck and timing is a big part of all of this, right?

Robin Gregg (47:31):

Right. It’s not like there’s some mathematical formula to what you’re going to get. So, it could even be for reasons that are not really justified on business fundamentals, or business quality, or anything like that. You just never know. And so, you can’t get wrapped around the axle. Your business is worth what someone’s willing to pay for it.

Balaji Gopinath (47:52):

So, that being said, Robin, again, another question I have a lot with founders and startup people are, how much did I raise? And what’s the right amount of money to take in? What’s too much? What’s too little? How do we determine what the right amount of money is? What are your thoughts on that? Because, obviously, you guys have raised a tremendous round and I’m sure there’s rationale behind that. But, you know, what insight could you give people as they try to figure out what is the right amount of money to raise right now?

Robin Gregg (48:24):

Yeah. I mean, I think that it’s what you think you can productively deploy. And really have a good thesis on I can spend this money wisely and hit the milestones and the metrics that I’ve put in front of the investors. And you shouldn’t raise much more than that. I think people, especially in the earlier stages, I would recommend being a little bit more conservative about what you raise when you’re really early, early, early. I think, you do see some of these bigger rounds. I mean, the reality is in some of the bigger rounds, you kind of have sizes that you’re not going to get a top tier investor if you’re raising a $5 million series B. So, you’re just kind of stuck with certain amounts of money at certain periods of time in your growth cycle. And you need to know, as the CEO or founder, that you can productively deploy it. And so, that’s how much you should raise. Otherwise, don’t play that game.

Greg White (49:22):

Yeah. This is going to sound counterintuitive, but the last thing you want to do is raise too much money. And too much money is defined by giving everyone a car as a sign on bonus to the company. And that’s an extreme example. But the truth is you need to be able to have a sound plan to know how you’re going to deploy those funds. We have this discussion frequently, how much is enough? How much is too much? Rarely do I talk to a founder who thinks they are asking for too much money for their round. The other thing, I think, companies – and you’re at a stage, Robin, where this rarely happens, but we see it frequently with seed stage companies – you’re not raising for timeline. It’s not runway that you’re raising for. You’re raising for milestones and accomplishments and levels of growth in your team, in your company, in your business model. You’re not raising to survive the next 18 months. Personally, that is a pet peeve of mine.

Greg White (50:33):

So, let’s talk about that. Now, that you’ve raised this money – we know as Balaji asked, you had a great plan for what to do it. It probably feels like a lot of people looking in from the outside that you’ve made it. You’re done. You’re good. You’re ready to go – now, though, the hard work starts. So, tell us a little bit about, you know, where you go from here now that you’ve raised and closed this round and that money has hit the balance sheet.

Robin Gregg (51:02):

Yeah. I mean, we’re very much focused on sales expansion. So, just dramatically increasing how big our sales team is and how we are deploying salespeople against the market. So, a lot of the money is being spent on that. And as we grow, that means we need more tools, more sales structure, more inbound lead generation. So, there’s people associated with that as well. And then, the other big area of growth for us is more product. I think the use cases that we serve are slightly different depending on who we’re talking to. And it requires really smart and effective multiproduct team. And so, really kind of getting us organized around that is sort of the second area of growth for us. And then, I guess finally, just continued investment and partnerships.

Greg White (51:57):

So, you will probably address with this funding. It sounds like you certainly are cognizant of that. Addressing some of the things to go all the way back to the beginning of what the investors did like, you’ll accelerate that. And some of the things that the investors didn’t like, you’ll shore that up. And I think that’s a really foundationally sound way to approach this. So, there were a lot of other things, you know, that are details in these things. But, ultimately, you have built a sales flywheel, as everybody loves to call it. Proven that you can get to market. You’ve proven you’ve got a sound product. You’ve got good customer momentum and retention there. Now, you just have to accelerate and grow all of those things, just – did I say just?

Robin Gregg (52:44):

You did say just. You know, executing is harder than it looks.

Greg White (52:48):

So, I want to give Balaji a quick chance kind of some final words. And then, Robin, I’d love to just get some final words, or takeaways, or whatever you think people ought to have heard here. So, B, go for it.

Balaji Gopinath (53:02):

I think Robin and RoadSync are a great case study in the evolution of a company in terms of getting from seed to series B, and doing so methodically and with purpose and a plan. And I think it’s a great model for people to consider in terms of when Robin came in the business, the vision she has, how she’s directed the team. I think all those things are important and you need to kind of build some of that domain expertise as you’re kind of unpacking and unwrapping your opportunity to get to where they are. I think a lot of the key points that she made are relevant at any stage. Always do your homework. Find the right investor. Focus on the right things in terms of where you are, in terms of market traction. Be honest about what you need and don’t need. Because there are people that want to help, like us and others, in the early stage markets. But if you don’t want that help, you know, find different sources of investment. Because professional investors want to get engaged and they want to be part of this in some way, shape, or form. That’s what they do. That’s what they live for. But, again, kudos to Robin and the RoadSync team. I think they’ve done a tremendous job. And I look forward to seeing the future.

Greg White (54:24):

All right. Robin, it’s almost time to get you back on the other side of the desk here. But share what you just like folks to take away from this.

Robin Gregg (54:33):

I think Balaji did a great job recapping some of the things that I said throughout the conversation. But I’ll just add something that I didn’t talk about, which is, I have wished that folks could figure out a way and hope for folks that they can figure out a way to make this fun. When you’re in a fundraise process, you’re getting to talk to really curious, smart people about your business and you love your business and you love to talk about your business. So, try to figure out a way to have fun with the conversations and just understand it’s a numbers game and a sales process. And you’re going to get lots, and lots, and lots, and lots of nos. So, figure out a way to have interesting conversations with people that are fun and interesting. Maybe you can find out something about the market, about similar businesses, get ideas. Like, I felt like the best I did was when I sort of figured out a way to enjoy the process. I mean, I could totally enjoy it. But, you know, just to figure out to take something positive.

Balaji Gopinath (55:28):

I think that’s spot on. And I’ll add on to that, many times we don’t make the investment, but we like the investor and still want to help. Sometimes it just doesn’t fit the funds thesis in terms of valuation and ownership, a lot of things. But it doesn’t mean we don’t like the business or the founders. And we still try to find ways to help. And I think a lot of people are of the same mind if they’re having fun with you along the way, to Robin’s point.

Greg White (55:57):

So, we have to wrap pretty quick because Robin has a day job, Balaji. So, I will keep this short and that is, I think it’s a lot easier to have fun when you’re as prepared and sound fundamentally as Robin is when you have prepared your backup documents, your presentation, when you’ve practiced it. The best way to sound unrehearsed in any presentation or discussion is to know your presentation or discussion inside out. So, the only way to sound unrehearsed is to be completely rehearsed. That gives you the ability to have fun and be a little bit more off the cuff. So, before you expire, Robin – because I want all of us to leave at the same time this time – thank you for joining us. Thank you for being on that side of the table. We welcome you back to being a judge next month. And congratulations again on your funding and on the forthcoming additional acceleration of RoadSync. You’re doing a great job there. And I think you’re a fantastic example of the kind of leaders we need in supply chain and in tech. So, thank you.

Greg White (57:09):

Balaji, always a pleasure. Thank you for your time. Thank you for your insights. Look, none of us would be doing this if it weren’t for you. So, I really appreciate you getting me on that side of the table, on the venture side of the table. And appreciate your insights as always.

Balaji Gopinath (57:29):

I’m always having fun, Greg. Number one.

Greg White(57:32):

Thank you. And, of course, to all of you out there and to the whole Supply Chain Now team, thanks for joining us. And, Scott, thanks for giving us this platform. I think this is valuable information for the marketplace. We have a ton of other shows at Supply Chain Now. And, of course, TECHquila Sunrise, we did drop another podcast and vlog episode with Shannon Vaillancourt, CEO of RateLinx. We need to introduce you to him, Robin. And, of course, subscribe wherever you get your podcasts from or on YouTube. And remember this one final thing, acknowledge reality, but never be bound by it. Thank you.

Intro/Outro (58:19):

TECHquila Sunrise is part of the Supply Chain Now network, the voice of supply chain featuring the people, technologies, best practices, and key issues in the industry. And, hey, listen up. To build your supply chain knowledge, listen to – get this – Supply Chain is Boring, where Chris Barnes connects you to who’s who to get supply chain wherever you are, point us to where we’re going, and take us to the next level. Or check out this week in Business History with Supply Chain Now’s own Scott Luton to learn more about everyday things you may take for granted. And pick up quick insights you can use as inspiration and conversation starters. The Logistics With Purpose series puts a spotlight on inspiring and successful organizations that give first, give forward as their business model. If you’re interested in transportation, freight and logistics, have a listen to the Logistics & Beyond series with the adapt and thrive mindset, Sherpa, Jaymin Alvidrez. And also check out TEKTOK, hosted by industry vet and Atlanta’s own Karin Bursa, the Supply Chain Pro To Know of 2020, where Karin discusses the people, processes, and technology of digital supply chain. For sponsorship information on TECHquila Sunrise or any Supply Chain Now show, DM me on Twitter or Instagram @gregoryswhite or email me at greg@supplychainnow.com. Thanks again for spending your time with me. And remember, acknowledge reality, but never be bound by it.

Featured Guests

Robin Gregg serves as CEO of RoadSync, who’s on a mission to modernize payments across the entire logistics industry. Prior to this role, Robin served as SVP/GM Direct Fuel Cards with FLEETCOR and SVP of Product Development & Strategy with Revolution Money. From the company’s beginnings in 2015, RoadSync has been on an upward trajectory, quickly becoming the chosen payment solution for some of the largest names in the logistics space. Our team is standing by, ready to help you integrate and manage a simpler, more efficient way to navigate payments. Connect with RoadSync on Twitter and learn more: https://www.roadsync.com/

Balaji Gopinath is an entrepreneur, board member, and investor, and currently serves as General Partner for Kubera Venture Capital. Balaji has had the privilege to work with hundreds of startups as an active investor, advisor, and mentor, and has been a featured speaker, contributor, panelist and interviewee on: TechCrunch, Vator, Variety, Multi-Channel News, Digital Hollywood, NAB, SXSW, Chief Digital Officer Conference, AppNation and others. Connect with Balaji on LinkedIn.